African Tech Startup Funding: Examining the Steady Growth of Debt Funding in the Last Five Years

African Tech Startup Funding: Examining the Steady Growth of Debt Funding in the Last Five Years

The global tech startup scene in 2022 saw nothing nearing the fundraising euphoria of the previous year, as VC activity dropped by up to 35%. Except for Africa, the reluctance of VCs to sign checks was severely impacted by a global economic downturn and a major slowdown in the venture capital sector, raising the cost of stock and driving startups to seek alternative funding. According to the Partech Africa report, this resulted in funding to Latin America falling by 79% from 2021 highs and 39% in Asia, while European startups received 25% less funding, leaving Africa as the only region to record funding growth, +8% to $6.5 billion, through 764 deals year on year in 2022.

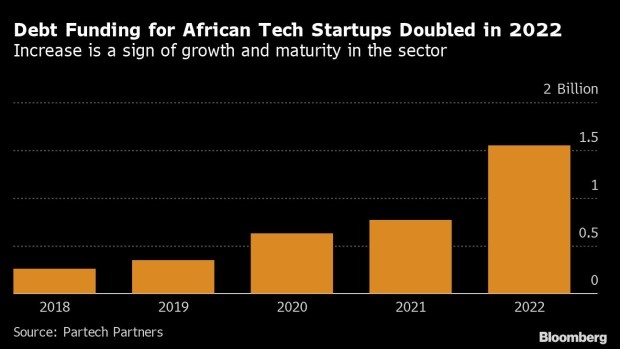

However, a further examination of Africa’s venture capital fundraising in 2022 reveals that debt funding accounted for up to $1.5 billion, more than doubling – +102% to $1.5B in 71 rounds – to offset a minor fall in equity rounds (-6% to $4.9 billion in 693 rounds).

Furthermore, the number of active debt investors on the African continent is increased 2.5 times year on year, with a solid mix of local debt institutions, foreign lenders, and development financing institutions.

In the last five years, debt financing of African tech startups has steadily increased, from a meager $261 in 2018 to a whopping $1.55 billion across 71 deals in 2022, indicating that it has become a viable alternative source of funding for African tech startups.

According to Tidjane Dème, general partner at Partech, the growth in debt financing is predicted to continue in the next couple of years. He said “In the same way equity funding picked up over the last few years, driven first by fintech, we expect other sectors to follow. We also expect to see more local players emerge and more global players to get involved.”

To put things in a proper perspective, let’s take a quick look at what these terms mean. Both debt and equity financing are some of the funding options available to startups. Most startups use a combination of debt and equity financing, but there are some distinct advantages to both. According to Investopedia, the principal among them is that equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business, while debt financing on the other hand does not require giving up a portion of ownership but by selling debt instruments to individuals and/or institutional investors. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be repaid.

Disclosure of Debt deals in 2022

According to the report, almost 75% of debt deals were fully disclosed in 2022, accounting for 76% of debt funding. • In the year, 18% of rounds were partially released, while around 7% of rounds were kept confidential. This amounts to 15% of total debt funding. The completely and partially disclosed debt transactions account for 66 debt transactions out of 71, or 93% of the overall deal count, and account for US$1.3 billion, or 85% of total debt funding.

The report equally noted that over 83% of all debt investment flowed to the four biggest tech centers – Kenya, Nigeria, Egypt, and South Africa – which also aggregated 69% of all loan agreements (i.e. 49 deals). Ghana (8 transactions) and Senegal (thanks to Wave) are close behind. – With two mega debt deals over $200 million, Kenya has attracted more debt than any other African country ($608 million in total), taking almost 40% of the total amount raised through 15 debt deals. – Egypt is #2 in debt financing with $350 million raised across 10 rounds, representing 23% of all debt raised. – Nigeria is #3 in debt financing behind Kenya and Egypt, with $252 million gathered across 16 rounds, representing 16% of all debt raised. – South Africa is #6 in debt financing with $77 million raised across 8 rounds.

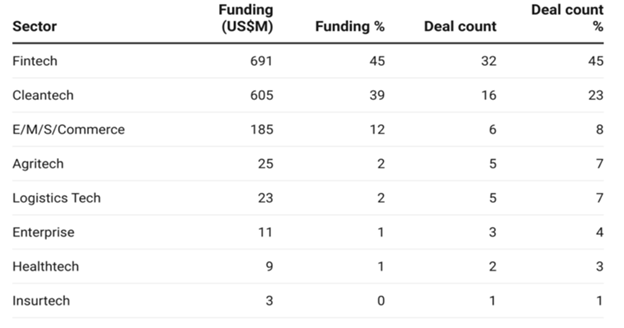

African Startups Debt Funding by Sector

Source: Partech Partners

As indicated in the table above, two sectors – fintech (45%) and cleantech (39%) – were responsible for 84% of debt funding across the continent. Similarly, nine startups were responsible for 66% of debt funding. The most active sources of debt funding for the year with at least three deals were Lendable (7+), Symbiotics (7+), Cauris (3+), Contact Financial (3+), FMO (3+), Oikocredit (3+), and Verdant Capital (3+), while the likes of Moove Africa and D.Light were the major beneficiaries.

With the future of global tech funding looking bleak in view of the continued economic woes, a solid debt funding growth (+102% YoY, 24% of total investment) in 2022 is a good development as it will once again act as a buffer to any funding shocks that the African tech startup ecosystem may encounter this year.