Amending the GST Act; More for E-commerce in Southern Africa

E-commerce Tax Act

Globally, governments place a high emphasis on tax collection in order to finance their spending. As a result of technical improvements creating a global economy and making it simpler to transact across borders with specific markets, various governments are also figuring out how to keep the balance. The difficulty in keeping the balance arises from the desire to finance expenditures while also promoting the expansion of the digital economy.

Many African governments have come under fire for imposing onerous tax requirements on businesses that use digital technology. According to Kin Mungai, a senior research analyst at the Center for Financial Regulation and Inclusion (Cenfri), taxing e-commerce and fintech platforms is hindering their development and uptake at this early stage.

The most recent African nations to announce plans for tax collection from digital and e-commerce giants like Netflix, Google, YouTube, and Amazon are Zimbabwe and Nigeria, which did so a few days ago.

Although sales taxes are uncommon globally, other countries’ decentralized commodity taxes are also being challenged by new technology and digital products. Value Added Tax (VAT) rates vary across the European Union, India and Brazil impose state-level rates through their tax systems, while Canada levies a federal and provincial Goods and Services Tax (GST). Even tax systems with a high degree of centralization are not immune to the challenges of e-commerce.

However, rather than focus on milking nascent digital sectors, governments can look to build on it via regional collaborations. This way, the economy can establish credible consumer class that can meet the tax demands of the government. India’s amended GST Act shows a path for digital growth.

Benefits of the India’s Amended E-commerce Tax Act

Certain provisions can allow merchants and large consumer stores not registered under the Goods and Services Tax (GST) Act sell in other states through e-commerce operators without having to register themselves as taxpayers under the Act.

www.cbic.gov.in/resources//htdocs-cbec/gst/CGST%20Act%20Updated%20as%20on%2031.08.2021.pdf

The GST Council in India recently approved the amendments in the GST Act and GST Rules for allowing unregistered suppliers and composition taxpayers to make intra-state supply of goods through e-commerce operators (ECOs), subject to certain conditions. The provision has been described as one that could prove to be a potential game-changer for millions of neighbourhood groceries, independent pharmacies, and other micro-enterprises.

According to Syam Prabhad, a chartered accountant with a Bengaluru office, independent retailers with yearly sales of less than Rs 20 lakh can now grow their customer base by listing on e-commerce platforms without having to worry about paying exorbitant taxes. India has more than 13 million neighbourhood groceries, or so-called kiranas, in the unorganised sector. Ecommerce accounts for only about 10% of all retail sales in the country.

Prabhad continued by saying that the choice was discussed at the most recent GST Council gathering in December. The government-sponsored Open Network for Digital Commerce is anticipated to see a rise in adoption as a result of the ruling.

The decision to include traditional merchants and stores in the e-commerce sector in the country will surely encourage online marketplaces and e-retailers to diversify their product portfolios.

Intervening and Collaborating for Growth

The digitalization of the economy necessitates fresh perspectives on trade, the labor market, taxation and industrial policy. From the tiniest informal deal to a significant supply agreement, the wheels of global trade will soon be totally propelled by the internet via e-commerce platforms.

The emergence of the micro-multinational, the facilitation of multinational value chains, and the creation of new tradeable goods and services are just a few of the ways that digitization has contributed to a changing trade environment. Additionally, it is erasing conventional distinctions between commodities and services as well as between countries. However, if e-commerce is in line with jurisdictions, jurisdictions won’t be muddled. The required balance is offered by e-commerce trade.

Trade agreements can significantly improve the institutional and legal structures that support e-commerce and digital trade. Increasingly, clauses on electronic commerce, digital trade, and the digital economy are included in regional and bilateral trade agreements.

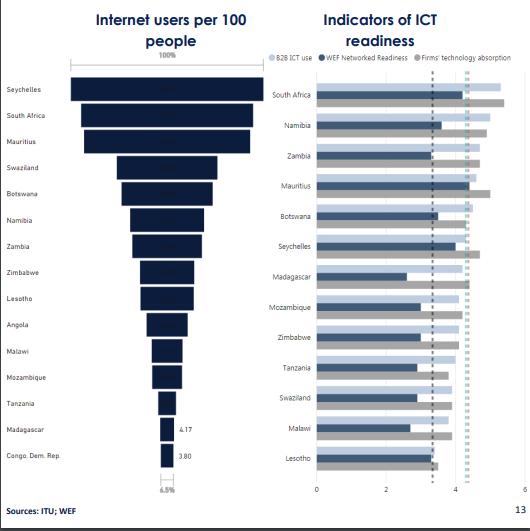

The risk of falling behind and widening the digital divide exists for Southern African economies that are less developed. With the exception of South Africa, Southern African nations are slower to adopt e-commerce than the rest of the world. Adopting the GST Act in Indian fashion will demonstrate a willingness to expand cross-national e-commerce.

With this act, the SADC, which consists of Angola, Botswana, Comoros, Democratic Republic of the Congo, Eswatini, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Tanzania, Zambia, and Zimbabwe, can accomplish a lot. It will give e-commerce the boost it needs, expand the digital economy, create a thriving consumer class, and boost their overall economies.