August Fall Versus September Increase: What’s all the Hype on Startup Funding in September?

Fundraising for the past 5 months has been a roller coaster for African startups. In June 2022, African startups made 36 fully disclosed raises totaling $426,280,000 million. This amount is a 2.4% decrease from May 2022’s $437,100,000. July brought the lowest startup funding of the year for Africa’s tech ecosystem. In July 2022, African startups made 20 fully disclosed raises totaling $239,706,000. This total is the lowest amount raised so far in a month by African startups, a 43.77% decrease from June’s $426,280,000.

Following lay-offs from Swvl and Vezeeta in June, more African startups announced lay-offs in July. Francophone African Unicorn Wave laid off 300 employees in a “hard call” to scale back operations in Mali, Uganda, and Burkina Faso. Kenyan logistics startup, Sendy, also laid off 10%—about 30 employees—of its workforce in an unfortunate turn of events that may see the startup halt its expansion to Egypt and South Africa.

Venture capital deals on the continent reached $3.5 billion in the six months through June, more than double the amount in the same period a year earlier. This was according to the African Private Equity and Venture Capital Association. The funds were raised by 300 companies, with 27% of the companies led by female founders, or having at least one female founder. This compares to 25% in the previous year.

Notwithstanding these results, general funding activities have slightly disappointed. The continent has yet to record a new unicorn in 2022 unlike in 2021 when as of September, there were already three startups that joined the unicorn club, with Nigeria leading the pack.

August Startup Funding

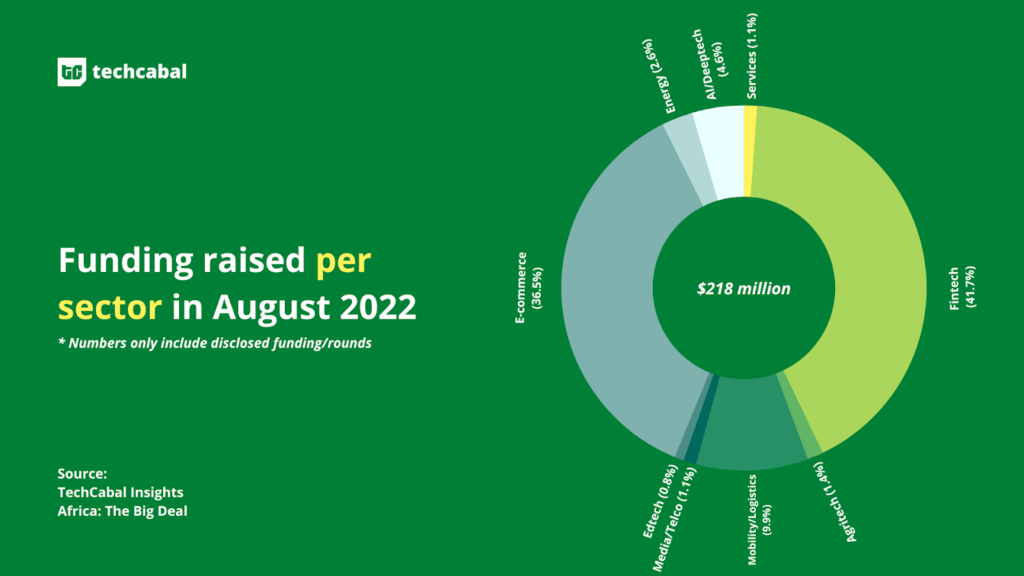

August brought the lowest funding announcements of the year so far for African startups. African businesses raised $218,000,000 in 38 fully reported rounds in August 2022. That was a 9.06% decline from July’s $239,706,000—the least that African companies have ever raised in a single month. Fintech, e-commerce/retail, and logistics ranked first through third, respectively, in each industry in August. E-commerce/retail firms raised $79,500,000 (36.5%), logistics startups raised $21,600,000 (9.9%), and fintech startups raised $91,000,000 (41.7%).

The top five disclosed deals in August 2022 included a $50 million pre-Series C raise by Nigerian fintech TeamApt, a $30 million pre-Series B raise by Egyptian adtech ArabAds, a $23 million pre-Series B raise by Egyptian fintech Homzmart, a $20 million raise by Egyptian mobility startup Swvl, and a $15 million pre-Series A raise by Nigerian retail startup Omnibiz. At $138m, the top five deals in Africa made up 63.3% of the total funding rounds in Africa’s tech space. This points that 33 startups combined for just $80 million, averaging $2.42 million.

There were significant layoffs throughout the computer industry in Africa, and the funding crisis was not the only issue. At least four African startups—54gene, Alerzo, Marketforce, and Viamo—were found to have secretly fired employees in August.

Nigerian genomics company 54gene sacked a number of contract workers, and services platform, Alerzo allegedly let go of 100 workers. Last but not least, a source inside Ghana-based Viamo, a social and technology company, alleged that the business had fired an undefined number of employees. Salary reductions are a last resort for other software businesses including Quidax, GetEquity, and Eden Life as they struggle to find finance.

The September Upgrade

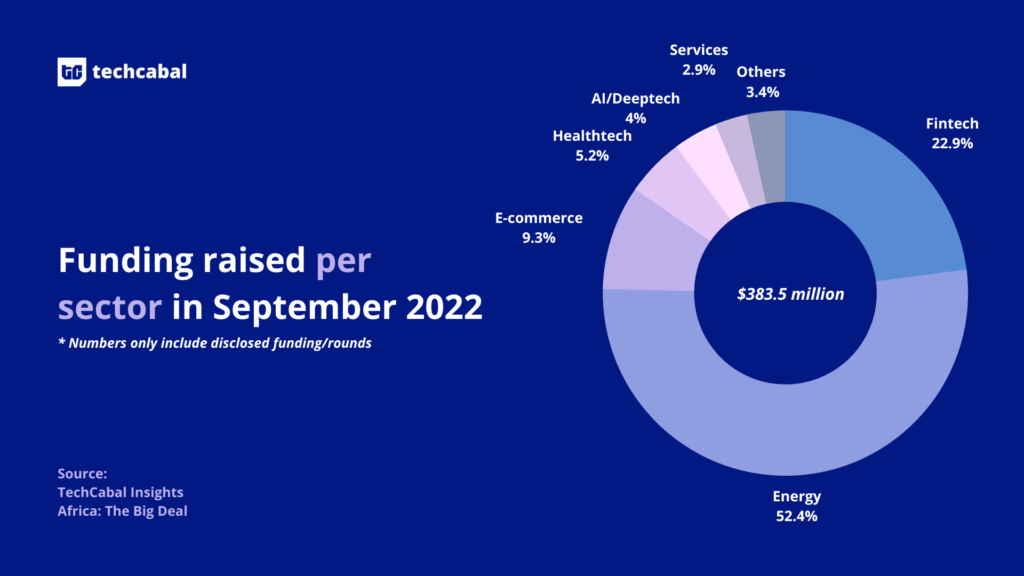

African companies raised $383,465,000 in 36 fully announced rounds in September 2022. This sum, which represents a 75.9% increase over August’s $218,000,000, represents the most money that African entrepreneurs have so far raised in a single month since June 2022.

Energy, fintech, and e-commerce are the top three sectors overall in September. Fintech businesses raised $87,945,000 (22.9%), e-commerce/retail startups raised $35,550,000 (9.3%), and energy startups raised $201,000,000 (52.4%).

The top 5 raises by African digital firms in September according to the numbers demand even more instability. Over 50% of the funding in September came from Bboxx’s $200 million purchase of the Ghanaian cleantech company PEG Africa. Others include the $40 million Series B raise by Nigerian crypto exchange firm Yellowcard, the $30 million raise by Nigerian digital procurement platform Vendease, the $15 million raise by South African biometrics platform iiDENTIFii, and the $13 million seed round by Nigerian fintech NowNow.

$298 million accounts for 77.7% of total startup funding in September. So while applauding the funding increase from last month, bear in mind that Africa’s tech space is yet to pick up the pace it started with at the beginning of the year with.