Be Mobile Africa launches in South Africa for Unbanked and Underbanked

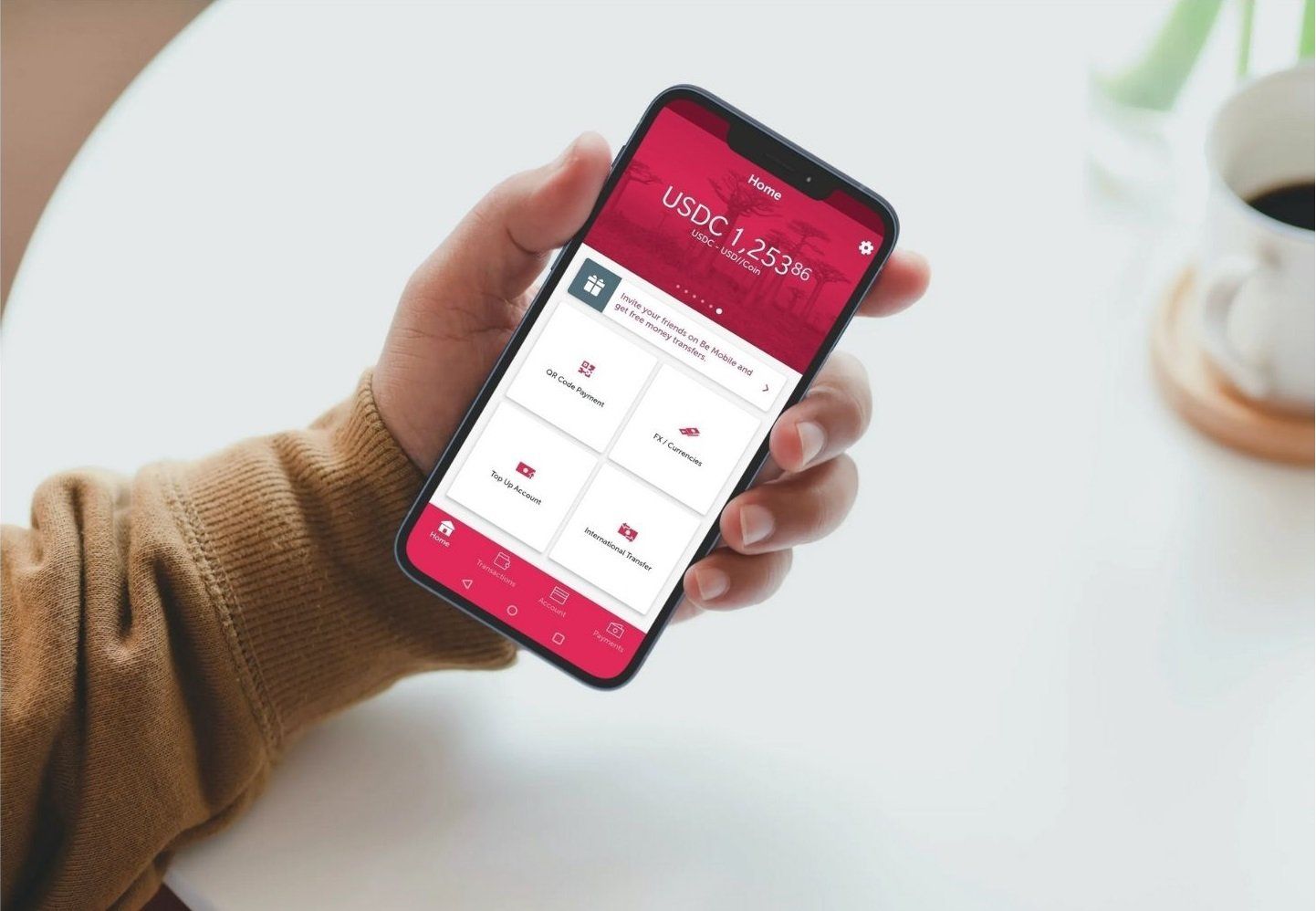

With a goal of providing banking services to the unbanked and underbanked in the nation, Canada-based Neobank, Be Mobile Africa, has announced its formal launch in South Africa. Through its mobile app, it also provides low- to no-fee banking services.

Opening a Be Mobile Africa account will let users hold, send, and receive money in a variety of currencies, including USD and EUR. With the savings product from Be Mobile Africa, customers will also be able to send money abroad quickly and receive 5% interest annually in USD and EUR.

Additionally, the business states that consumers will be able to instantaneously and cost-free send and receive money from anyone in the Be Mobile Africa network. Users can as well request money from anyone in the network, and exchange currencies with low foreign exchange fees.

“We are incredibly excited to be launching our services in South Africa. This is an important market for us and we believe there is great potential for growth.” says CEO & co-founder of Be Mobile Africa Dr Cédric Jeannot.

The business offers a mobile app for both Android and iOS smartphones, and it has ambitions to introduce a B2B product soon. Currently offered in 30 African nations, Be Mobile Africa has intentions to enter more markets.

What Be Mobile Offers Africans

With Be Mobile, users can send money in their choice of 22 currencies to recipients in 35 different countries. Between Be users, everything happens instantly and is free, regardless of where they are located or with whatever bank they use. Be completes the swap after safely holding deposits until both pieces are present. Visa cards can be used to make payments in multiple currencies and without paying any currency rates.

With Be, sending money to anyone quickly and affordably using their phone number or bank account number is enabled. Utilize the SWIFT, SEPA, and Interact networks to send or receive international electronic payments, with 22 currencies available for acceptance and holding by merchants.

With only a 1% charge, no set up costs, monthly fees or minimum balance, merchants can accept payment using the Pay with Be Mobile widget by simply adding a line of code to their site.

Be Mobile also allows users investment opportunities in USD or EUR which can see them earn 5% per annum when they have any of 22 currencies indexed on USD. The platform converts the savings into USD, which then gets invested. So users can make 5% on the USD plus any appreciation on the currency exchange over the investment time frame.

Be Mobile is designed to be accessible, with a deposit from 100 USD (or the equivalent) you can benefit from the power of the Blockchain to make more from your money.