Boya is Transforming the Credit Culture of African Businesses

According to research, 51% of 44 million formal SMBs in sub-Saharan Africa cannot access finance. Each day, African SMBs have billions locked up in receivables due to long payment cycles. This leads to cash flow problems that cause businesses to be late on important expenses and fulfilment of new orders. Startups like Float and Boya are already fixing this problem for African businesses.

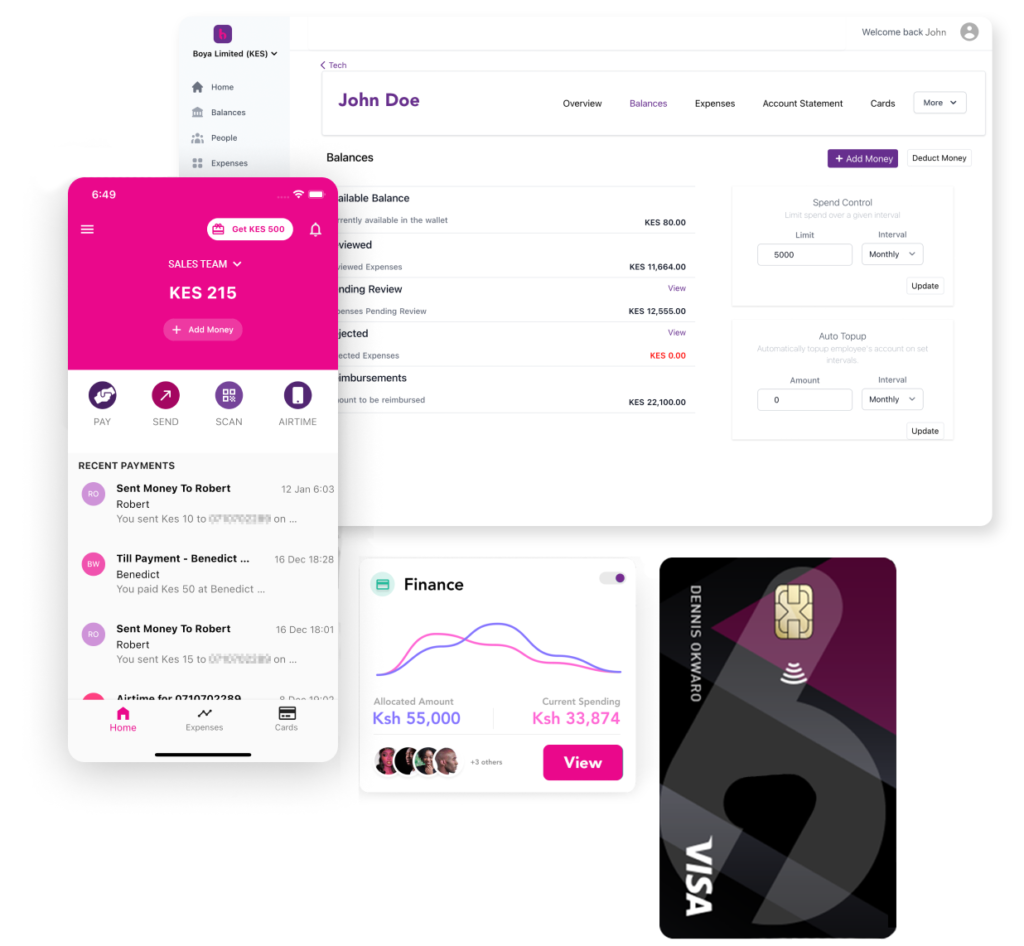

The idea for the YC-backed Kenyan Fintech startup came Alphas Sinja, Boya’s CEO discovered that more than 50 million businesses across Africa can’t easily streamline and track employee spending in real-time. Boya now provides corporate expense cards and spend management for businesses in Africa to fix this problem.

“We want to make it easy for these businesses to issue corporate expense cards (Visa for now) and software, mainly for sales and marketing teams, to track and control spending,” said Alphas Sinja, Boya’s founder with over eight years of experience in the banking and finance sectors.

Boya will be participating in Y-Combinator’s W22 and will be looking to have the same effect as Flutterwave after the program.

A Look at what Boya Offers

Boya is similar of Ghanaian Fintech, Float. They both provide a credit line that businesses can tap into any time they want. Both platforms also provide invoicing, budgeting tools and spend management tools for businesses. This enables them manage all their bank accounts and see all their balances and transactions. However, while Float places more emphasis on software and less on cards; Boya, on the other hand, plans to execute on both fronts using overdrafts.

Boya provides software solution with credit embedded. The platform allows businesses get credit to meet contingencies. The system is built to allow users access credit and make payment immediately.

Boya also provides a free Visa card for users. The card is connected to the smart app and allows for expenses that are not constrained by the user’s balance. In other words, users get overdraft to pay for business expenses. Your overdraft limit grows as you transact on Boya.

Boya’s in-built tools also help businesses stay on top of their cash flow. Users receive invoicing, budgeting tools and spend management tools and a way for them to manage all their bank accounts. On the platform, they can see all their balances and transactions. The app also enables businesses to make payments from their accounts on Boya.

Spending on Boya will show you clear details of all your expenses so you can make smarter and better spending decisions. The startup considers itself as an all-in-one spend platform for smarter and better spending decisions.

“We believe that businesses will grow faster when they have access to useful financial information. Businesses will have access to growth capital when they have organized useful financial information. We believe that he cost of credit will significantly reduce when businesses have accessible and useful financial information.”