Capitec Partners Ozow for New Payment Channel

To introduce a revolutionary payment option that might completely transform the South African banking industry, Capitec has teamed up with Ozow and other key partners. Innovative payment ecosystems and increased financial inclusion in the nation will be established through cooperation.

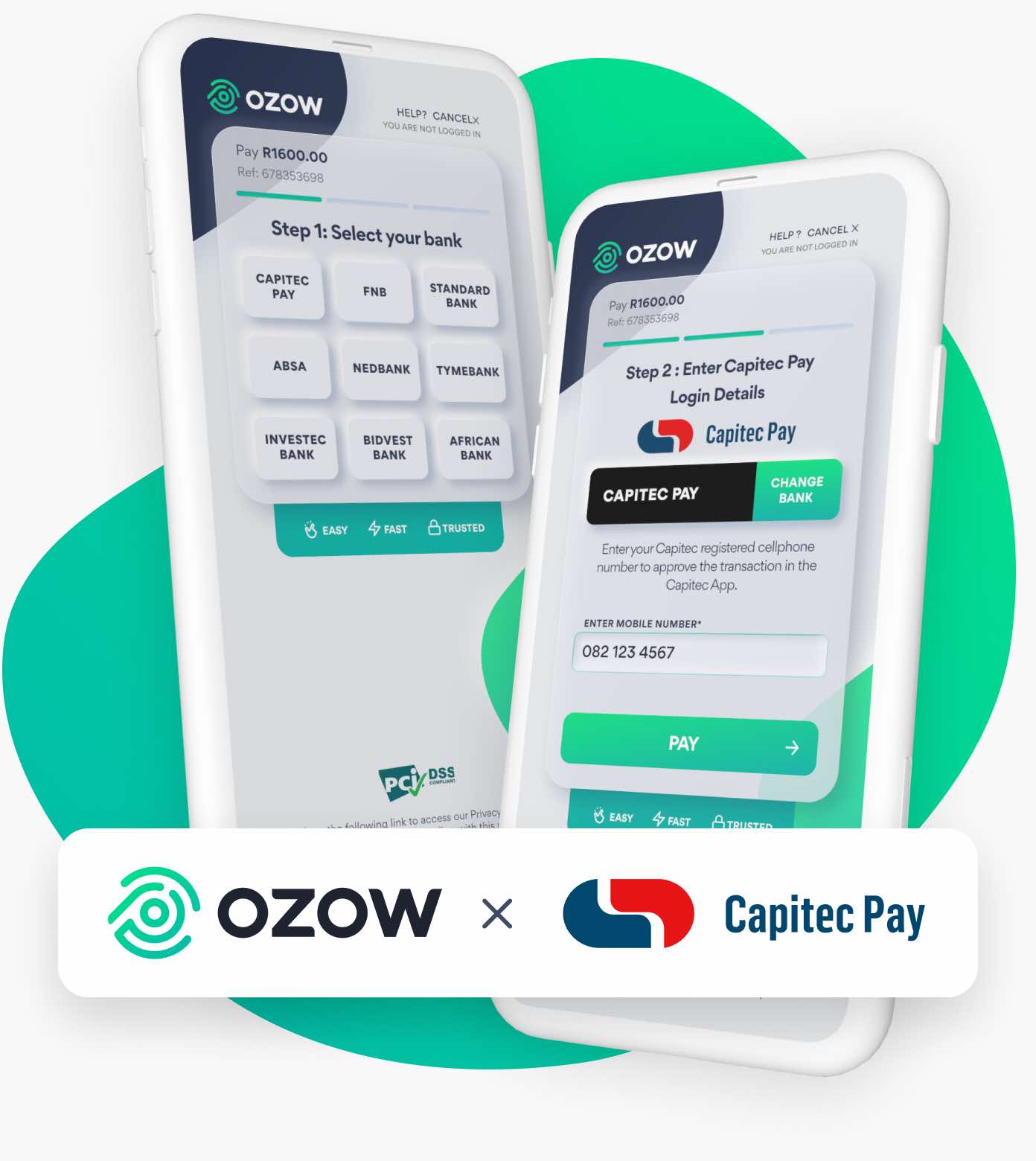

For underserved customers and businesses, a simpler and more convenient payment option will be made available by integrating Ozow’s platform with Capitec Pay via South Africa’s first proprietary open banking-payments API.

Third-party developers can create services and applications for financial institutions using open banking, making it possible to increase accessibility while offering safer, simpler payment methods.

97% of South African customers want to use a digital payment method in the upcoming year, according to the most recent annual New Payment Index from Mastercard. With a focus on providing merchants with advantages like as assured settlements, automated reconciliation, and increased uptime because of bank-side monitoring, Capitec Pay provides a straightforward, quick user experience.

Customers now have access to a more safe and convenient payment alternative thanks to Ozow and Capitec’s partnership, which also shows a commitment to democratizing Africa’s burgeoning neobank sector. Other financial institutions are urged by Pays to embrace the future of payments by embracing the digital revolution.

According to Thomas Pays, CEO of Ozow, “We can see the impact this kind of innovation is having in global markets. It has the potential to improve economic growth, and my team will continue to engage with all banks to support them in adopting open APIs for better third-party payment provider (TPPP) and fintech integration.”

What the Partnership Offer

Capitec Pay will be incorporated into Ozow’s Pay by Bank service, which is a quick, safe, and easy way for customers to pay a merchant straight from their bank account without using a bank account or credit card.

Using Pay by Bank, money will be transferred right away after a transaction has been authenticated from the customer’s personal bank account to the merchant account. As a result, processing times, fraud occurrences, and the cost of payment operations have all dramatically decreased.

Instead of using the username and password combination that has previously been the main way for users to access their bank accounts, clients can identify themselves with the Capitec Pay system using their mobile phone number or ID number. Customers benefit from additional security as the final payment is approved in an app pop-up confirmation message. Customers may also withdraw their consent and choose not to participate at any time.

The relationship between Ozow and Capitec, in Jerome Passmore’s opinion, has the potential to completely alter how South Africans interact with their money and conduct business. Passmore claims that customers may use Capitec Pay to feel secure when making online purchases by simply giving their approval from within the Capitec banking app.

Capitec’s latest partnership is coming barely 6 months after the firm introduced its mobile virtual network operator (MVNO), promising data at low prices, using Cell C’s enabling infrastructure.

The bank had stated that it plans to “disrupt the prepaid industry” with a “simplified prepaid solution for phone, data, and SMS.” The partnership with Ovow is a significant step towards providing a simpler and more accessible payment solution, and a more inclusive financial sector.