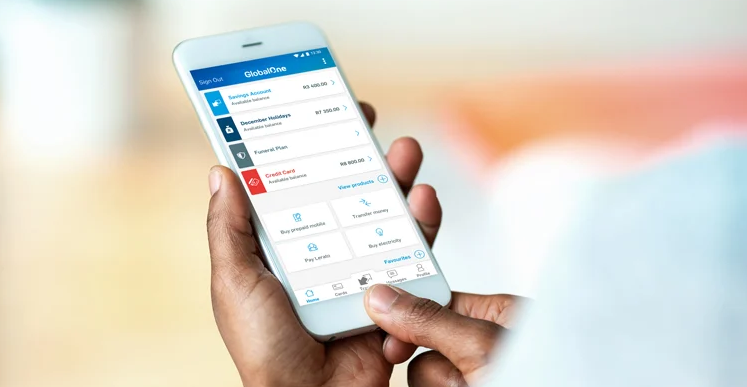

Capitec's Banking Application Positions Number 1 on South Africa's Apple and Google App Store.

Capitec has uncovered that its new banking application has reached the #1 spot on both the South African Google Play and Apple application store graphs.

It as of now move in front of Zoom, Whatsapp Courier, Tik Tok, and Facebook.

Their computerized financial administrations are the most broadly utilized in the nation, with over 7.5 million dynamic clients.

They’ve likewise noticed a huge increment among January and July 2020, with the bank inviting just about 600 000 new computerized financial customers, according to Gerrie Fourie, President of Capitec Bank.

This achievement comes when the bank’s conventional help channels are taking a rearward sitting arrangement to its computerized contributions; a pattern, which was been fundamentally enlarged by the COVID-19 emergency. The bank accepts that its customers are looking for more secure, more helpful, and reasonable approaches to the bank and computerized channels to give the appropriate response.

Fourie says A bank’s capacity to keep customers fulfilled through customer-driven advanced arrangements will separate it in this quickly evolving condition. She accepts that in future years, bank offices will keep on being a significant purpose of customized administration, however, will likewise fill in as computerized administration focuses, ready to help customers the nation over continuously

Capitec as of late declared that it has made the last stride in its paperless excursion with the presentation of an e-signature capacity, by methods for a biometric unique finger impression. This makes it the principal South African bank to present a legitimately consistent e-signature. The bank will stretch out this ability to facial biometrics in the not so distant future, permitting their customers to eSign archives from anyplace, day in and day out on their banking application.

“Our digital banking services are the most widely used in the country, with over 7.5 million active users. We’ve also noted a significant increase between January and July 2020, with the bank welcoming almost 600 000 new digital banking clients,” says Gerrie Fourie, CEO of Capitec Bank.

This success comes at a time when the bank’s traditional service channels are taking a back seat to its digital offerings; a trend, which was been significantly augmented by the COVID-19 crisis. The bank believes that its clients are seeking safer, more convenient, and affordable ways to bank and digital channels provide the answer.

Fourie says, “A bank’s ability to keep clients satisfied through client-centric digital solutions will set it apart in this fast-changing environment. I believe that in future years, bank branches will continue to be an important point of personalized service, but will also serve as digital service centers, able to help clients across the country in real-time”.

Capitec recently announced that it has taken the final step in its paperless journey with the introduction of an e-signature capability, by means of a biometric fingerprint. This makes it the first South African bank to introduce a legally compliant e-signature. The bank will extend this capability to facial biometrics later this year, allowing their clients to eSign documents from anywhere, 24/7 on their banking app.

“Our use of AI technology has allowed us to continuously improve our processes and efficiencies while giving us a better understanding of our clients’ needs on an individual level. Not only has this allowed us to offer our clients more personalized service, but we’ve also passed the efficiencies onto them through cost and time savings across our digital channels and branches. This allows us to offer affordable digital fees that challenge the norm, such as immediate payments for only R8, compared to an industry norm of around R50,” Fourie concluded.