Crypto Outlook in West Africa in '22. Driving More Adoption and Increasing Investors' Confidence in 2023

Globally, 2022 was a terrible year for the digital asset and cryptocurrency markets. After reaching all-time highs in November 2021, the value of most of the major cryptocurrencies has plummeted dramatically. Bitcoin is down about 60%, while Ethereum is down more than 65%. For many investors and crypto enthusiasts, the entire collapse of the Terra stablecoin in May 2021 and the mother of all tragedies, FXT filing for bankruptcy in October 2022, shook their faith in blockchain technology.

Although crypto is still in its infancy in West Africa, there is rising interest in blockchain technology and its potential uses in the region. With a population of about 427 million people, the region’s growth potential is enormous. Its young and tech-savvy populace is well-positioned to become a big participant in the crypto economy.

Crypto Funding in 2022

In terms of funding, crypto startups in Africa raised $91 million in the first quarter of 2022 alone, with the fundraising streak continuing into the second quarter, which saw four fundraising rounds totaling $213 million.

In May, Seychelles-based crypto startup, KuCoin received a record-breaking $150 million in a pre-Series B fundraising round, raising its valuation to $10 billion and delivering Africa’s first blockchain “mega-deal,” as well as the continent’s first blockchain unicorn.

During the second quarter of this year, Mara, a pan-African crypto trading platform, raised $23 million, Jambo, a Congo-based business, raised $30 million, and Nigerian startup Afriex raised $10 million.

As of Q3 2022, the monies raised and publicized in this sector totaled $304 million, more than double the $127 million raised for the whole year of 2021.

According to research by Crypto Valley Venture Capital and Standard Bank, funding increased by 1 668% year on year in the first quarter of 2022, growing from $5.1 million in 2021 to $91 million in Q1 2022. Nigeria, Kenya, and South Africa – three of the “big four” startup ecosystems, together with Egypt – contributed to the majority of venture dollar inflows in the crypto space in 2021, totaling $ 122 million. Nigeria equally led the 2021 list, raising $49.6 million, followed by Seychelles, which raised $33.8 million.

Driving More Crypto Adoption in W’ Africa

However, certain hurdles must be overcome before West Africa can genuinely adopt cryptocurrency. For one thing, the region is still mainly unbanked, with just roughly 30% of the population having access to formal banking services. This is a problem for crypto adoption because consumers must have bank accounts in order to purchase and sell digital currency.

There is also the question of infrastructure. West Africa is not as developed as other regions of the world, and this lack of infrastructure might make it difficult to trade and store digital currencies. Again, this is something that must be solved before West Africa can fully realize the promise of cryptocurrency. Despite these challenges, there is still a lot of enthusiasm and confidence in West Africa about the future of cryptocurrency.

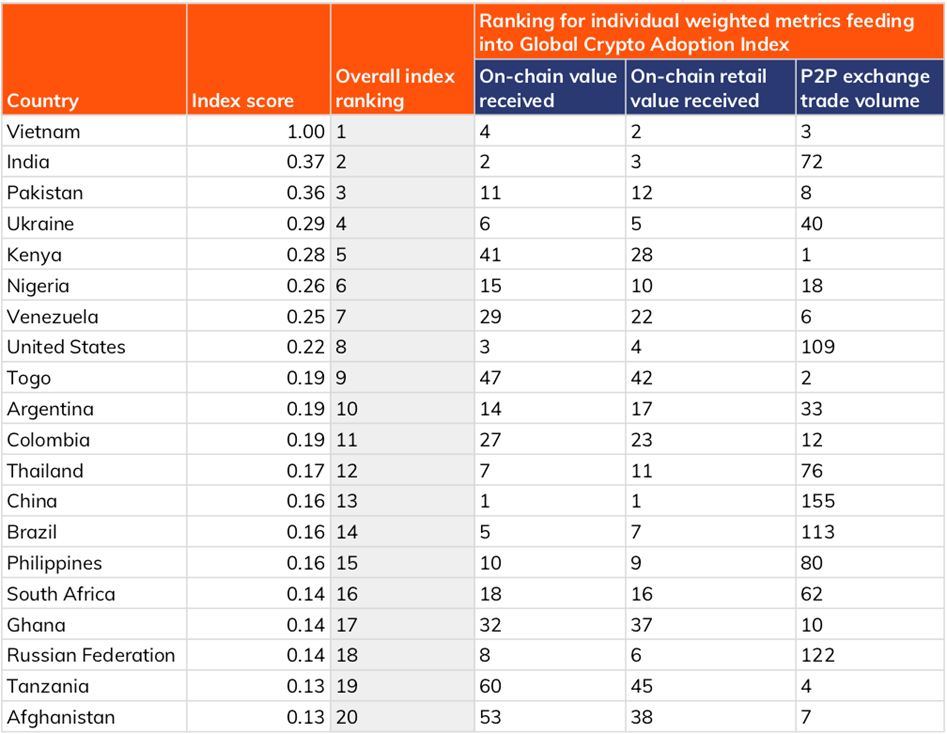

Cryptocurrencies are becoming more popular in African markets. Africa’s cryptocurrency market rose by more than 1200% between 2020 and 2021, according to Chainalysis. According to Chainalysis’ 2022 Global Crypto Adoption Index, three African countries – Nigeria, Morocco, and Kenya – are among the top 20 countries utilizing cryptocurrencies and related services.

Source: Chainalysis

Also, according to the UNCTAD research, 8.5% of Kenyans owned some type of digital currency, making it the biggest in Africa and the fifth largest globally, with South Africa coming in second with 7.1% and Nigeria coming in third with 6.3%.

Furthermore, as developing markets take the lead in crypto acceptance, Ghana is expected to catch up with other African nations in terms of cryptocurrency use in the near future. According to the Chainalysis report, Ghana has the potential to attain crypto adoption levels comparable to Kenya and Nigeria, which are placed 11th and 19th on the Global Crypto Adoption Index, respectively.

Some Factors Driving Crypto Adoption in W’ Africa

Innovation in the blockchain industry in Defi, NFTs, and GameFi has increased interest and drawn in more newcomers, contributing to the mass adoption of digital assets in Africa, particularly the Western African region, due to its young tech-savvy population aware of the potential of cryptocurrencies and blockchain technology, and eager for innovative wealth-generating opportunities.

Additionally, the region has a long history of insecurity and hyperinflation, making conventional currencies less dependable. Moreover, the majority of West Africans lack access to conventional financial services, making it impossible to keep or move money. Cryptocurrency provides a solution to both of these issues. Cryptocurrency is also becoming more popular as a means of sending money remittances. The World Bank estimates that Africa gets roughly $40 billion in remittances each year, whereas Nigeria is only second to Egypt as the second-highest receiver of remittances in 2022. However, these transfers may be costly and time-consuming, taking days or weeks to arrive. Cryptocurrency may be used to swiftly and cheaply move money throughout the world.

Conclusively, although it is hard to predict how long the current crypto winter will last considering the global macroeconomic activities that have seen countries like Ghana getting a last-minute bailout from the IMF and Nigeria’s hyperinflation getting to the rooftop. Crypto investors, particularly the ones in West Africa are not out of the woods yet taking into account the bitter experience that the FTX crash has caused the ecosystem. They will likely see another dip followed by a slow climb back considering the fact that the global stock markets have already been battered and will continue to take a beating as people convert their investments to cash to avert further devaluation of their holdings. However, the FTX crash might set the global blockchain and crypto ecosystem towards increased transparency enabled by regulations of blockchain activities.