DIGITECH SECURES $330K PRE-SEED FUNDING ROUND

Ivorian Insurtech startup providing fully integrated and cloud-based Insurtech platform to incumbent insurance companies, Digitech, has announced it rasied $330k in a pre-seed funding round.

BLOC Smart Africa fund (BLOC SA) led the round with the goal of advancing the development and marketing of Hyperion 2.0 reinsurance ERP software, a cloud-based system that automates transactions between insurers and reinsurers. Hyperion eliminates all threats and save resources, offering only the most important in business lines.

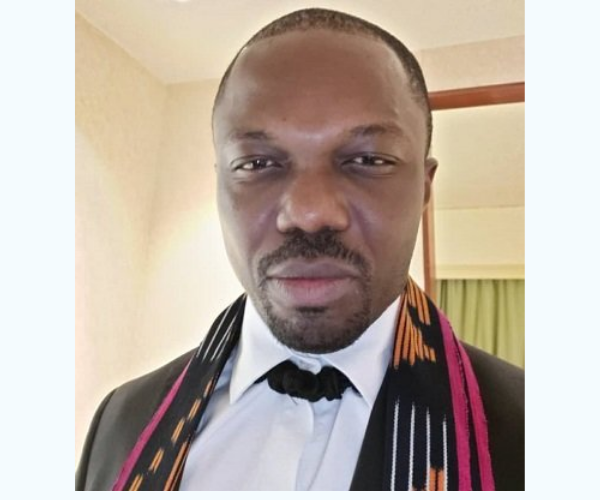

Digitech was founded in 2016 by Alexandre N’Djore. The startup focuses on the creation, integration, and marketing of professional solutions and value-added consumer services.

Digitech leverages on emerging information and communication technologies to supplies incumbent reinsurance and insurance businesses with fully integrated and cloud-based Insurtech systems.

“We are extremely delighted to welcome BLOC SMART AFRICA as the leader of this investment round. Their Support goes beyond capital supply and has extended to strategic advice and company development. We are excited to witness the digital transformation of a century old industry as we gear up towards creating a new digital ecosystem for the entire reinsurance and insurance industry in Africa,” said Mr. Alexandre N’Djore, CEO, Digitech.

Digitech’s systems are extremely scalable and adaptable to the unique requirements of each business client. Through secure web access and data repositories that adhere to the most stringent global cloud standards, including GDPR and PCI-DSS, reinsurance and insurance companies can already automate more than 80% of all processes, from premium subscription to intelligent claims processing and billing to technical real-time accounting and visual statistics.

Hyperion 2.0 will cover all reinsurance contract types and automate 100% of the procedures through the use of some proprietary machine-learning algorithms, resulting in immediate operational efficiencies for our clients.

Lacina Koné, CEO/Director General, Smart Africa Secretariat expressed the light why also adding that digitech will transform Africa’s insurance market.

“We are extremely pleased to impact and accelerate the growth of such a dynamic start up as Digitech for the benefit of the continental insurance and reinsurance market. Investing in businesses using scalable technology-led solutions is the DNA of the BLOC Smart Africa fund. Côte d’Ivoire, as one of the first investors, is naturally the first beneficiary. We believe their commitment will inspire and encourage other countries to join the fund so we can rapidly meet the target of $110 million,” said Lacina.

Breeding Africa’s enterprise and financing creativity and technologies for growth was the main aim of the founding investors (The Ivory Coast Government) in Bloc Smart Africa.

“I am excited to witness an Ivorian startup engaging in solving current challenges in the insurance, reinsurance market and unlocking opportunities to ultimately, contribute to improve financial protection and increase resilience against various risks for Ivorian people through digital innovation. Technology plays a crucial role in leapfrogging access to essential financial services in Africa. It is my hope that other member states will contribute towards supporting the continent’s digital transformation through this initiative,” said honorable Minister Roger Adom, Minister of Digital Economy, Technology and Innovation, Government of Côte d’Ivoire.

“Luxembourg’s Development Cooperation has always strived to harness partnerships and experience in the financial realm to explore innovative ways that can scale up its development impact and reach. Creating a blended finance technology impact fund, like the BLOC Smart Africa, is a significant step and illustrates this course of action”, commented Mr. Manuel Tonnar, Director of the Development Cooperation at the Ministry of Foreign and European Affairs of Luxembourg.