Emerging markets neobank Canza Finance raises $3.27 million in seed funding

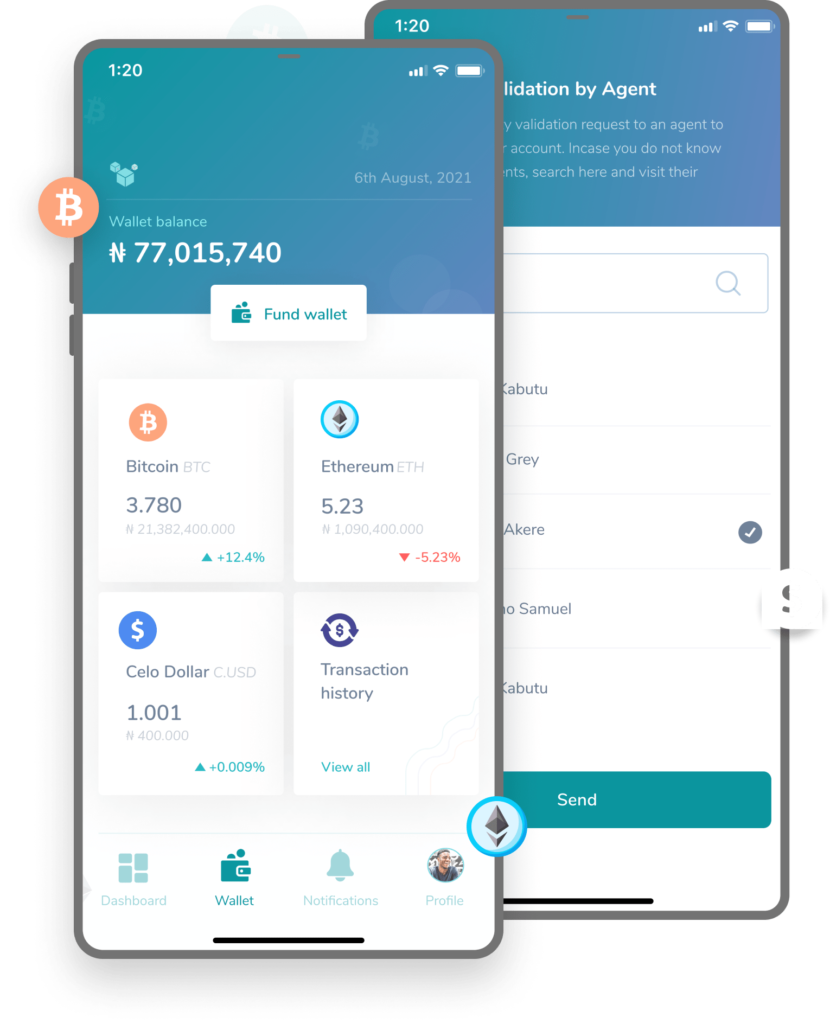

Canza Finance, an emerging markets neobank that is building the world’s largest non-institutional-based financial system, announced the completion of its $3.27M seed round.

The funding round was led by Fenbushi Capital. Dominance Ventures, Bixin Ventures, Consensys, Protocol Labs, Emergo Ventures, MEXC Global, NGC Ventures, XanPool, Hashkey, the founders of Celo, and others also participated in the round.

Prior to this funding round, Canza was financed by Flori Ventures in its pre-funding round, and through its participation in the Filecoin Launchpad Accelerator, Powered by Tachyon.

Canza Finance was established in 2020 Oyedeji Oluwoye. Canza leverages its large network of local money market operators to provide financial and transactional services to customers in Sub-Saharan African countries through.

Colin Evran, Ecosystem Lead at Protocol Labs, expressed excitement on the investment while adding that Canza will hugely impact the development of web3.

“Canza is a shining example of the power of the Filecoin Launchpad Accelerator to transform promising early-stage projects into high-growth businesses on the brink of making a huge impact in developing markets and Web3 ecosystem.

“Given the early traction of Canza, we are delighted to help expand access to Web3 technologies like decentralized identity tools and KYC options to the sub-Saharan Africa region. We’re excited to help the next cohort of African innovators turn their visions for Web 3.0 into reality,” said Colin.

Oyedeji Oluwoye, CoFounder and CTO of Canza Finance, commented, “Today, we stand at a critical juncture in the journey to democratizing finance, with Nigeria emerging at the vanguard of crypto adoption globally. Against a backdrop of high inflation, financial instability, and barriers to access to traditional financial services, sub-Saharan Africa’s underdeveloped financial infrastructure has made the region a perfect vector for decentralized finance — according to a 2021 report by KPMG, more than 1 in 3 Nigerian adults are excluded from traditional finance.”

Oyedeji also added that the startup aims to promote financial freedom in target markets.

“Our vision is to become leaders in decentralized finance and to spearhead this movement to offer financial freedom to millions of individuals. The tremendous interest and backing of our investors and strategic partners will enable us to grow the world-class Canza team, improve our security and most importantly take a definitive leadership position in our target markets,” Oyedeji said.

This funding will enable Canza to continue headcount growth and expand its service offering in Nigeria and other growth regions including South America and Asia.