eSIM Adoption. Is Africa Ready?

By 2025, six billion gadgets, including smartphones, watches, tablets, automobiles, and utility meters, are anticipated to employ eSIM— the next-generation SIM technology. According to Counterpoint’s most recent research, which lists twice as many firms as last year, there are now more vendors offering over-the-air management systems for the technology as a result of rising demand. The completeness, capability, compliance, and quantity of live deployments of each eSIM platform provider were evaluated. In comparison to past years, the criteria have been widened to take into account the changing demands of the market, including those for cloud hosting, interoperability, entitlement device management, and time to market.

In Africa, mobile phones already serve as the interface for a variety of crucial services like banking, education, and healthcare. Although 4G LTE network infrastructure deployments have increased wireless coverage, there are still obstacles to be solved. Additionally, by enabling secure Machine-to-Machine (M2M) communication, eSIM technology has promoted improvements in the linked ecosystem. As a result, eSIMs provide secure, dependable, and affordable cellular connectivity for IoT/M2M applications, which has led to a rise in the use of wireless cellular-based solutions like eSIMs across a variety of end-use sectors.

The size of the global eSIM market was estimated at $8.03 billion in 2019 and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2020 and 2027. The market is growing as a result of the quick rise in IoT-connected devices across a variety of end-use sectors, including automotive, consumer electronics, energy, and utilities.

The market is growing quickly as a result of the rise in IoT-connected consumer gadgets and M2M applications. With the noticeable global advancement and frequency at which eSIM profiles were downloaded to consumer devices, are Africans ready for this change?

How eSIM Works

Mobile Network Operators (MNOs) can store data using radio signals on an eSIM hardware chipset, which is permanently integrated in the device. Additionally, the microchip is smaller than a nano sim and can be reprogrammed by software; as a result, eSIM offers the same services as traditional SIM cards.

In addition, eSIMs have a number of advantages over traditional SIM cards, including support for several mobile carriers, which simplifies subscription management for the device end-user and does away with the need for the end-user to handle multiple physical SIM cards. Since eSIMs are physically secured by being directly soldered to the device’s circuit board, it is difficult to tamper with the device to remove the SIM for unreasonable or fraudulent purposes.

In South Africa, Vodacom officially launched support for eSIM devices in March 2019. With the OneNumber service from Vodacom, users were able to attach their wearable device’s eSIM to a single mobile number for use across different devices. Vodacom users were therefore able to use their smartphone and an eSIM-enabled device to place and receive calls, send and receive texts, and maintain active data connections.

Without using a conventional SIM card in a SIM slot, the OneNumber platform also enables the capability of storing several profiles. When purchasing the device, users can scan a unique QR code to link the eSIM inside to their master number.

MTN Group were the next to launch eSIM support on wearables in October 2019. Cell C and Telkom are the only networks in South Africa that offer eSIM on prepaid services. Although, MTN told MyBroadband it would launch eSIM support for prepaid phones later in 2022.

Africa’s eSIM Problem

According to a global projection from Omdia, 5% of smartphones will have eSIMs by the end of this year, and this number will rise to 20% by 2024. Apple, Huawei, and Samsung have all introduced handsets with eSIM, and they collectively account for more than half of the global smartphone market. The arrival of eSIMs gives the mobile ecosystem a new tool to help reduce Africa’s digital divide. However, it is probably this digital divide that has stunted the adoption of eSIM in Africa.

- B. Say’s neoclassical economic theory holds that “Supply creates its own demand”. Africa’s market has probably not created the necessary demand to accelerate the production and adoption of eSIMs in the region.

Africa differs from many markets globally, notably from those adopting more sophisticated tech. According to Adapt IT Telecoms, the significant differences in this case are the absence of 5G infrastructure, the low adoption rates, and the limited level of knowledge about eSIM technology in this market.

North America held the largest smartphone revenue share of over 35% in 2020 and is expected to continue dominating during the forecast period. Europe is expected to grow at a CAGR of over 9.6% with market players such as Giesecke+Devrient Mobile Security GmbH, Gemalto NV, and ARM Holdings, acting as key contributors to the growth. Asia Pacific is expected to witness a CAGR of over 9.4% during the forecast period. Increasing adoption of IoT technology and the demand for embedded connectivity in vehicles from the consumers is expected to drive the market growth.

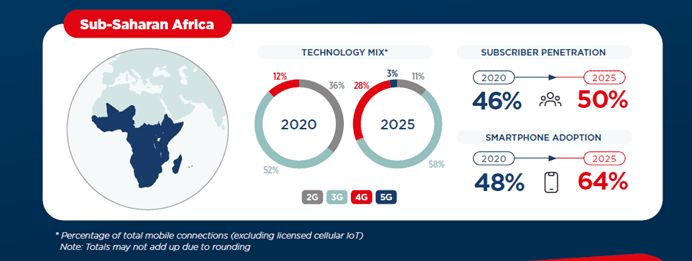

According to GMSA’s Mobile Economy 2021 report there are specific regions in Africa where, 2G and 3G technology is still set to dominate over the next five years, with the adoption of 4G and 5G still being marginally small.

The Ouut’s Take

Mobile operators will be essential in the advancement and market penetration of this new eSIM technology. Many operators have not made the effort to raise awareness of and educate their end-users on eSIM technology and its advantages due to the infrastructure and acceptance of new technology in this region being slower than in other regions.

By using several methods like mergers, acquisitions, joint ventures, and collaborations, global businesses have concentrated on improving their market presence. These tactics assist businesses in geographically expanding their operations and improving their solution offerings around the globe. For instance, the eSIM technology from Gemalto has been incorporated into the Qualcomm Snapdragon mobile PC platform by Qualcomm Technologies, Inc. For consumer application devices, this integration will allow smooth LTE and 5G communication.

What are other factors responsible for Africa’s slow adoption of eSIM? Engage with us and let’s start a discussion about this; we’d want to hear your ideas and perspectives.