Fintech Farm secures $7.4M investment, set to launch in Nigeria and other emerging markets

Fintech Farm, a British fintech company that creates neobanks in emerging markets, has raised a $7.4M investment to launch neobanks in 8 countries during the next two years.

The round was led by Flyer One Ventures and Solid, while Jiji, TA Ventures, u.ventures, and AVentures Capital also participated.

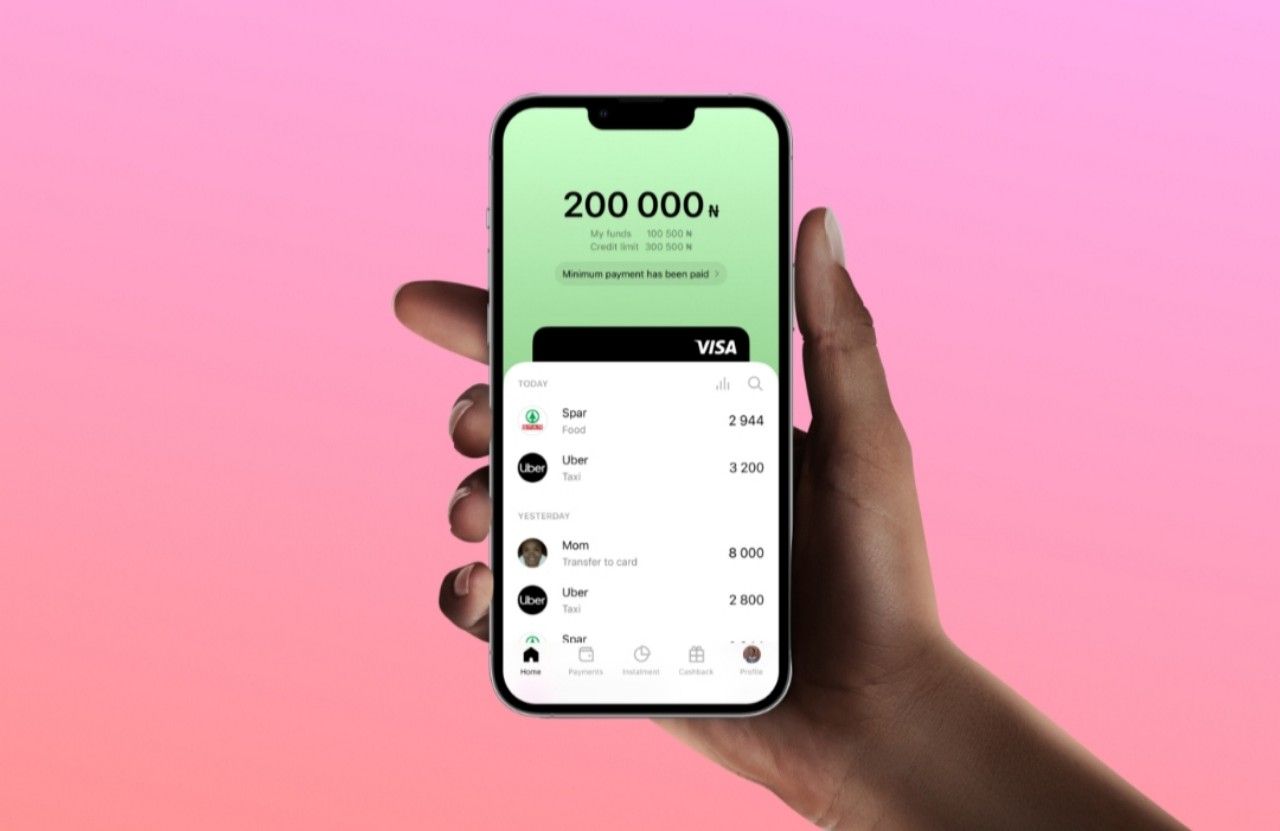

Fintech Farm creates neobanks providing customers with user-friendly mobile apps and credit products for mass audiences and even clients with thin credit histories. In November 2021, Fintech Farm launched Leobank in Azerbaijan, and 100,000 cards have already been issued. Over the next two years, the company plans to enter eight emerging markets spread across Africa and Asia.

Fintech Farm partners with local banks to enter the new market instead of getting its banking license. In each country, neobanks are launched with new names but the same design and mascot — a funny lion with a lilac mane.

“We have a theory that today digital banks have to be not only useful and simple but even entertaining. So we’ve developed our app with beautiful design, useful functions and made it fun to use,” Dmytro Dubilet co-founder of Fintech Farm said. Adding that “there are a lot of nice micro-interactions that bring the UX to the next level. On the other hand, we have one of the best data science teams globally, so we can launch neobanks with credit products from Day 1 and issue credits even to clients with a thin credit history.”

Nigeria is the next market on the company’s radar, where they expect to launch in the coming months.

Nick Bezkrovnyy, a co-founder of Fintech Farm, said “in terms of the credit product, we see an opportunity for a “mass credit card” in Nigeria. Currently, credit cards issued by traditional banks are limited to the upper-middle class. At the same time, APRs of credit offerings from neobanks and alternative lenders may well be over 100%. We are going to fill this gap and accept those customers neglected by traditional banks and offer them fair interest rates.”

Along with financial support, Flyer One brings extensive operational expertise in Africa and other emerging markets. Vladimir Mnogoletniy, Flyer One partner and CEO of Genesis, a tech group, which operates a leading African e-commerce platform Jiji, will be joining Fintech Farm’s board.

Vladimir Mnogoletniy said: ‘We firmly believe in the long-term potential of emerging markets. Over the past seven years, we had tremendous success building Jiji — the largest e-commerce platform (on the GMV basis) on the continent and the only sizable e-commerce player in Africa operating near profitability. We were looking for the right partner to enter the second most interesting market — neo banking — on the continent. We believe that Fintech Farm, with its extensive experience, is the right team for the move, and we’re delighted to announce this strategic investment.