First National Bank introduces Virtual Debit and Credit Cards to facilitate online and physical payments

First National Bank (FNB) is launching virtual cards for individual customers and businesses across Debit, Fusion, and Credit Cards.

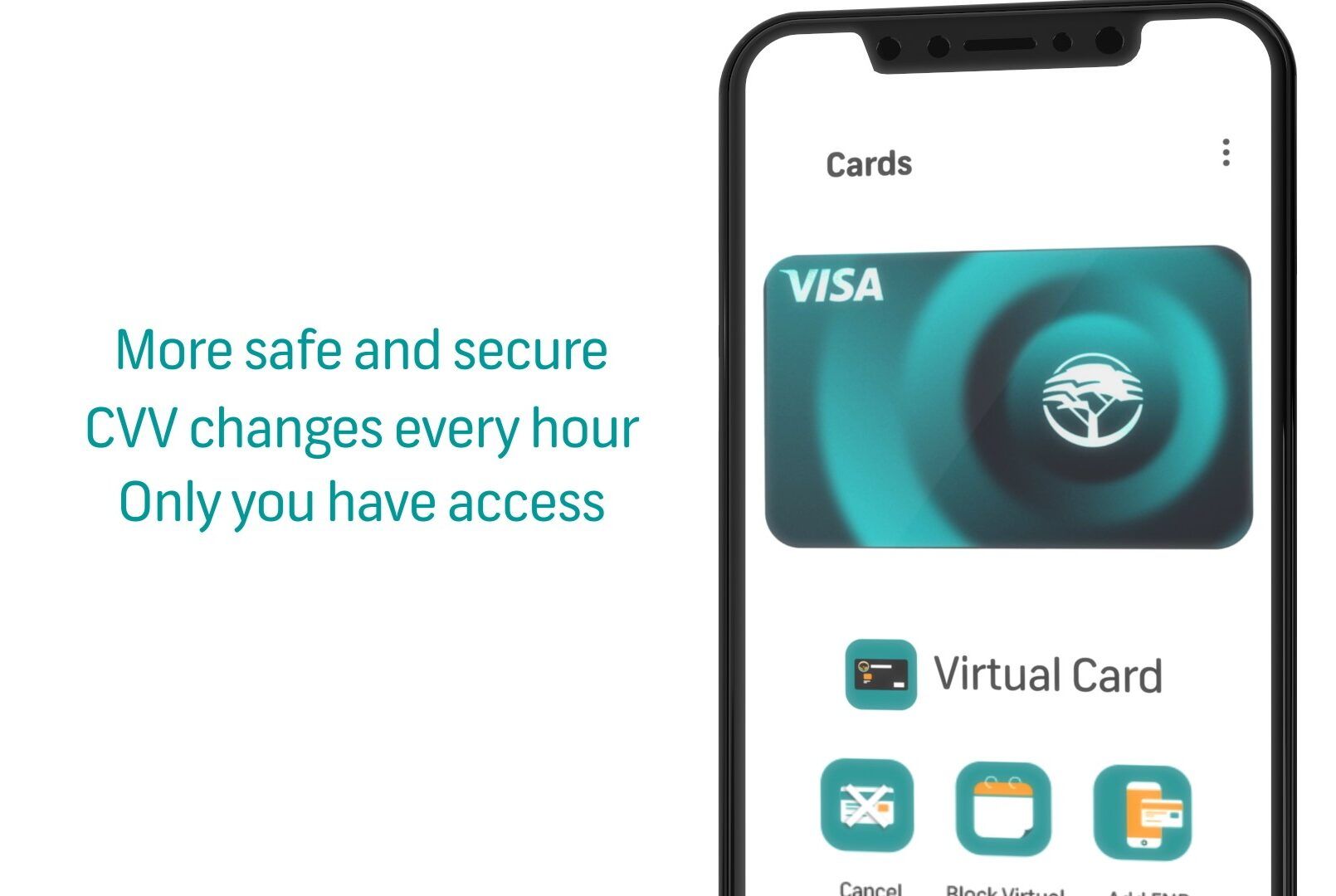

The digital card solution built into Android and iOS which will facilitate both online and physical payments safer and more convenient.

According to FNB executives, the Virtual Card will be rolled out and fully available to customers by October 2020.

Once available, customers can request the card at no additional cost and can access it through the FNB App and the RMB Private Banking App

FNB Payments Executive, Raj Makanjee said, “We have made significant strides in enabling our customers to use digital payments, even when they shop at a physical Point of Sale. We believe that digital payments are a more convenient, secure, and cost-effective solution for both the consumer and the merchant.”

Customers do not need a physical card at merchants that have Tap-to-Pay functionality as they can either use an Android smart device or an Apple device where the merchant accepts QR Code payments via Scan to Pay for a completely contactless digital experience at Point of Sale.

Besides the security and convenience features, the Bank advises customers to use trusted platforms when shopping online and safely keep information such as PINs and passwords safe and to only authenticate transactions they have initiated.

For shopping online, users can log into the FNB app and copy and paste the virtual card number. The dynamic CVV number and expiry date will also have to be captured.

This will function for both local and international online shopping and will also work when users travel internationally and use tap-to-pay in retail.

Customers can create as many virtual cards as they wish or even create one for every online or physical merchant they visit.

The bank said, “If you need to cancel or block the card, you can do it on the FNB app and reactivate it with the touch of a button.”

Virtual Card will not use one-time Pins sent via SMS rather a message will be sent via the FNB app where users can approve or decline a transaction to improve security for online shopping and mitigate chances for fraud.

The bank described Virtual Card as a “plastic-free and safe way to pay”. Also, the card arrives at a time where people are being advised to use contactless payments to reduce the spread of COVID-19.