Flutterwave Secures EMI and Remittance Licenses in Rwanda

Flutterwave, a leading African technology payments startup, has received Electronic Money Issuer and Remittance Licenses from the National Bank of Rwanda (NBR) to expand its operations in East Africa. This is a significant milestone for Flutterwave’s vision of connecting all parts of Africa through payments and connecting Africa to the world.

Moreover, Flutterwave’s expansion into Rwanda is a strategic move towards achieving its goal of providing seamless payment solutions across Africa. With these new licenses, Flutterwave can offer a range of products, including money deposit and withdrawal, electronic funds transfer, inbound and outbound remittance services, and cross-border money transfer solutions.

Rwanda is a critical market for Flutterwave’s expansion plans in East Africa. As a country that fosters innovation and promotes the use of digital technology, Rwanda offers enormous potential for Flutterwave’s growth. Data from the National Institute of Statistics in Rwanda indicates that MSMEs account for about 97% of businesses and contribute almost 55% to the total GDP in Rwanda. This makes MSMEs critical to job creation and the economic growth of the country.

Also, this comes barely a month since the African tech unicorn expanded its payments services to the Northern African region, in its ambitious expansion drive to accelerate customer acquisition in existing markets and growth through mergers and acquisitions. In addition to entering the North African market, Flutterwave co-led Dapio’s $3.4 million raise to scale its contactless payment solution in the UK and Europe. The company is also looking to acquire British fintech Railsr.

Flutterwave’s suite of products, including Store, payment links, invoices, and checkout, will help individuals and businesses in Rwanda make the most of the booming eCommerce market. This will further stimulate the economy and facilitate seamless cross-border transactions for Rwandans and support the expansion drive of global and Rwandan businesses.

What Flutterwave’s Stakeholders are saying

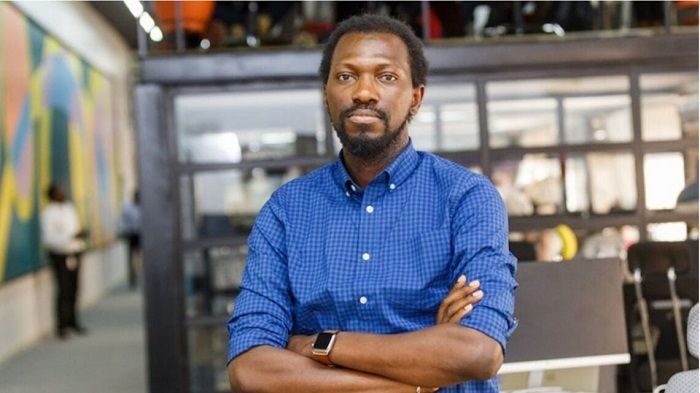

Flutterwave’s CEO, Olugbenga Agboola, expressed delight at the new licenses, saying, “From our first transaction to over 400 million now, we have remained committed to our vision of connecting all parts of Africa through payments and connecting Africa to the world. As a country well known for fostering innovation and promoting the use of digital technology, Rwanda has always been important to our expansion plans in East Africa. We are delighted for the vote of confidence in being granted these licenses. With them, we will leverage our extensive global reach and continuous growth in emerging markets to provide MSMEs in Rwanda with the tools they need to stimulate the economy, facilitate seamless cross-border transactions for Rwandans and support the expansion drive of global and Rwandan businesses.”

Also speaking, Leah Uwiroheye, Flutterwave’s East Africa Regional Lead, Regulatory and Government Affairs, said “This is a great achievement for the company. As Rwanda continues executing important reforms to enhance the ease of doing business and implementing its Fintech Strategy 2022-2027, Flutterwave keeps contributing towards achieving a cashless economy by innovating and employing digital technology to support businesses and stimulate the economic growth of countries where we operate. The licenses will enable us to provide safe, secure and seamless payment services for individuals and businesses in Rwanda. This is definitely a starting point for Flutterwave as we continue to expand across East Africa.”

More about Flutterwave

Flutterwave, which is currently the most valuable startup on the continent, processes more than 500K payments daily and operates in over 34 countries in Africa while accepting payments in more than 30 currencies. It offers over 15 payment options on the platform, and more than 20 million API calls are received daily.

Furthermore, its e-commerce solution had grown to over 30K merchants by February 2022. Flutterwave’s fastest-growing product, Flutterwave Send, launched in December 2021, processed 4,729 transactions worth $3.6 million in the first full month of operation. The product attracted customers from the US, UK, and Nigeria.

Also, as of March 2021, Flutterwave had processed 140 million transactions worth over $9 billion. By February 2022, the number of transactions processed had increased by over 40% to 200 million transactions with transaction value increasing by 78% to $16 billion. In the same period, the number of businesses that used Flutterwave’s different payment modes globally rose threefold from 290K to 900K.

Flutterwave’s expansion into Rwanda is an essential step towards providing seamless payment solutions across Africa. With the new licenses, Flutterwave can offer a range of products that will help individuals and businesses to thrive.