FrontEnd Ventures Prepares To Supports Kenyan Startups With $5Million

Kenya-focused venture capital fund, FrontEnd Ventures has closed its first $ 1 million venture capital fund to make funding available for early-stage startup founders in Kenya.

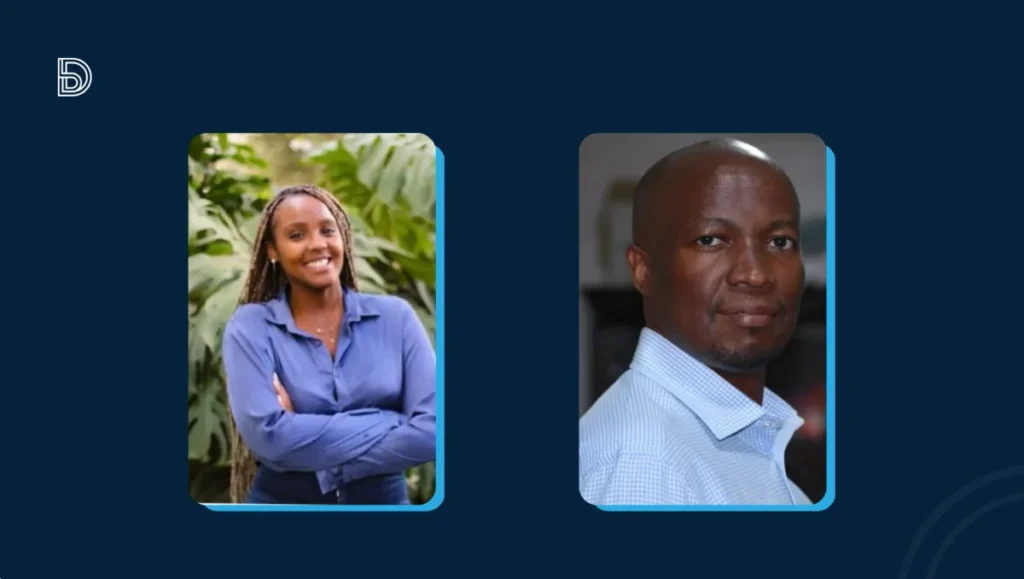

Launched in 2021 by Steven Wamathai and Njeri Muhia, the venture capital is supported by a Five million US Dollars ($ 5 million) fund which is likely to increase to Ten million ( $10 million). FrontEnd targets Kenyan established startups, impactful, and tech-supported startups in various industries not excluding those in e-commerce, agriculture, transportation, and health establishments.

According to reports Njeri Muhia stated, “We are investing in Kenyan founders because we believe in our thesis that people who have lived experiences have a much better chance of creating products that address related nuances.”

She further explained, “This means investing in local women founders too since they bring with them a different profile of experiences, solutions, and ingenuity that is unmatched.”

FrontEnd Ventures is providing One Hundred Thousand US Dollars ($100,000) cheque size yet it is available to make follow-on investments up to five times its initial cheque size in startups under their portfolio. By the end of the year 2022, FrontEnd plans to make at least five more investments, not including two startups in its portfolio.

In further discussion, Wamathai talked about the funds that back up FrontEnd Ventures stating in the quote “The $5 million fund is made up of local capital from high net worth individuals (HNWIs), institutional funds and family offices. “One notable mention about our current LP population is that we have a significant representation of Kenyan locals within the mix—a previously underrepresented cohort in the current African VC ecosystem, so we are proud to be able to drive more representation and inclusion throughout our fund structure.”