Backend Stories: Gbenro Dara's Insurtech startup, Octamile, is enabling insurance access to every social class

The global insurance industry was affected by the COVID-19 pandemic. With nationwide lockdowns and insecurity arising from health and jobs, event cancellation and other risks became the order. Amidst this, insurance companies especially the traditional ones were on the brink of failing and losing revenues. Shocks and more payouts were subject to the impact of COVID-19 on the insurance industry.

While most insurers couldn’t connect with their customers, they had no choice but to go digital. This will save the cost of operation as well as enable efficient delivery against the government’s stay-at-home order. Now in the post-COVID era, Insurtechs deliver faster payments, detection of fraud, risk modelling and identity verification, with underlying technologies among others. Valued at $3.85 billion in 2021, the Insurtech industry is expected to grow at a compound annual growth rate (CAGR) of 51.7% from 2022 to 2030.

The importance of Insurance in Africa is not hugely felt as income earners are sceptical about ‘discretionary expenditure’. The continent is home to a not-so-large working population but is yet the most exposed to fragility in cases of several pandemic outbreaks, rate of mortality, mobile insecurity owing to underdeveloped infrastructures, property theft etc.

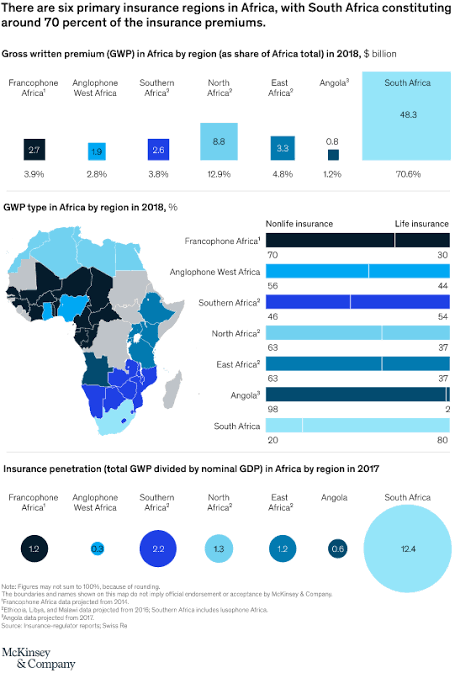

South Africa, a country with barely 62 million people, leads insurance in Africa with around 70 per cent of premiums directed towards the country according to a 2020 McKinsey report. Of the statistics, 54 per cent are for life insurance.

In Nigeria, the National Insurance Commission (NAICOM) Q2 report stated that the industry grew at 20.1% and recorded about N369.2 billion gross premium. While there are only a few insurtechs in the country significantly disrupting the industry, traditional companies have also discovered the need to implement embedded tech features.

One of the Insurtech companies in Nigeria is Octamile. Founded in 2021 by serial entrepreneur Gbenro Dara, the insurtech company enables non-insurance B2C businesses to have access to digital insurance tools via the company’s embedded insurance APIs. Traditional insurance companies are also serviced with improved customer experience, claims, onboarding, payments and distribution.

Having studied Insurance at the University of Lagos, Dara has led several startups in sectors ranging from e-commerce to automobiles and even insurance where he is now referenced as one of the industry’s stakeholders. He started off in the automotive industry as he sold cars until he graduated and joined Sabunta — what is now popularly identified as Jumia — in 2012 as part of the founding team.

“I believe that insurance plays a catalyst role in ensuring the poor in Africa are taken out of poverty and protected from financial losses and other risks.”

The African population has always been a pull factor for foreign and local investors and entrepreneurs. This inherent capacity of the continent was also one Dara would settle for. In the last decade, he led managing director roles in Efritin, Hotels.ng, and more recently Olist by Opera software from 2019 to 2021. He was also the CEO of Cheki, a car marketplace acquired by Autochek in 2020.

Before venturing to establish Octamile, Dara had co-founded an Insurance comparison platform, AutoGenius in 2014. He describes entrepreneurship as his natural path and is driven by the passion for creating solutions to society’s teeming problems.

The insurtech company is sector-agnostic and has worked with leading insurance providers enabling coverage in health, SME, life, marine, motor, device and so much more. Its All-in-One insurance infrastructure enables underwriters, brokers and tech businesses to distribute digital insurance products seamlessly.

“Across the board, there is an agreement that the industry needs to provide more seamless experiences for consumers and digitise the entire insurance value chain to address the needs and behaviours of today’s consumers,” Dara said.

“It is why we are focusing on enabling the ecosystem, including insurers, insurtechs and consumer businesses, with the sole aim of deepening insurance penetration and changing how consumers perceive insurance.”

Even though access to mobile phones and the internet in Africa is relatively low compared to the shift and disrupted operations, innovations are rapidly growing on the continent. One cause of the lag in mobile phone and internet use cases is the poverty lens that identifies Africa. Rural areas are behind in the adoption of technology tools, yet, they serve as the target customers.

“I believe that insurance plays a catalyst role in ensuring the poor in Africa are taken out of poverty and protected from financial losses and other risks.”

With Octamile’s embedded insurance solution offered to several sectors; banks, fintechs, microfinance institutions, etc can provide insurance for their loans to mitigate the risk of repayment.

It has offered its products including faster claims solutions, risk assessment and embedded insurance, among others to over 30 B2C businesses and also covered 10% of insurance providers in Nigeria. Its partnership with Gokada, a logistics platform, assures automatic insurance for the company’s 1000-plus riders. To enable faster claims, Octamile has also partnered with Axa Mansard in Nigeria limiting the processing of claims from weeks to minutes.

Currently operating a B2B model, the CEO noted that “our goal is to be the digital enabler for the entire Insurance ecosystem by leveraging our technology expertise to drive critical partnerships and collaborations in the industry.”

“We aim to provide access to over 1 million users across Africa, which will require expanding our current product offerings and partnerships and launching in other markets across sub-Saharan Africa.”

In December 2021, Octamile raised $500,000 in pre-seed led by EchoVC with participation from Fiat Ventures, Kesho VC, Trade X, Verraki Partners, Dale Mathias, Kyle Daley and other local and international Angels.

Backend Stories is The Ouut‘s special edition that focuses on African tech founders, sharing their stories, especially their entrepreneurial journey.

If you loved this piece, kindly share it with your network across every social media platform. To be spotlighted, send an email to adebola@theouut.com.