How Kennedy Ekezie-Joseph is Developing the Financial Management of Small Business Owners through Kippa App

Technology has been a satisfying global phenomenon. It has and is making business finance management easy. This management is easy and needs no mobility because it could be done at your comfort zones, with the help of smart phones by containing helpful apps that helps safe resources (energy, time and money).

Transactions on credit cards, customer management, invoice management and gigantic financial manipulation and calculations, all have apps for their functions. All scales of business similar to each other should find or create apps capable of syncing everything, it will save time and strength.

Prior to the advent of calculative apps, small businesses in Nigeria have had difficulties computing their daily transactions. Accounting really is a difficult process, the processes are enormous- systematic process of identifying, recording, measuring, classifying, verifying, summarizing, analyzing and interpreting and communicating financial information. An uneducated or uninformed small business owner will go through this process to ascertain their profit or loss for a given period, and the value and nature of a firm’s assets, liabilities to provide assurance that the objectives of internal control are being met.

‘Wahala for who no get Kippa’

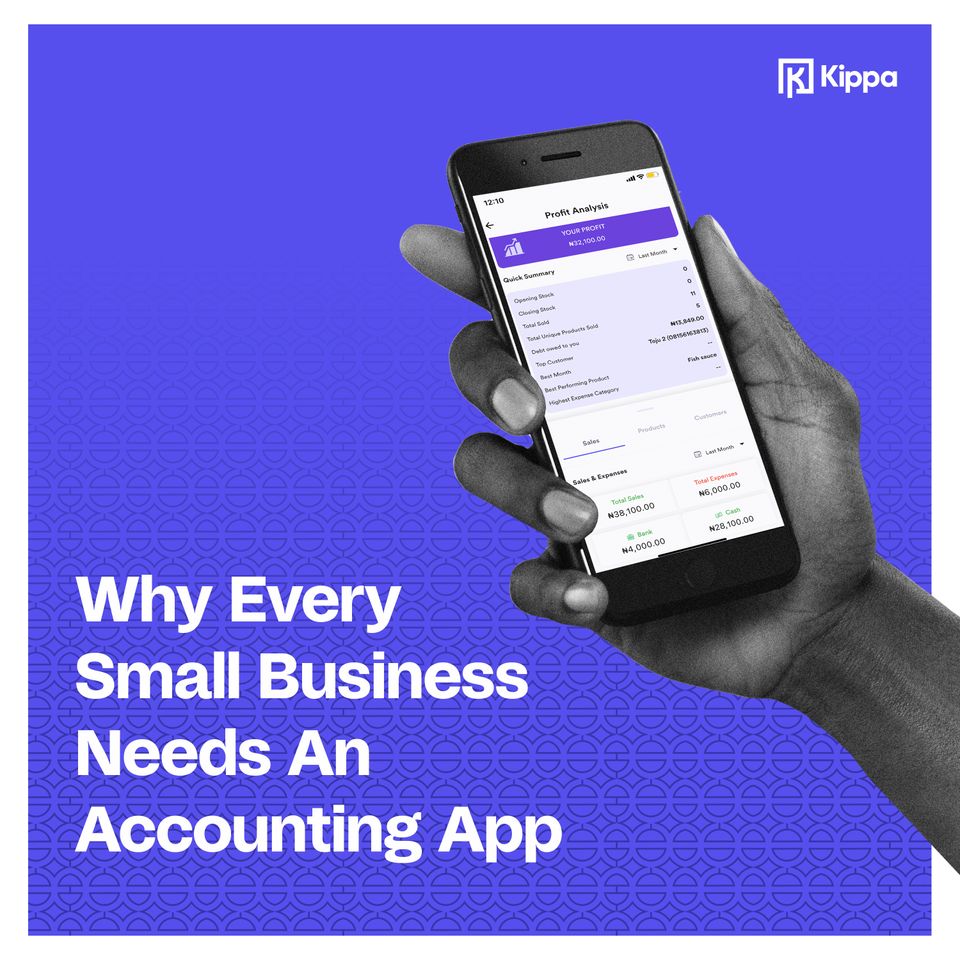

A good accounting system is not only judged by how well records are kept but by how well is able to meet the information needs of both internal and external decision-makers. The Kippa app is all of this. Kippa, was created by Kennedy Ekezie-Joseph in 2021. The app helps small business owners keep accurate books in order to Price their products accurately, know if they are making or losing money—in general and on specific jobs, know their cash flow – both in the short and long term.

Kennedy Ekezie-Joseph is reportedly one of the youngest Chief Executive Officers in Africa when he co-founded Kippa alongside Jephtah Chidozie-Uche and Duke Ekezie-Joseph in 2021. Shortly afterwards, the company announced a pre-seed funding round to the tune of $3.2 million.

Speaking to Business Insider Africa, Kennedy said that the company is focused on development of product and technology to deliver value to merchants, and growing our global team with the most talented people.

“We have focused on two important things: continued development of product and technology to deliver value to merchants, and growing our global team with the most talented people. When we think about it, building technology that solves problems is only possible at the intersection of these two things. More importantly, we are able to think of bigger, scaled-up products, and that’s critical when we are trying to accomplish such audacious goals,” said Kennedy.

A Proud CEO

Kennedy was presented with a Queen’s Young Leaders Award in 2018 for his work to promote women’s rights in the areas of female genital mutilation (FGM), domestic abuse and forced child marriage and access to education for girls, through the organisation he founded, Calabar Youth Council for Women’s Rights. He started Kippa 3 years later with the desire to cater to a previously ignored segment. “When we started out, we wanted to help small businesses run more profitably and sustainably,” he said. Kippa playing pivotal role in help small businesses in Africa record their daily income and expense transactions, manage their inventory, and automate the debt recollection process. Thanks to Kennedy and the Kippa team, small businesses don’t have to be digitally excluded while dealing with their financial management processes. This is the level field they’ve always wanted.

According to Kennedy, “The most critical success factor is the intimate, candid understanding of the needs of our users, and the consequent speed at which we innovate for small businesses in Africa. Traditionally, these businesses are ignored and shut out of the current financial system. We see this as an advantage for us, because it provides us room to build more infrastructure and solutions for them, consequently making us more powerful at scale.

“Kippa stand out: our discipline around our customer segment focus and our product approach – building for merchants who are coming online for the first time requires a radically different approach to design and development. Our product ecosystem also allows businesses to link different aspects of their business on one app and that in many ways simplifies running all the moving parts of a business”.