Jumia’s Fall from Grace and Takealot’s Strategy for Growth

The Shadow Over E-commerce in Africa

The value of e-commerce in Africa reached $16.5 billion in 2017, and by 2025, it may reach $75 billion. Although these forecasts present an upbeat picture, caution should be exercised before putting too much stock in them. The fact is that due to a number of systemic problems plaguing the African continent, e-commerce in Africa is presently far from reaching its full potential.

The second-largest and youngest population in the world is found in Africa; thus, the region presents a sizable digital audience. The adoption of smartphones and other mobile devices has pushed internet penetration to 11.5%. Despite its spectacular growth, African online shopping is still behind the global norm, particularly in the most significant markets on the continent. Recent statistics show that 57% of Egyptian internet users made some kind of online purchase. Almost 58% of consumers in South Africa make digital purchases. 77% is the overall percentage.

Nigeria, South Africa, Kenya, Morocco, and Egypt are a few of the African countries with competitive markets. According to a number of leading businesses, including Jumia, Konga, Takealot, and Kilimall, which also have operations in other African countries, online retail is expanding in these areas.

The two best-known online markets in Africa, Jumia and Konga, have their headquarters in Nigeria. Takealot.com, the biggest e-commerce site, is headquartered in South Africa, while Kilimall was founded in Kenya.

Examining Africa’s E-Commerce Sector

Given the importance of e-commerce, taking a look at the most well-liked online retail companies does not only afford the needed knowledge on e-commerce in Africa but also opens it up for funding. Unsurprisingly, Jumia’s online shopping is the best in Nigeria and Kenya and is only second to Souq in Egypt. But the biggest e-commerce company is reportedly lagging. They really can’t be falling from grace when Africans need them.

Fall from Grace

Jumia was valued at $1.1 billion when it went public on the NYSE at $14.50 a share. Four days later, its stock price reached $49.77, bringing its value to a record high for an African company of $3.8 billion. And no, the glory was fleeting. A few weeks later, Jumia’s stock experienced a sharp decrease as a result of claims of fraud and hidden losses, a damning report by a well-known short-seller, embarrassing fraud cases in New York courts, and a PR disaster about the company’s identity.

Due to Jumia’s identification problems, a public relations war ensued that was reminiscent of a Marvel movie. There was a disagreement regarding its identification during its IPO. Jumia’s claim to be African in its S1 filing drew heavy criticism from African industry insiders, despite the company being established in Germany, listed in New York, and based in Dubai.

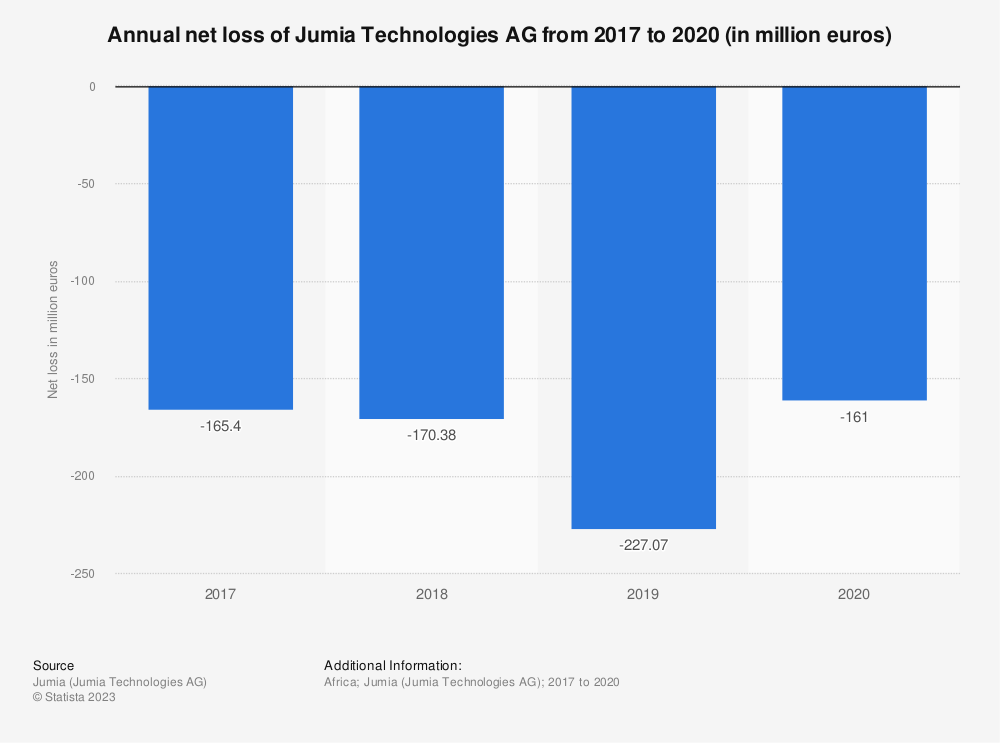

Beyond Jumia’s identity problems, the company also had trouble turning leads into customers. Jumia has informed investors that its goal is to become profitable by 2022. Although it continues to disclose significant million-dollar quarterly losses, there is no sign of a loss reduction trend.

Operating losses grew by 15% to €61.1 million ($66.5 million) in the fourth quarter of 2019, while they grew by 34% for the entire year. Jumia has increased its cost-cutting efforts in recent months, discontinuing operations in Rwanda, Tanzania, and Cameroon. Nevertheless, it has also increased its focus on its current markets, looking at ways to increase its user base, order volume, and revenue.

The e-commerce sector, one of the most well-funded in Africa’s tech ecosystem, expects top-notch performance from its key participants. Due to Jumia’s downfall, Takealot and others are on high alert. In order to avoid a similar fate, strategy is necessary.

Takealot’s Strategy for Growth

Like many other South African online marketplaces, Takealot’s business strategy offers a framework for the company and other vendors to sell their goods. It is an online store that sells a range of goods and lets other third parties list their things for sale there. In addition to its own retail line, Takealot offers a thriving market for independent merchants that use the website’s capabilities for warehousing and fulfillment as well as sales and returns.

Takealot now has a momentary advantage over rivals. Takealot began operations in June 2011 and has since grown to dominate the South African e-commerce market. The key to Takealot’s success is its ability to assess markets and make necessary adjustments to meet all intended demand. According to analysts, the store was better equipped to handle the coronavirus-induced surge in demand thanks to Takealot’s pre-pandemic investments in warehouses and delivery hubs. For the business to be sustainable, market actions have been essential.

One Market

Geographically speaking, Takealot might have expanded outside of South Africa, but they have chosen to stay in the region where their market resides. Takealot made the decision to stay put because it believes the local e-commerce business has plenty of room for growth. Increased mobile accessibility has made it easier to realize the full potential of the nation’s e-commerce industry.

Just 1% of the country’s overall retail market in South Africa is made up of e-commerce. The business has a chance because of the market gap in South Africa. Along with this, Takealot’s 2014 merger with Kalahari, $100 million investment, and purchase of MR Delivery gave the company control over their own logistics network, which dramatically reduced expenses and allowed them to offer the same products at lower prices. By focusing on its competitive advantages, Takealot has been able to compete favorably.