Lazerpay is driving the growth of businesses in Africa with its blockchain- enabled payment gateway

Commerce across Africa is fragmented because currencies are different. According to the World Bank, approximately 41 currencies are serving Africa’s 54 countries. This fragmentation has made moving money across borders over time, effectively preventing businesses from expanding their reach.

Lazerpay is driving the growth of businesses in Africa with its blockchain-enabled payment gateway.

When Lazerpay set out to build solutions for businesses in 2021, the goal was simple: help African businesses and creators get paid from anywhere around the world in cryptocurrencies, specifically, stablecoins.

Since coming out of private beta in February, the startup has evolved its understanding of the

challenges its customers are facing.

This insight, coupled with a relentless drive for improving the current financial landscape for underserved businesses has led to the release of a new, and improved version of its product with a couple of eye-catching features created to make commerce seamless for businesses

collecting crypto payments.

Here are some of the new updates users can look forward to exploring over the next few days.

Improved onboarding and compliance

One of the most significant updates to Lazerpay’s offerings is its onboarding and compliance section. Although crypto transactions are still a regulatory grey area, the startup is taking preemptive measures to make sure that all businesses registered with it are vetted by compliance systems on par with traditionally regulated financial businesses.

Since Lazerpay caters to enterprise businesses—it has enhanced its compliance procedures to cater for all these different classes. On sign-up, users can select their business type and then be guided through the specific compliance requirements for them. An LLC business, for instance, will be required to submit the name and details of its directors and shareholders while a freelancer will only be required to submit their ID.

Data-informed dashboard for decision-making

Recognizing the need for data to guide decision-making for its businesses, Lazerpay has

improved its dashboard to provide more data.

The dashboard is the nerve center for every user signed up on Lazerpay; whether you’re a freelancer using payment links to receive or pay for services, or an e-commerce business using the startup’s easy-to-implement payment button to power checkout.

On the overview screen, merchants get a view of their wallet balance, and financial performance over the past few months, with a summary of recently concluded transactions. They’re also able to update their business information or upgrade their account KYC if need be. The transaction dashboard gives users access to all their transactions which they can export if need be to conduct further analysis.

On the Customer dashboard, merchants can access customer details that have been collected and filter them to learn more about their customers e.g. filter customers who made purchases within a specific period, etc. They can also learn about the nature of their customers’ transactions and block fraudulent customers if the need arises.

Payouts by Lazerpay — move your money on your terms

Another major change coming to Lazerpay is how it processes payouts. Initially, the startup facilitated stablecoin transactions, paying out earnings to business owners and creators in whatever stablecoin they earned in. This posed a problem as customers sometimes got paid in one stablecoin but needed to transact in another.

Going forward, users are going to be able to swap their stablecoins between the supported tokens on the platform which currently powers earnings in USDT, USDC, BUSD, and Dai. This allows users more flexibility with moving their money in and out of the platform. But that’s only the beginning.

Lazerpay has also added fiat payout options for its users. While users could only receive payouts in stablecoins before. They can now get paid in any of the following currencies:

– Nigerian Naira

– Ghanaian cedis

– Kenyan Shillings

– Rwandan Shillings

– US Dollars

– UAE Dirham

With the new payout options, merchants can also send money to other businesses in their desired currencies, meaning more freedom to move their money how they want to.

Products by Lazerpay — sell better and faster

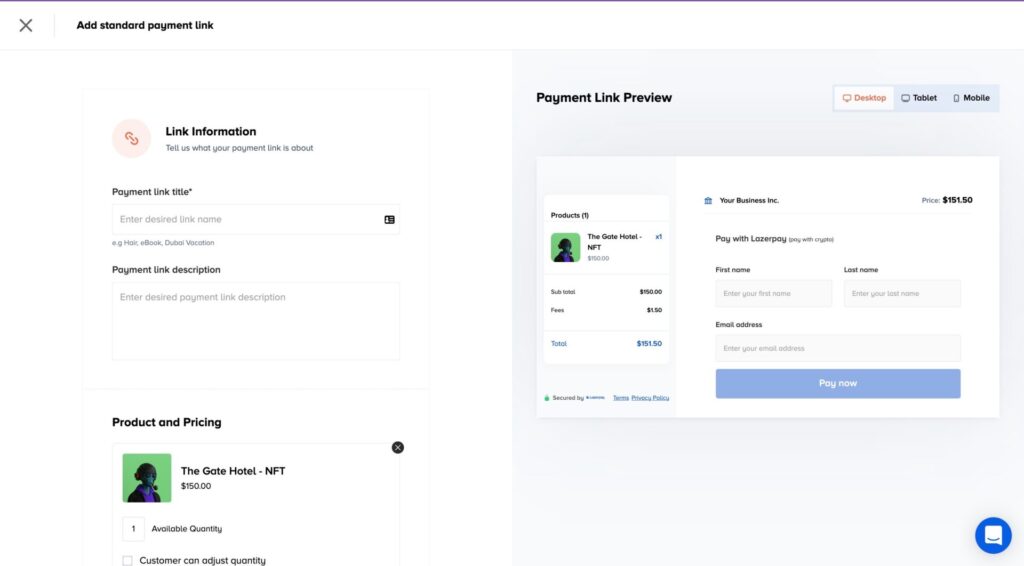

Products are Lazerpay’s take on a flexible, yet effective storefront for small business owners and creators. Using Products, a Lazerpay merchant can upload and create multiple product listings, indicating the number of items they have in stock.

During a purchase, merchants can use any combination of these product listings to create an order for their customers and then generate a single payment link they can use to pay for all the purchases.

While the solution sounds simple enough, flexibility is where the magic happens. Before Products, merchants Lazerpay had to manually create links for each product they wanted to sell. However, with the new update, users can combine multiple product listings in just one link, helping them get paid faster.

In addition to that, merchants can add customizable descriptions to their orders. These descriptions can be previewed so the merchants have an idea of what the users see when they open the links. Other features include the ability to collect delivery details and other custom transaction details plus the option of a “Thank You” message when payment is received.

Building the future of commerce with crypto

The recent changes to Lazerpay come at a time when African businesses need to rely more on decentralized finance solutions to scale their services. Through these updates, Lazerpay is bridging the gap between the accessibility that crypto offers and the simplicity of mainstream solutions.

“The future of commerce is one where merchants have the flexibility to offer products and receive payments from anywhere in the world. We’re equipping SMEs in Africa and the Middle East to key into the global market”, Njoku Emmanuel, CEO of Lazerpay said in a statement about the new updates.

Over the last few weeks, the new products and solutions have been tested extensively with external partners in preparation for this launch. The startup is excited to open up its new features to the public and keen to hear feedback.

That said, Lazerpay wants merchants to know that it is still day one, with further improvements coming down the line. Shortly, the startup hopes to add more analytics to merchants’ data, allowing them to make smarter decisions about their businesses.