How Lenco will Service 50 Million African Small and Midsize Businesses

Africa’s fintech sector is heating up. But, as much as we see more fintech startups launch, the industry still needs more. Millions of businesses and individuals need the services these startups provide. We have the likes of Sparkle, Prospa, Float, and consumer Neobanks Carbon and Kuda, but we still need Lenco for businesses.

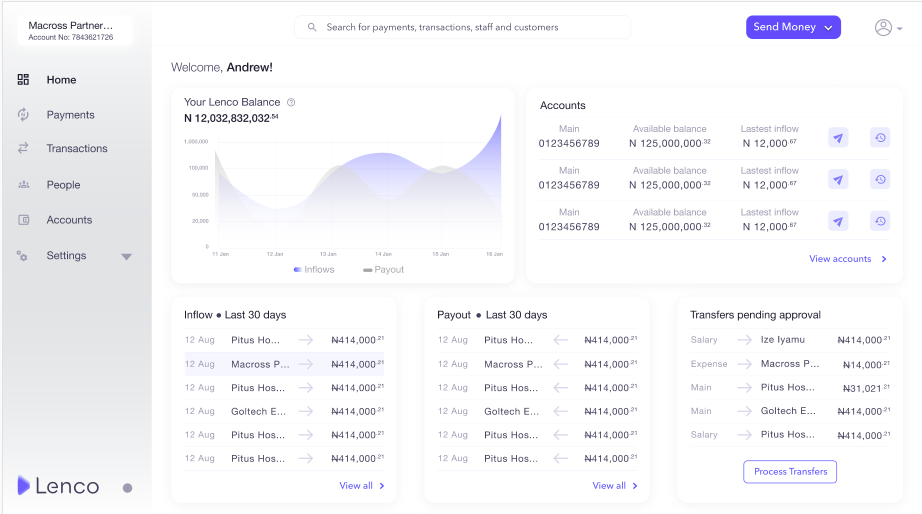

In a world where technology is helping companies and entrepreneurs manage their businesses with ease using digital platforms and apps, Lenco’s end-to-end suite— which will include corporate card management soon, makes it a player to watch. Lenco is a digital platform you can trust to take care of Africa’s 50 million businesses.

Essentially, these apps help make the business management processes more efficient, convenient, and stress-free. In addition, Lenco’s banking services are provided in partnership with CBN licensed bank partners. The startup is also one of the 24 African startups selected for Y-Combinator’s W22 accelerator program.

The Growth Process of Lenco

Lenco launched in Nigeria in 2021. However, the startup disbursed the beta version of its app to alpha users earlier on. A group of professionals created Lenco using specialized software and tools. These products provide solutions to the company’s ever-increasing needs. As a result, it promotes corporate expansion.

CEO Andrew Airelobhegbe, who previously co-founded ogaVenue, shared his experience with businesses.

“At our previous company ogaVenue where we partnered with over 30,000 businesses in 5 countries (including UAE), getting complaints from businesses about their bank partner as usual. Interestingly, we had a fair share of this experience ourselves at our Lagos and Kenya operations.

“We kept asking ourselves, why can’t a team build business banking that just works? The idea seems straightforward to me. We were (still are) open to connecting such a team to our network of thousands of businesses who would be ready to switch,” said Andrew.

The global economic shock in 2020 due to the COVID-19 pandemic might have delayed the launch of Lenco. According to Andrew, it broke the team. However, the CEO saw it as a sign from the universe to fix this seemly reoccurring problems businesses. Problems that stem from banking and expense management.

“We went ahead to speak to 98 different CEOs, CFOs, and, Finance teams across Automobile, Hotels, Oil & Gas, Healthcare, Logistics and, other industries — they all had similar issues with the way their business banking works. At this moment, we knew business banking and expense management needed to be fixed in Africa,” said Andrew Airelobhegbe.

Lenco’s Services

Lenco’s banking and expense management service comes in three parts:

Financial Services: Lenco issues businesses a bank-backed business current account (not virtual account) from one of its partners. Applying for an account takes <10mins and approved within 24hrs. With Lenco account, businesses will receive financial services on a simple user interface, with great user experience. The platform also gives customer support when needed. Businesses would earn between 0.25–1% on their average balance. Lenco believes that businesses should always have unrestricted access to their money. Ideally, the money should be deliverable to anywhere in the world they want it, and they should have access to not just their present revenue but future revenues based on their cash-flow.

Spend Management: With businesses usually having cost associated with their operations, Lenco simplifies the identification of their biggest cost drivers. Lenco is also able to optimize it and make smart money decisions. With a Lenco account, users are also able to invite team members with different access levels, categorize transactions, group recipients, and comment on a transaction. The platform creates indexed, filterable files, then downloads them in CSV or PDF form. The platform also split across sub-accounts dedicated for important company needs such as salaries or savings.

Business Analytics and Recommendations: Lenco helps businesses explain data and recommends ways to cut cost, identify missed revenue opportunities. The platform also connects users to other Lenco users who are potential customers. Startups will be able to manage their core banking activities from a simple API. Lenco will use its robust Hotel Management System which is linked to specific banks to collect payments and manage operating expense in very simple but innovative ways.

Opening a Lenco Account

Lenco require just a few documents for intending users. A business will need the following documents:

- Your Certificate of Incorporation (Certificate of Incorporation)

- Important information about your company’s directors and owners.

- Your company’s registration number (RC/BN)

- Complete form Co7 which contains the information about your company’s directors.

- Fill out Form Co2 with the allotment of your company’s shares

- Your social security number

- A current power bill and a passport photograph.

- SCULML

- Finally, get a referee.

Customers can also get required information by clicking here.