Maplerad Secures $6 Million in Seed Funding, to Soar Client Acquisition Among Others

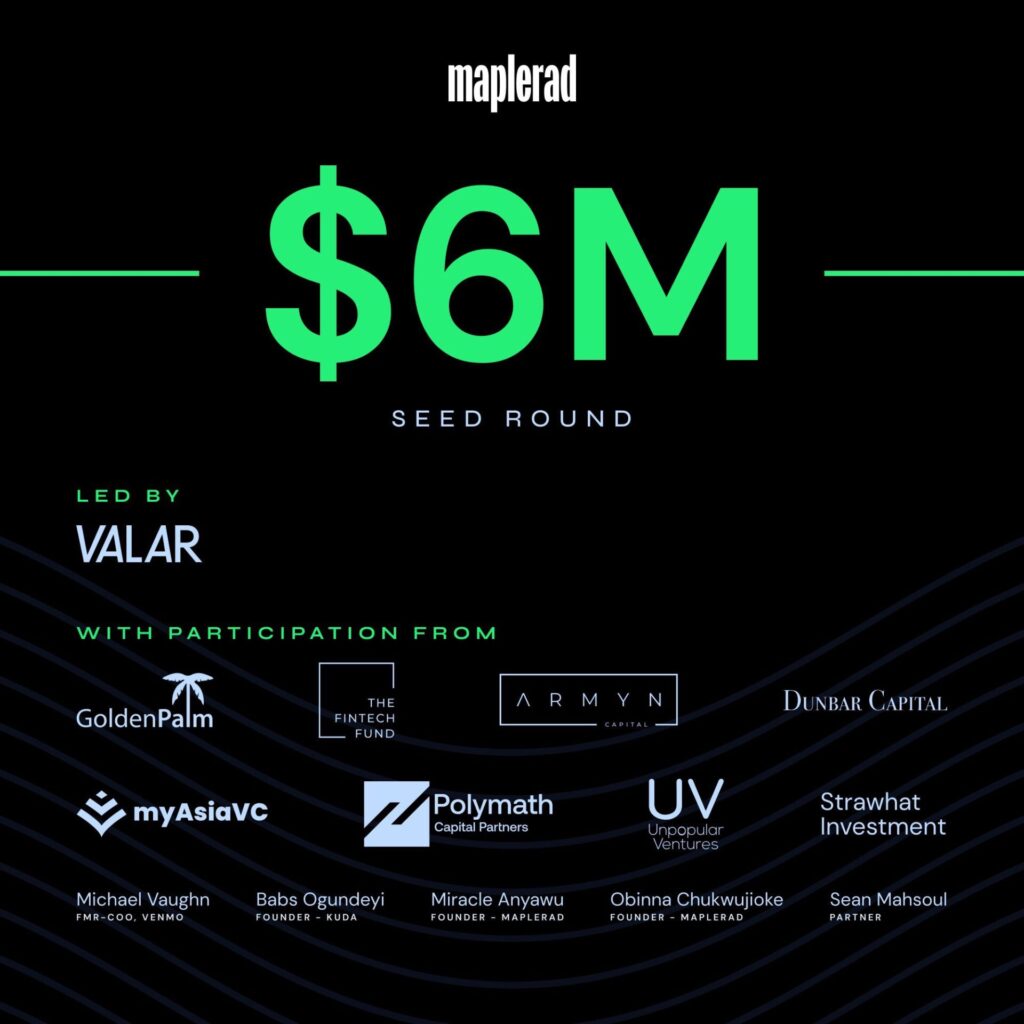

US-based Nigerian Banking-as-a-Service (BaaS) platform, Maplerad has raised $6 million in Seed funding led by Peter Thiel Valar Ventures to accelerate product offerings, empower builders and businesses and help consumers make payments across borders differently with Wirepay, its cross-border payment solution.

Other participants in the round include; Golden Palm Investments Corporation, Fintech Fund, Dunbar Capital, Strawhat Investment, Polymath Capital Partners, My Asia VC, Armyn Capital, Unpopular Ventures, Michael Vaughn (Former COO, Venmo), Babs Ogundeyi (Founder, Kuda) and Seun Mahsoul as well as Maplerad’s two founders; Michael Anyawu (also CTO) and Obinna Chukwujioke.

The Fintech company’s trackable existence was since 2020 when its first product, Wirepay was launched to help users make cross-border payments in fiat and cryptocurrency. It has now evolved to enable users to receive, hold and make payments in multiple currencies, create virtual and physical cards, and pay bills seamlessly. The product has raised an undisclosed pre-seed. It also became a beneficiary of $125,000 from On Deck as part of its ODX1 batch.

As Wirepay’s parent company, Maplerad has also added new features to its platform which include: accounts (to generate virtual and physical account numbers that can receive payments from financial institutions); FX (to enable businesses conversion of currencies and access liquidity at best rates); issuing (to distribute virtual and physical cards to customers in different currencies); and payments (to accept payments and attract revenues).

In a statement said to TechCrunch, Anyanwu said: “From day one, when we built Wirepay for our consumers, we knew the end move would be infrastructural even though we didn’t start the business infrastructure first. For anyone to build anything finance-related, they have a whole lot of banking stack that they have to start with and even before integrating features, they have to go past many hurdles.”

“One of them is banking relationships and compliance. The other is licencing. So Maplerad is solving financial infrastructure problems for these businesses in Africa. We handle that whole stack and provide the best-in-class APIs to use that can make you launch a financial product within five minutes. So instead of a company spending 8 months and a couple of million dollars to start building a fintech product, you can integrate with our APIs and go live.”

The BaaS company has processed $100 million for over 100 startup businesses such as Pastel, Spleet, Bridgecard, Onboardly, Vella, Crowdforce, Dojah, and GetEquity, among others — while in stealth. With its latest seed funding, it plans to acquire more customers and expand globally.

Speaking on the investment, Partner at Valar Ventures, James Fitzgerald said: “there’s a huge opportunity for Maplerad which is the best-in-class banking as a service solution to provide businesses with the financial infrastructure to scale across Africa and globally quickly and seamlessly.”

Banking-as-a-Service (BAAS) is identified as a disruptive payment tool which enables non-banking institutions to develop APIs for brands after partnering with traditional banks to ensure fundamental banking services such as payments, card verification etc. as well as save money for brands and ensure great user experience.

Anchor Secures $1 Million Dollars Pre-Seed Funding, Launches Beta