Mastercard, FASTA introduce first virtual credit card in South Africa.

Mastercard in collaboration with fintech firm, FASTA is introducing the first virtual credit card in South Africa dubbed, FASTACard.

FASTACard which is backed by Standard Bank and Tutuka offers locals access to instant credit, loaded onto a secure digital card used both online and in-store.

Chief Executive Officer of FASTA, Kevin Hurwitz said, “We launched FASTA to help South Africans quickly and painlessly gain access to an instant, and affordable credit facility at the point of purchase – be it for replacing a fridge that unexpectedly breaks down, splurge on new tires for their car or to buy a new mobile phone.”

“With the virtual Mastercard, we are giving our customers the convenience of being able to spend their credit at millions of Mastercard retail locations in South Africa and around the world. It also provides savvy shoppers with a secure solution to shop online and instore – without the hassle and time spent applying for a traditional credit card.”

This virtual card comes at a time where the demand for contactless payment is high due to the ongoing COVID-19 pandemic.

Speaking on FASTACard, Country Manager at Mastercard, South Africa, Suzanne Morel stated, “South Africans are increasingly shopping online to access what they need without leaving their home, but the safety of their payment details remains a key concern. The new virtual card means that consumers no longer need to use their primary bank card for online shopping. It also provides them with additional security and control as they select the exact amount they want to load onto the card for their purchase.”

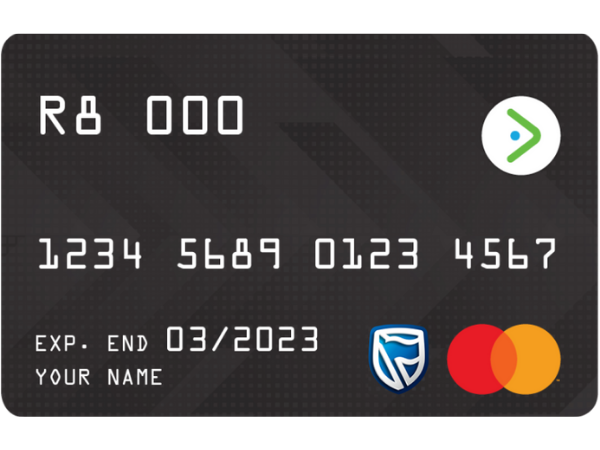

Individuals can apply for credit up to R8,000 equivalent to $474.58 with a repayment plan of up to three installments paid over four months.

In just a few minutes, the loan application is approved and customers are sent a virtual card valid for three years.

FASTACard comes with a 16-digit card number, security code and expiry date can be used at nearly 200,000 retailers and billers in the country that accept Masterpass, a digital wallet from MasterCard, Samsung Pay, SnapScan or VodaPay.

The moment the card is loaded, the cardholder can use their mobile phone to Scan a QR code displayed at checkout.

Just like a physical card, FASTACard can be used on apps like Uber and Netflix.