Moneymie Nigeria Shutdown B2C Cross Border Digital Banking Service

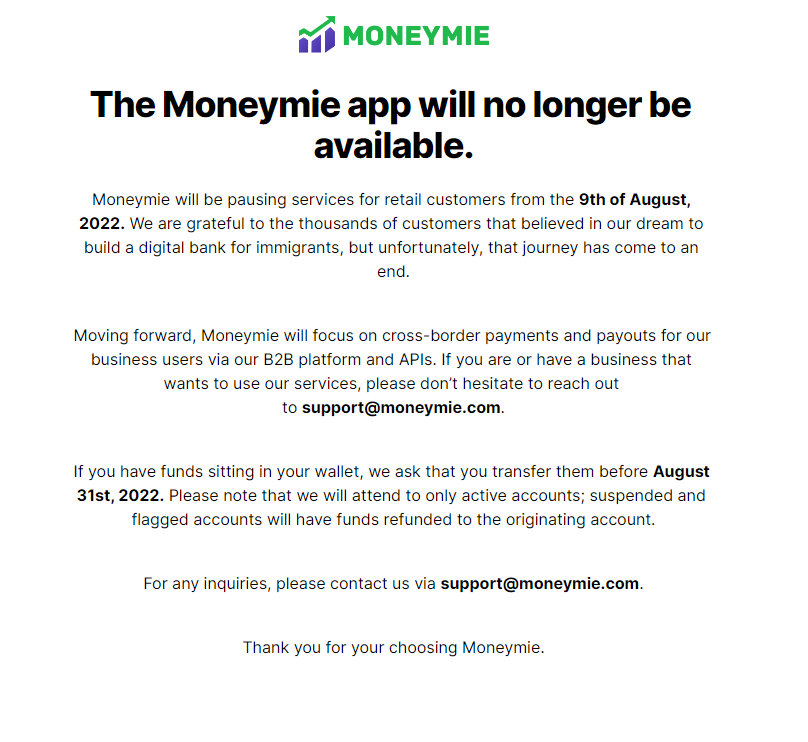

Moneymie, a fintech startup in Nigeria has shut down its cross-border business-to-customer (b2c) service, this was made known in a newsletter startup released recently.

This action disenables African immigrants located in North America from receiving and sending money to Ghana, Nigeria and South Africa.

According to the message boldly posted on the startup’s website, the startup reiterates its action to pause services “We are grateful to the thousands of customers that believed in our dream to build a digital bank for immigrants, but unfortunately, that journey has come to an end,”

Even as Moneymie points shut down its B2C service, it has restated that it will now concentrate on its cross-border transaction tilted toward business-to-business (B2B) through its API and B2B mediums.

Opeyemi Awoyemi, a venture builder founded Moneymie in 2019. he had founded Jobberman before he exited, and WhoGoHost previously.

The information on the websites informed users to transfer the remaining funds in their active account wallets to other accounts. In contrast, flagged accounts or accounts with related issues will have to wait for a refund. All these are expected to be done on or before the 31st of August 2022.

The event following the shutdown shows that the fintech’s mobile application has been removed from both Google and Apple playstores but it has been noticed that the Moneymie B2B platform is still active.

This event comes two months after Michelle Van Staden became Neobank’s CEO.

Payment influx to sub-Saharan Africa in the last decade has increased to an extent since 2020, there has been an upward percentage of about 6% to Forty-five Billion US dollars ($45 Billion).

In as much as there has been a consistent influx of payments to the region, the transactions have not been cheaper for the users, not the fintech. The world bank had reported that sub-Saharan Africa is the most expensive region, for payment transactions both for receiving and sending. Transactions attract 8% on averagely when compared to the global average of 6%.