Nigerian agency banking startup, CrowdForce raises $3.6M to boost access to cash for underserved communities

Abuja-based startup, CrowdForce, a Y Combinator-backed agency banking platform, has today raised a $3.6 million Pre-Series A funding round to triple its PayForce agent network this year and deepen its financial service offerings to underserved Nigerian communities.

The equity-and-debt round was led by Aruwa Capital Management with participation from HAVAÍC and AAIC. The company said it will use part of the capital to expand its team, geographical operations and marketing to triple its 7,000-strong active agent network this year.

“There is a clear need to build an offline distribution network to enable fintechs and challengers to reach the mass market – this is exactly what we’re doing at CrowdForce, and this round will accelerate our momentum even more.” Oluwatomi Ayorinde, CrowdForce’s CEO said.

Prior to this round, the startup raised $500,000 from angel and VC investors including 500 Startups, Ventures Platform, and Right Side Capital. That was after bootstrapping the startup early on with the co-founders’ savings.

The fintech startup was founded by Oluwatomi Ayorinde and Damilola Ayorinde in 2015 as MobileForms, a data analytics platform that provides insights on hard-to-reach rural and semi- urban populations for businesses across several sectors, NGOs, and development organizations. In 2018, MobileForms performed KYC on 4.5 million eligible micro-traders for the Nigerian government’s TraderMoni small loan program.

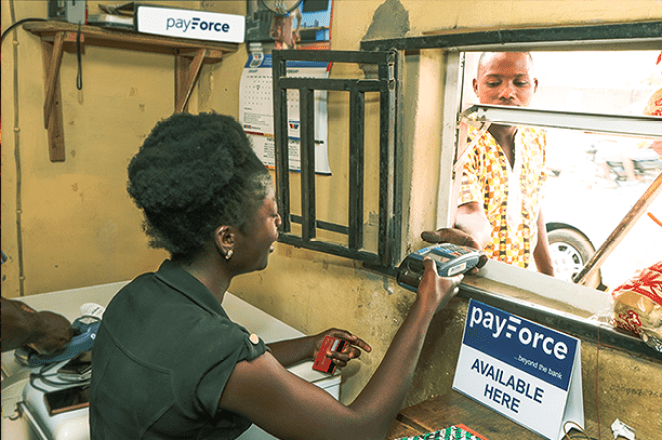

The startup has developed a financial services distribution platform that can turn any merchant into a mobile bank branch within minutes. The platform uses data analytics to build financial service products that truly tackle financial inclusion. Its PayForce product is a PoS-enabled system providing ATM services, transfer, and bill payments.

It also plans to distribute more point of sale terminals to small businesses – gas stations, pharmacies, and aggregators/resellers – which act as mobile bank branches to serve the over two-third of the nation’s adult population that currently do not have access to banking services within a reasonable distance.

“Fintechs and challenger banks are emerging in Africa to deliver better financial services via digital rails. It’s a fantastic development in the market, but cash is clearly still king in Nigeria. Ninety-seven per cent of retail transactions happen offline.” Ayorinde said.

CrowdForce still runs its MobileForms products. But it’s PayForce, its second product that the company has placed in the driving seat. PayForce is a POS-enabled system merchants — who double as agents — use to provide ATM services, transfer and bill payments to consumers in areas where banks are traditionally absent and with high cash demand. For agents, PayForce helps manage their cash float safely and allows them to earn extra income by acting as an agent.

The startup in an official statement claimed it has over the last 3 years partnered with 19,000 fuel stations, 20,000 merchants, and 6,000 pharmacies. CrowdForce claims it has the largest liquidity among Nigerian agent banking networks – leveraging over $4 billion (₦1.7 trillion) through its partners. It also claims to have been cash positive since 2020 and served 1.9 million unique customers in 25 Nigerian states to date—the majority in the north—with user growth increasing 25% month-on-month.

“We are excited to lead this investment in CrowdForce. We see significant value in the product as it is solving a real problem by providing access to critical financial services in rural areas that have been overlooked by traditional financial institutions. CrowdForce is actively deepening financial inclusion through its products and services, and has unique competitive advantages through its proprietary technology and extensive agent distribution network across the country.” Adesuwa Okunbo Rhodes, Aruwa Capital founder and managing partner said.