Nigerian fintech startup, Lemonade Finance expands to 7 more markets

Nigerian fintech startup, Lemonade Finance, has announced it is expanding its services to seven new markets, namely Senegal, Ivory Coast, Benin, Cameroon, Tanzania, Rwanda, and Uganda.

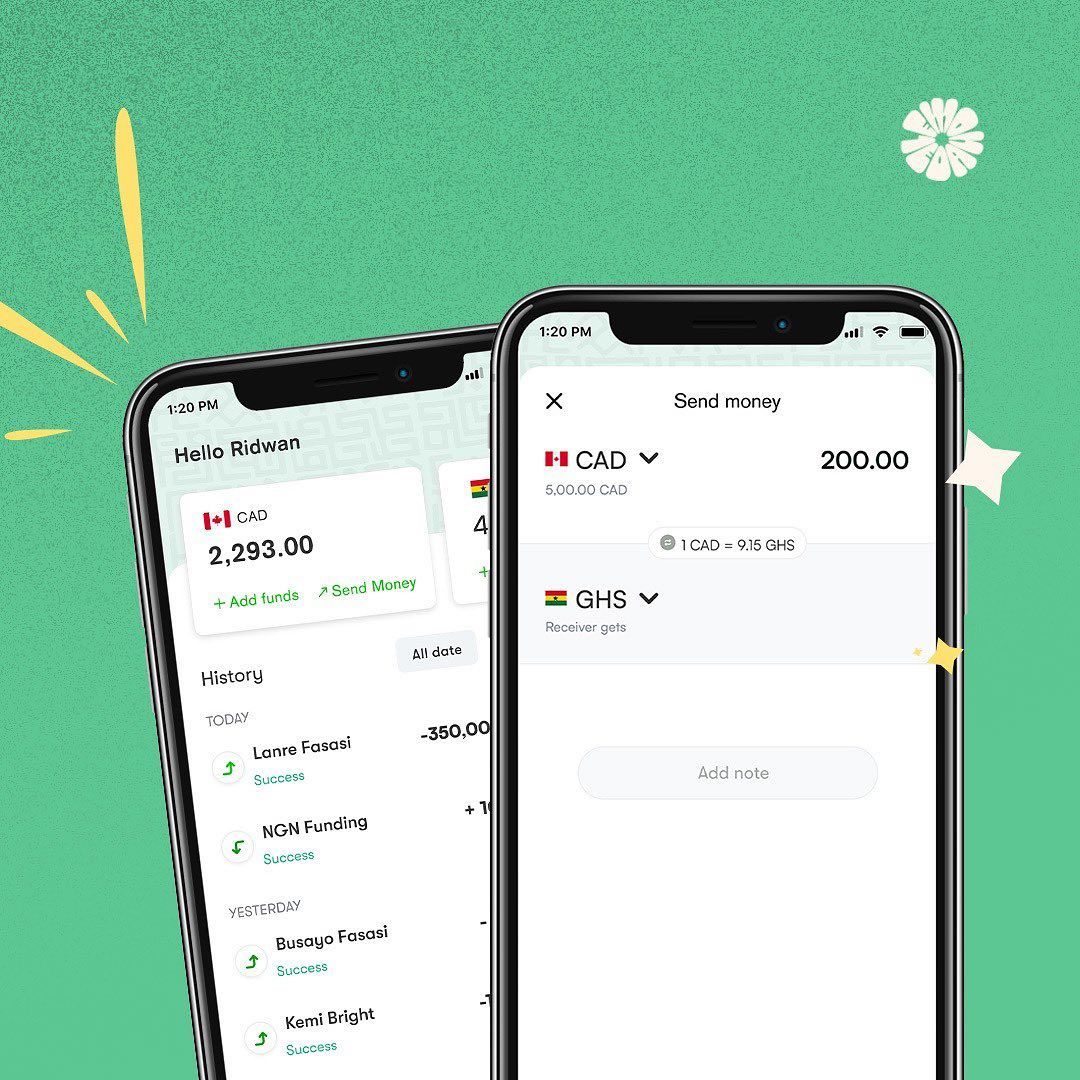

Founded in 2020 by Ridwan Olalere and Rian Cochran and a participant in Y Combinator’s W21 batch last year, Lemonade Finance allows Africans abroad to send and receive money from their home countries efficiently, affordable, and fast ways. In addition, its app enables users to hold their balances in the currencies that matter, easily converting one to the other.

The company already offers local and international transfers to Ghana, Kenya, Nigeria, Canada, and the United Kingdom (UK) instantly without hidden fees. It makes international transfers at the actual market exchange rate.

Thanks to a new integration, Lemonade users in the UK and Canada can now send money to Senegal, Ivory Coast, Benin Republic, Cameroon, Tanzania, Rwanda, and Uganda. This new integration opens Lemonade Finance to a larger share of the African market and cements its promise to “build the biggest neobank for African immigrants.”

“The addition of Senegal, Ivory Coast, Benin Republic, Cameroon, Tanzania, Uganda, and Rwanda was data-driven. These six countries have nationals abroad who often need to send money back home,” said Afeez Gbotosho, Lemonade’s head of products.

Lemonade claims to have thousands of users across North America and Europe. In the wake of its Y, Combinator participation raised a US$725,000 pre-seed funding round that featured the likes of Microtraction, Ventures Platform, and Acuity Venture Partners.