MENA's $1billon funded E-commerce,Noon VS it's Untold Losses

With vast access to the internet, the Middle East and North Africa (MENA) region has been a considerable partaker and beneficiary of the e-commerce boom. This is a system that allows users to purchase goods on various online platforms either in bulk or in retail bits. Such avenues have been greatly embraced even before e-commerce had a universal blow-up (scale) during the COVID-19 pandemic.

According to Gulf Business, 91% of customers in the MENA region are digital converts maximizing the use of e-commerce. This is a result of the pandemic, an action that promises to increase the adaptation and scalability of e-commerce. Being embraced meant there were and still are top players in the MENA e-commerce field. A few of them are Noon, OLX, and Opensooq.

Just like every other trade, tech-enabled or not, the face value (media routine, promos, and publications) is not as important as the books (revenues, debts, investment), even for e-commerce. With the rate of startups closing down operations recently, it is important to note that many startups might look healthy at face value yet shut down unexpectedly, depending on the state of the books.

Noon From The Top

There are hints that MENA’s famous e-commerce Noon could face the challenge of being lost. Noon was launched by business tycoon Mohammed Alabbar in 2017 with the financial backing of $1 billion. This made rounds as digital technology welcomed Noon to the field with open arms.

The e-commerce was first launched in UAE and Saudi Arabia. Although the startup was not fully founded by Mohammed (50%), it had the conjunction of Saudi Arabia’s Public Investment Fund (PIF) (50%) and some notable Gulf Investors.

Noon was established with the vision to make a statement in the MENA ecosystem. In an interview with Journalists, during the launch, Mohamed stated, “As digital technologies cause disruptions across industries and geographies, it is important for us to shape a digital marketplace that is relevant to our local markets and serves as a growth platform for brick-and-mortar retailers.”

It should not be overlooked that during the time Noon launched in UAE, Souq.com was purchased by Amazon for a sum of US$580 million. The likelihood that Noon’s launching with such capital was meant to contend with Amazon’s latest buy should be considered. Yet, as formally stated, businesses are different.

In 2019, Noon revealed that it was planning its expansion to Egypt. This was quite predictable, it was an entry into the second-largest continent in the world. The country itself had the prospects to assist Noon’s scalability, in population and in internet penetration. At this time, Noon was run by an expert in property development and was present in three nations.

At face value, this was a success trait in manifestation, great backing, expansion, and contending with almighty Amazon. But is that the real deal? Could Noon actually stand alone without PIF and the great Mohamed?

The Fall?

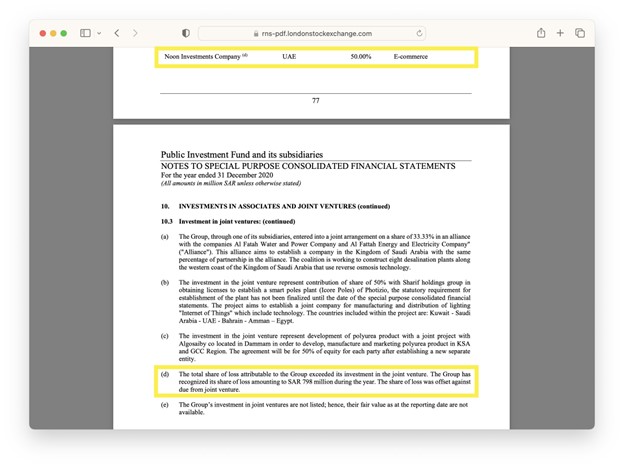

According to PIF’s report published on the London Stock exchange in December 2020, the group recorded a loss of $213 million, and Noon itself recorded a loss of $ 424.81 million.

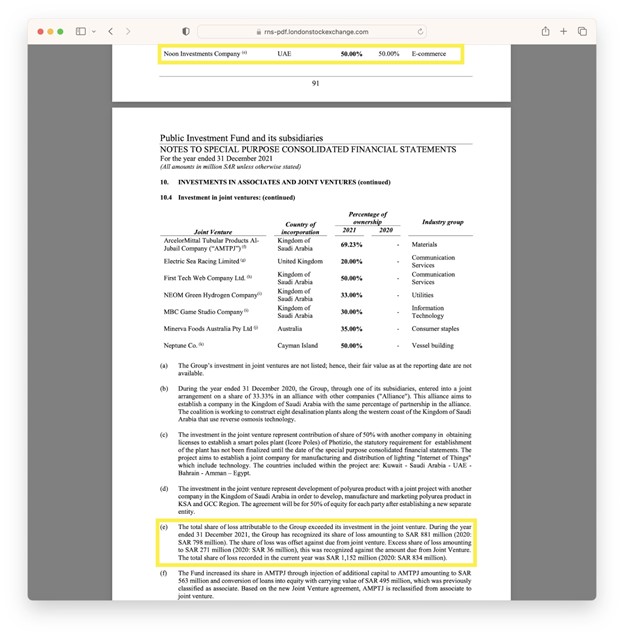

With capital funding of such magnitude, the record of over 40% loss in 2020 affected Noon’s activity. 2021 was not a better year for the start-up as it recorded more losses. Published on the same platform, PIF recorded that it had exceeded its investments in Noon, and still made a loss of about $235 million. Increased by $22 million, the report states that the 2020 loss was not written off, instead, it was written down on a balance sheet. While PIF owned a share of $306.63 million, within 2020-2021 it recorded a loss of about $620 million.

The reported figures would note that the group has invested more than its initial capital in the following years.

Noon With The Questions

While the company was silently recording losses concurrently, it was still keeping up with appearances. The E-commerce Revenue Analytics reported Noon’s scaling activities such as its global sales of US$251.7 million in 2021 and it’s global ranking.

In a bid to curate more traction, Noon held its version of Black Friday, Yellow Friday, slashing prices on electronics, fashion, groceries, and many more. Whether it was held before or after COVID it still did not translate to recognizable profits.

With such figures unfolding, various questions have been raised. Backed by such financial strength, why the recorded loss? Will this loss continue? What is the report as of 2022? How long will Noon’s investors continue to record losses?

These are questions that come to mind when this case is raised. The figures appear odd in comparison to the record of the captain running the ship, Mohamed Alabbar. Owning half of the company as an individual gives him more access to the start-up than as a group.

Famous for being a business tycoon, Mohamed is known to run ships that sail. His companies, Zand, fintech, and Emaar properties have been reported as successful over the years. However, being a professional in real estate does not equate to being an expert in e-commerce, re-emphasizing the uniqueness of each business.

Would Noon’s record in 2022 take a semblance of 2020 and 2021? Only time will tell. There will be further updates on this story as Noon’s situation continues to unveil itself.