Paystack Makes yet Another Move: Launches Paystack Transfers in South Africa

Nigerian Fintech giant, Paystack, has launched the Paystack Transfers Service for its South African customers. The startup announced the development yesterday via its blog page. According to the startup, businesses can use the service to transfer money in small and large amounts to South African bank accounts through their dashboards and the Paystack API.

Paystack has claimed that the tool will save businesses time. Before its launch, businesses had to move between utilizing Paystack to collect online payments and a different platform to transfer money. Companies can carry out both transactions on the same platform thanks to Paystack Transfers.

The recent development is coming less than 14 months after the startup officially launched in South Africa after a 6months pilot.

After a 6 months pilot, Paystack officially opens its South African Office

Abdulrahman Jogbojogbo, Paystack’s product marketer, noted that Paystack already helps businesses in South Africa accept payments via cards, EFT, SnapScan, and Masterpass and is working closely with companies.

“We’ve worked closely with several businesses in South Africa to understand their money transfer needs and provide a solution that’s simple, reliable, and customizable to fit a variety of business models,” said Jogbojogbo.

Accessing the Service

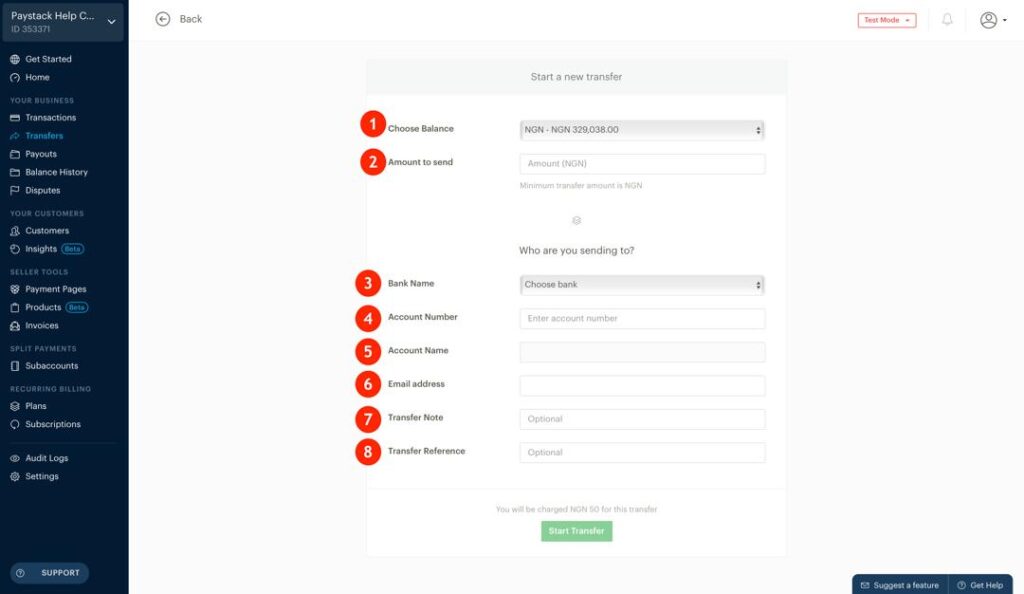

Using transfers on Paystack saves time because you can send money from the same platform where you accept payments. In addition, the startup’s easy-to-use interface allows for easy and swift transfers for users. The API activates the transfer by uploading a spreadsheet of the recipients’ bank details and clicking ‘send.’ This service will help reduce the chances of errors that usually occur in transfers.

To use the Transfers feature, you need a Paystack Registered Business. You must also top up your Paystack Balance before sending out the money.

Click here for steps to top up your balance and transfer money from your Dashboard. Customers can also make bulk money transfers from the Dashboard. However, users in South Africa have to pay 0.8% top-up fees whenever they top up their accounts.

Paystack receives ZAR 3 per successful or failed transfer.

What this means for Paystack

South Africa’s growing financial sector might have inspired Paystack’s interest in providing different services. The overall transaction value of digital payments in South Africa is anticipated to reach $14.55 billion in 2022, with an additional cumulative annual growth rate of 13.23% expected between 2022 and 2026. This projection indicates that by 2026, the nation’s total digital payment transaction value will be close to $23.92 billion.

Fintech appears to be in a solid position to capture a sizeable market share of the nation’s expanding total transaction value of digital payments by providing clients with the ease of accessing prices and transfer services on one platform.