Remedial Health Raises Seed Funding Of $4.4 million

Remedial Health, a Nigeria health-tech startup has revealed its latest feat, the raising of seed funding to the tune of Four million, Four hundred thousand US dollars ($4.4 million).

This raise is meant to expand the startup presence across the nation and also to other West African and East African countries.

The round was led by an international VC firm, Global Ventures, and had Cathexis Ventures, Y Combinator, Tencent, LightSpeed Venture Partners Scout Fund, True Capital Management, Ventures Platform and Alumni Ventures, with a few other angel investors such as Christopher Gold and Guillaume Luccisano.

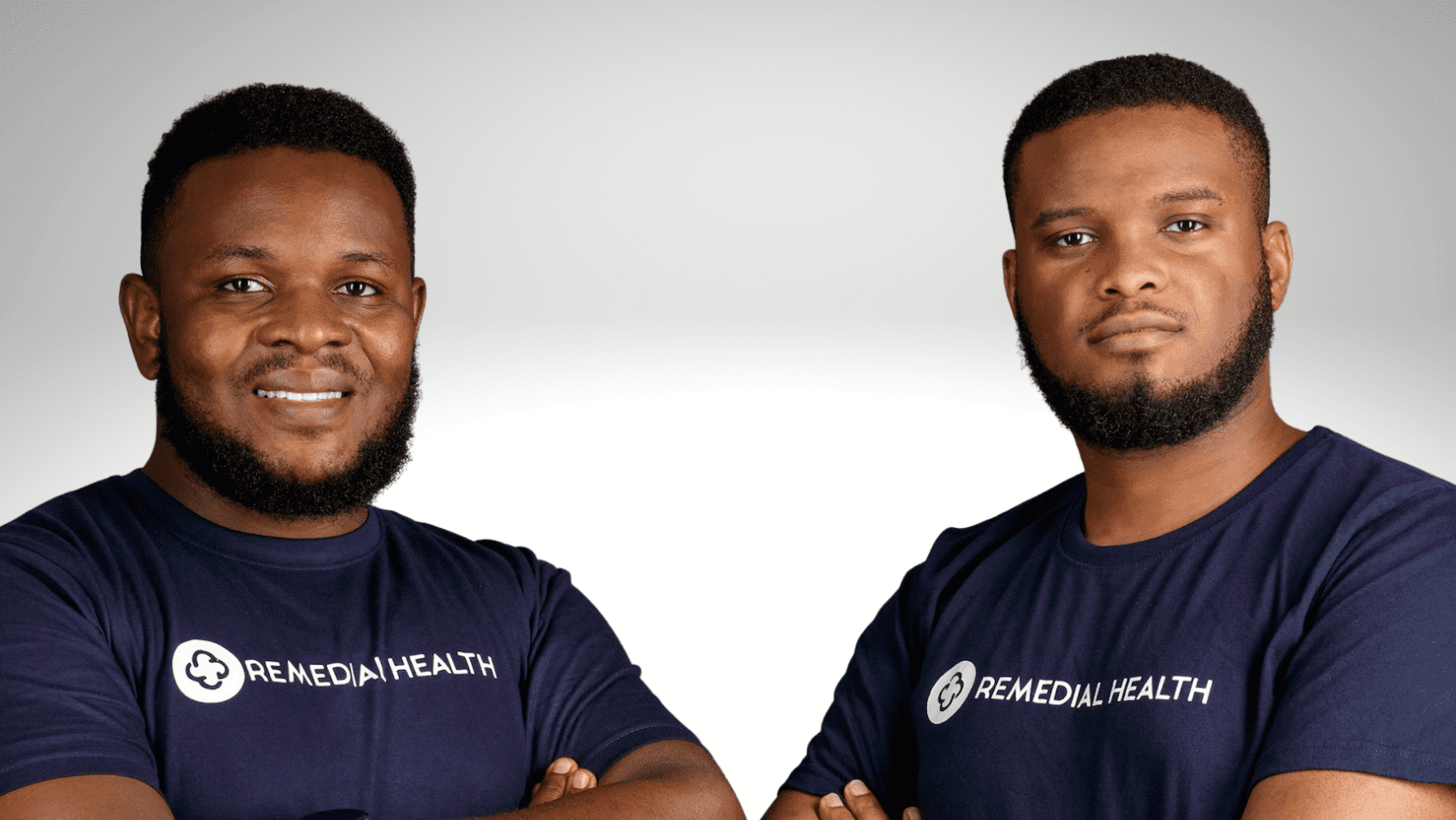

The health tech was co-founded in 2020 by Samuel Okwuada and Victor Benjamin and CEO and COO respectively, Remedial Health provides pharmacies with ease and access to purchase pharmaceutical products from manufacturers and distributors.

While addressing the funding, CEO Samuel Okwuada expresses positivity about the company’s progress since it launched, according to him the company has increased in customer size.

He mentioned, “We have seen more than 6x growth in the number of customers on our platform since January. The feedback we constantly receive about what they like the most about our platform is around the ease and efficiency of our inventory finance offering, the variety of products they can access on our platform and the effectiveness of our procurement process.”

Both founders cited that their inventory finance product’s launch had drawn more users to their mobile application, a result of their use of technology to scale their business and counter the challenge of constant price inflation

In his words, “More than 60 per cent of our customers use the inventory finance product and we have seen more than 50 per cent growth in their average basket size since we launched the product.”

He further said “Wherever our customers are based in Nigeria, they typically receive their orders within 24 hours. Our last-mile delivery, backed by its distribution hubs, is done in-house or through our partners.”