Rental Financing Platform, Kwaba, is Looking to Improve Housing Welfare in Africa

Housing for most middle-income earners in the modern economy is scarce especially in most of the world’s megacities. A report from BBC noted that “middle-to-high-income” apartments can cost anything from $5,000 to $40,000 per year. A two-bedroom flat with electricity in a good Lagos neighborhood, Victoria Island, was demanded for between $11,000 and $22,000. This poses housing fee poses a challenge to middle-income earners who also struggle to meet other necessities.

The rapid rise of the population and urbanization has not been matched by an adequate and affordable housing supply. In Nigeria, one of the most serious housing issues is the scarcity of affordable homes for low and middle-income earners.

The rising cost of building materials, the rate of inflation, the high space and quality standards adopted by designers, the fees of professionals involved in design and construction, and the excessive profit of contractors/developers are all factors that contribute to the high cost of housing units. Few people are able to buy or rent a building if the cost per unit is unreasonably high.

Kwaba understands this need. The startup understands the economic reality of Nigerian renters and have built its product to reflect this. Obinna Molokwu launched Kwaba in 2020 to improve the financial well-being of renters.

Kwaba’s rent payment platform helps low-middle income earning Nigerians pay their house/apartment rent in convenient instalments. Kwaba ensures that credible renters get affordable accommodation to match their financial status.

How The Startup Operate

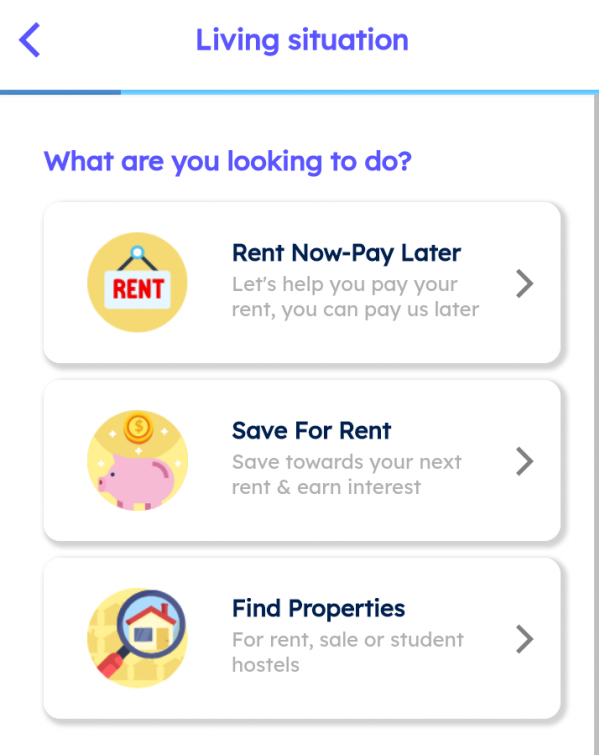

Kwaba has come up with a way for individuals to rent apartments for a year and pay them back over a few months. Kwaba pays the landlord or house agent the annual rent, and the tenant pays Kwaba on a monthly basis. Users will need to install the Kwaba app and set up their profile with name, email and phone number. The platform carries out three main functions. You can either search for a property to rent, ask Kwaba to foot your payment upfront while you pay later, or save towards a later rent.

The platform is able to curates a list of places available in an area as well as their prices. Kwaba also insures rent against job loss, permanent disability or death.

Users can access instant loans from Kwaba when they need to sort out life emergencies or unexpected expenses. As users pay back loans on time, their credit scores improve. This allows them access better loan offers.

Saving through the app is easy and requires your bank details including BVN, the amount that you want to save and the frequency at which you want to save.

Rising Expectations

Requesting for an upfront rent payment feature is only available in Abuja and Lagos states and only to salary earners who earn above N80,000 monthly. After securing an undisclosed pre-seed funding from Co-Creation Hub (CcHub) and other investors, the startup is expected to expand across Nigeria and Africa.

“We aim to improve the financial well-being of renters as we grow,” said Molukwu while speaking on the fund. “For us, this new investment comes at a time when we are looking to strategically reposition and expand our services,” said Molukwu.

Kwaba will be looking to further mitigate the rent issues facing Africans by expanding its services.

Download Kwaba app on here.