Synthesis launches Halo – the secure, instant, contactless payment solution set to enable all businesses.

Synthesis, an innovative software development and consulting company has launched ‘Halo’, becoming the first official Tap on Phone technology provider in Africa. In collaboration with Nedbank, the Tap on Phone solution was unveiled on the 30th of June.

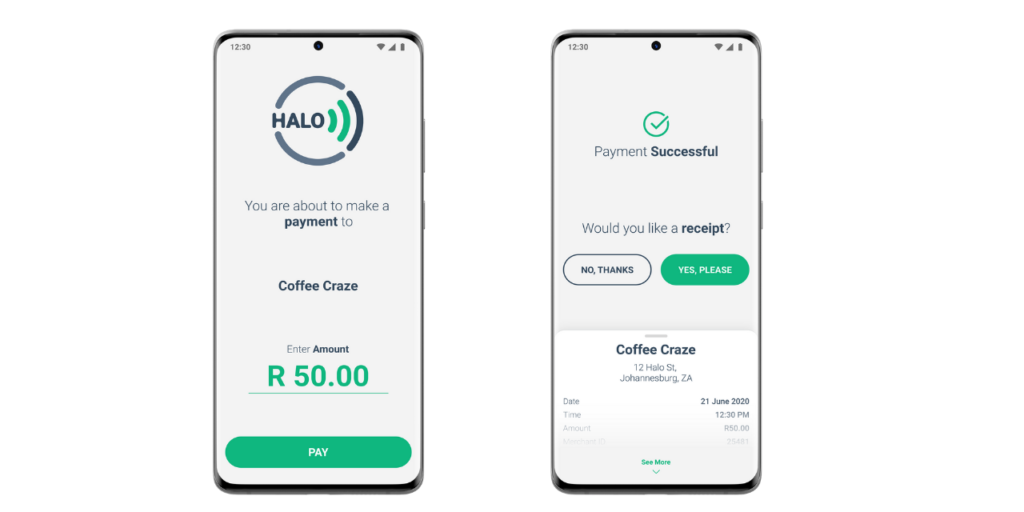

Halo is a radical advancement in mobile payments that enables secure contactless card payment acceptance on any Android device. The technology is termed ‘Tap on Phone’ due to the way in which a payment card is tapped on a mobile device or phone. It is used by a business or a merchant to ‘receive’ a payment. “Think of ‘Tap on Phone’ as a substitute for traditional POS terminals just without the extra hardware only a mobile device is required,” says Pierre Aurel, Product Manager at Synthesis. This payment innovation should not be confused with mobile wallets (like Samsung, Google, Garmin, or Apple Pay) that have been around for a few years. These wallets make use of Host Card Emulation (HCE) where the phone essentially acts as a contactless card and is used by a customer to ‘make’ a payment. In fact, Halo is the inverse technology of a mobile wallet – putting simplicity into the hands of small and medium business owners to accept a card payment.

Aurel adds that “We see Tap on Phone playing a significant role in the future of mobile payments due to its speed, convenience, and enhanced security. The technology has immense potential for small and micro merchants as it will allow them to accept card payments and enter the digital payment ecosystem without incurring any upfront costs for expensive POS terminals. Additionally, this technology reduces the reliance on cash and reduces any physical contact during the payment process.”

The technology arrives at a time where hygiene and reduced physical contact are paramount to society. The COVID-19 pandemic has accelerated the adoption of contactless payments due to the safe interaction when paying since the card does not leave the cardholder’s hand. Mastercard has reported a significant rise in the adoption of contactless payments since the start of COVID-19 and this trend will continue as more people enjoy the speed and convenience of contactless.

Halo will also boost financial inclusion for small businesses and micro-merchants. “Just think about the benefit to informal traders who could not previously accept debit or credit cards simply because they didn’t have POS terminals. Now they can easily and securely accept payments that are verified online in real-time,” says Aurel.

Being able to process card payments using only a mobile App will liberate the appropriate merchants from point-of-sale (POS) devices as well as removing the requirement for installing fixed telephone/data lines before they can start trading.

Synthesis has developed the Halo software kernel that has been Certified according to EMV Level 2 standards for both Mastercard and VISA. Halo has achieved the same certification as traditional POS terminals and is more secure than other QR based payment methods.

The technology may be embedded in other payment applications from 3rd party developers by making use of the Halo Software Development Kit. It is compatible for any NFC-enabled device running Android 7 and above.

Synthesis is proud to pioneer a new era for payments as contactless becomes the preferred payment option for customers and merchants.

About Synthesis.

Synthesis is a true South African success story. Synthesis believes that providing innovative solutions based on emerging technologies will help their clients become globally competitive. Synthesis focuses on banking and financial institutions, retail, media, and telecommunications sectors in South Africa and other emerging markets.