Dubai-Based Tabby Expands BNPL Payment Solutions to Egypt

Tabby, a Dubai-based and the Middle East’s leading Buy-Now-Pay-Later (BNPL) and shopping payments solutions provider, has announced its entry into Egypt, to capitalize on the country’s growing e-commerce sector to provide consumers with interest-free, flexible payment options in the face of the rising cost of living.

With $275 million in its war chest, the Dubai startup partnered with multiple brands, including Lacoste, L’azurde, Faces, In Your Shoe, KAI Collections, Ariika, Marcqa, Dresscode, and Floward, to offer flexible payments at checkout, allowing Egyptians to stay in control of their spending, pay over time without interest, and make the most of their money. Its entry into the Egyptian market will allow it to capitalize on Egypt’s e-commerce boom, which generated $5.2 billion in revenue last year.

Announcing the expansion on Tuesday, Ahmed Khalil, Tabby Egypt’s GM, said, “Expanding in Egypt is a proud moment for us at Tabby. We’re excited to provide Egyptians with flexible and honest payment experiences with no interest and no fees. We’re also delighted to be a growth partner for our retail partners by helping them tap into millions of active shoppers”. Khalil added, “After securing $275 million in funding from leading global and regional investors, we’re looking forward to becoming Egypt’s preferred BNPL services provider.”

With BNPL penetration in the Middle East and North Africa region at 24 percent in 2021, Tabby’s entry into Egypt contributes to the region’s growing fintech maturity and the rise of e-commerce in Egypt. The app is developing financial products to reshape people’s relationships with money to create financial freedom in the way they shop, earn, and save. The app, which is based on trust rather than interest, enables commerce while encouraging responsible spending by giving its users more purchasing power.

Ahmed Khalil, Tabby Egypt’s GM

Egypt’s BNPL Sector

According to The Central Bank data, Egypt’s annual core inflation rate rose to 15.6% in July from 14.6% in June. Since the onset of the Covid-19 pandemic, the BNPL business model, which allows consumers to make online purchases instantly and spread their payments out over interest-free installments, has boomed, driven by millennials and Gen Z. High inflation, on the other hand, is driving the global popularity of the BNPL payment option, with consumers taking advantage of short-term financing to split payments and better manage their money.

According to Grand View Research, the global BNPL market will be worth around $39.31 billion by 2030. While Egypt’s BNPL sector will rise 132.8 percent year on year to $434.7 million in 2022. Also, BNPL payment adoption in Egypt will grow at a compound annual growth rate of 559.9% between 2022 and 2028, with gross merchandise value expected to reach $6.23 billion by 2028, up from $186.7 million in 2021.

In Egypt, existing BNPL players include valU Consumer Finance, which collaborated with Amazon, the world’s largest e-commerce company, in May to offer consumer financing in installments as a payment method on amazon. eg.

About Tebby

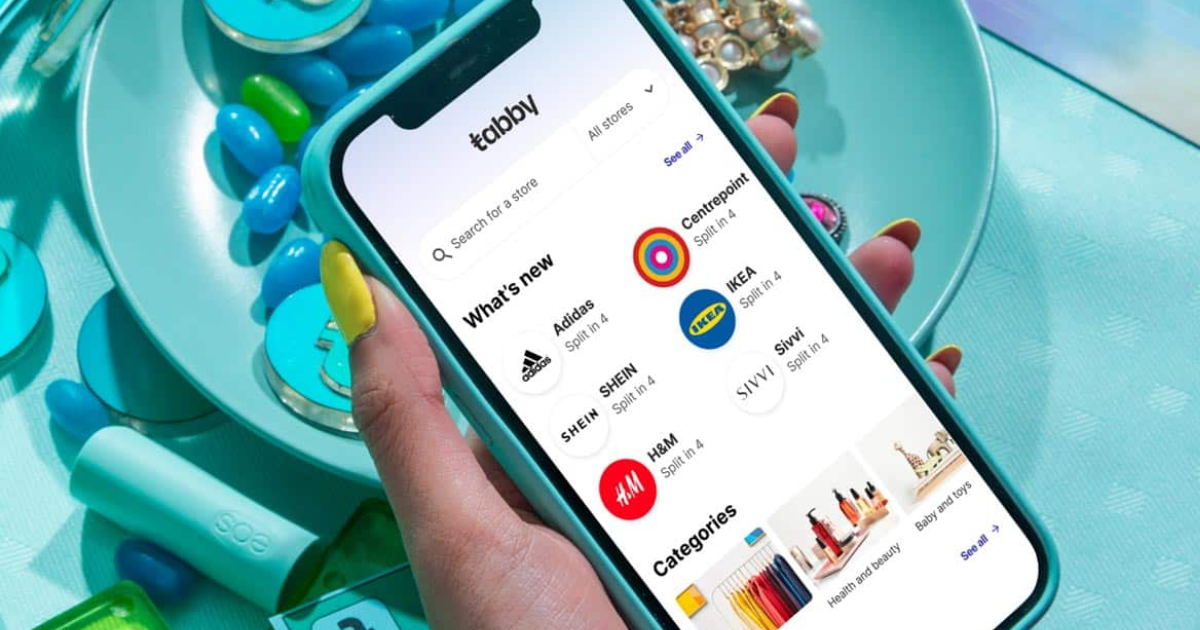

Tabby was founded in 2019 by Hosam Arab to provide users with a buy now, pay later (BNPL) option for online and offline shopping. Tabby’s platform, which has over 2 million users, went live in the UAE in February 2020. It will expand to Saudi Arabia in July 2020.

Since then, it has signed agreements with over 3,000 global brands and small businesses in the UAE and Saudi Arabia, including H&M, Adidas, Nike, Ikea, Bloomingdale’s, Marks & Spencer, Swarovski, and Toys R Us.

Tabby has received $275 million in funding to date, with the most recent $150 million in debt financing from Atalaya Capital Management and Partners for Growth (PFG) in August of this year.