The Big Four and Incomplete data: Lesotho suffers from paralysis amidst growth in the African tech industry

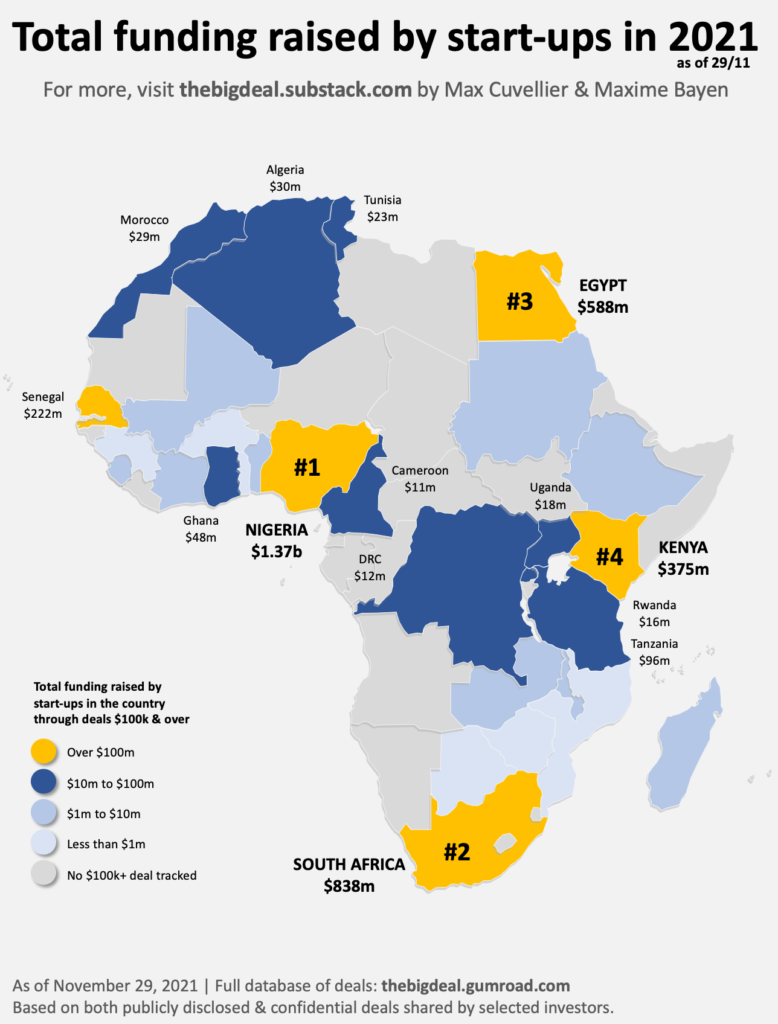

Data revealing growth in the African tech industry focuses on the ‘big four’ — Nigeria in Western Africa; South Africa in the Southern part of the continent and; Egypt and Kenya in Northern and Eastern Africa respectively. Undoubtedly, tech has witnessed Year-over-Year development, attracting attention from local and foreign investors; however, it is bleak to identify the continent’s growth majorly from this lens.

For instance, in 2021, Nigeria led the total funding round with $1.37 billion, South Africa with $838 million, Egypt with $588 million and Kenya with $375 million. Out of the startups that received funding last year were the recently-attained unicorns — Flutterwave, Chipper Cash, OPay, and Andela in Nigeria; and Wave in Senegal. The incentives they enjoy are likely to be inspired by data accessible to investors.

As seen, other countries in which their data are almost invincible have also accounted for significant Y-o-Y growth, although, some including, South Sudan, Lesotho, Somalia, and Mauritania among others received below 100k in funding as of 2021. Factoring these countries and the proper coverage of their startup ecosystem might be a step toward enabling investors make informed decisions rather than the panorama view of ‘Africa’s growing tech ecosystem’.

The focus of this article – Lesotho – has not been one to reference in Africa’s tech – well, the fact that it is in a crawling stage and its sectors are enjoying little or lack of local competition thereof. This is owing to several factors which might include its geographical location, government policy, population and innovation labs to be discussed.

Managing Partner at Playfair Capital, Chris Smith writes in a Forbes report that “ultimately, location is still a factor in increasing the chances of raising money.” The VC has invested in two African startups (Andela and Mobius Motors) in Nigeria and Kenya per Startuplist Africa. Although Smith addresses the famed, new remote work culture which has been affected by the pandemic, it emphasises the need for strategic positioning as Investors consider various recommendations.

“Why do so many Silicon Valley VCs demand that the startups they fund be located here?” The Quora query was responded to by Partner at Google Ventures, Crystal Huang. In her assessment, she pointed out that proximity, the exit of opportunities, accelerated education and density of talents are key reasons.

From Lagos to Johannesburg, startups are preferred as they are mostly coveted for funding and chosen as headquarters. But a critic’s idea might save Lesotho. The Investor ‘Silicon Valley approach’ is terminating ideas against the rigidity entrepreneurs are expected to meet.

Starting from its geographical location, Lesotho is a landlocked country. This already means it has limited economic choices. It depends on agriculture and has the benefit of tourism owing to its mountains. Agriculture, its main economy sustains a population of not less than 2 million. Given its small population, the country is still unable to manage 37.44% of unemployed youths.

Leveraging technology infrastructures to combat youth unemployment has proven valid results globally. Several incubation hubs are created in different countries to nurture tech talents and pave the opportunity to scale forward.

Politicians in Rwanda are busy implementing 4IR science and tech projects to improve lives of their countrymen. Here in Lesotho, our politicians are just having vibes: politicking using food parcels and blankets, increasing their earnings and composing political songs.

— Kanono Thabane (@Kanono_Thabane) April 6, 2021

But, government policy goes a long way toward improving the startup economy in the country. It has a small population it could manage and this will gear it forward to being one of the countries with little or no youth unemployment. In 2019, the Ministry of Communications, Science and Technology pledged that it will provide 4000 jobs for youths through IT at the National University of Lesotho (NUL) Innovation Hub in Maseru.

The Hub was created to promote a culture of entrepreneurship and provide job opportunities key to economic growth. So far, it has innovated a range of tech products, especially in agriculture including robots for plants and hardware for simpler processes.

The NUL Vice Chancellor Prof. Nqosa Mahao urged stakeholders — government and private sector investors to commit to funding the technology industry since the world adopts innovations and it is a way to sustain the economy. “Investing in science and technology is highly important because that is where the economy of any country lies.”

Yet in its early stages, Maseru, Lesotho’s capital could be the Silicon Valley. It already has a leading Central Bank-licensed fintech like Chaperone, and the NUL Innovation Hub as well as a social impact startup, Girls Coding Academy.

“One of the great challenges faced by the tech industry in my country is that we are totally landlocked by an economic giant like South Africa, which makes us get overlooked. We would like Impact School to be the bridge that connects the rest of the world with the tech talent Lesotho has to offer,” non-profit ed-tech founder, Impact School, Mamonaheng Koenane said in a feature by Silicon Republic.

Meanwhile, access to funding is very limited. Even as data puts it that Lesotho only gained less than 100k in 2021, payments company, Chaperone has raised more than $1 million in VC investments since it was founded in 2017 by Mohau Mochebelele.

Recently, in September 2022, the World Bank in collaboration with the Ministry of Trade and Industry launched the Lesotho Entrepreneurship Hub and Seed Financing Facility. According to the Minister of Trade and Industry, Mr Thabiso Molapo, the fund is directed towards women and youth in the country.

Local investments in Lesotho are established in the Business Licensing and Registration Act 2019 (BLRA 2019) which also impacts Foreign Direct Investments restricting its reach in certain sectors.

With the country completing the Technology Needs Assessment (TNA) after a three-day workshop sponsored by the United Nations in April of this year, it might be able to make significant progress in its Science, Technology and Innovation (STI). The TNA report states that it has limited internet access, low infrastructure for education and ineffective technical and vocational education and training etc.

Lesotho is only one of the several countries with a lagging technology framework. Intentional coverage of specific regions will help to note that only certain countries are beneficiaries of foreign investments directed towards Africa. Although, the negligence or incomplete datasets are Missing Not At Random (MNAR); data collection from countries without an encouraging tech ecosystem is necessary. Relatively, growth in the continent is not uniform and this divergence is foul by using the ‘big four’ metrics.