Waya Digital Bank Launches Cross Boarder Money Transfer Services.

Kenyan fintech startup, Waya, has launched its latest service. The US-based startup made it known that it now offers cross borders transactions which are targeted at serving African immigrants.

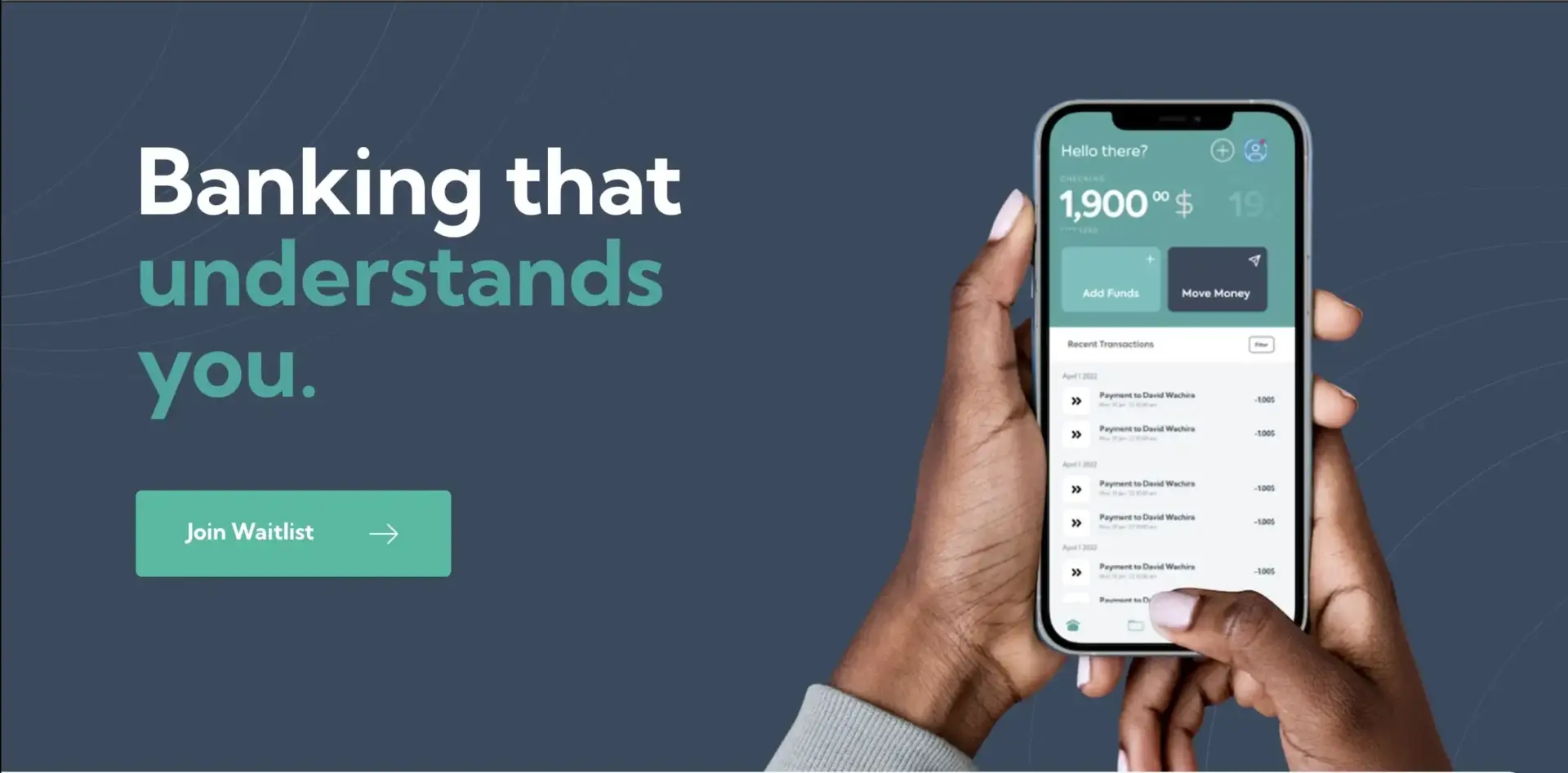

Now, through the Waya App, users can digitally create their own bank accounts, make money transfers to other Waya account holders for free, expend cash through their Waya cards, and transmit cross boarder transactions sending money to about Ten countries across Africa, which include Kenya, Ghana, Nigeria, Uganda and many more. Money sent across the borders will be deposited into the receiver’s wallets or bank accounts within the African continent.

Speaking about Waya’s intention with the new service, Ex-World Bank Finance Specialist, and Co-founder and COO of Waya, Dr David Wachira said, “Waya’s mission is to unlock financial barriers, provide unlimited financial access and opportunities for millions of African immigrants living and working outside their home countries.”

Highlighting the prospects of the startup launching into this new market, which has the potential to serve millions of African immigrants, Dr Wachira said “The African Diaspora send over $50 billion dollars back home every year and lose up to $3B in hidden fees and high FX rates when sending money back home. We not only want to help them move money back home in a faster, cheaper and affordable way but want to enable them to also store, spend and transact the over 80% of their income that remains in the countries where they live and work.” It is important to note that African immigrants have a tangible impact on the continent’s economy.

Waya users can also perform domestic financial transfers within the US and other nations where Waya is active, gaining access to money transfers, and bill payments. The fintech is in the process of launching other services, which include providing savings, credit accounts, and other investment opportunities for Africans in the diaspora. The investment plan will be provided to make users to be financially protected and included. He also added that “remittances support 1 in 9 people globally.”

To access the services, the Waya mobile application on application stores as of the 16th of September 2022.