Why MENA is Now the Fastest Growing Crypto Market in the World

Over the years, the West has frequently been regarded as the world’s de facto technology capital, far outweighing emerging regions such as the Middle East and North Africa (MENA). However, with recent advances and outperforming in digital innovation and emerging technologies by MENA countries, there is a growing urgency and importance in recognizing the region’s role in steering the global progress of blockchain and digital assets.

While the region has frequently been overlooked, it is clear that the rest of the world must now follow MENA’s lead on forward-thinking policies, regulations, initiatives, and innovation. In the future, the MENA region will emerge as a valuable crypto capital, driving the development and progress of digital assets across the world.

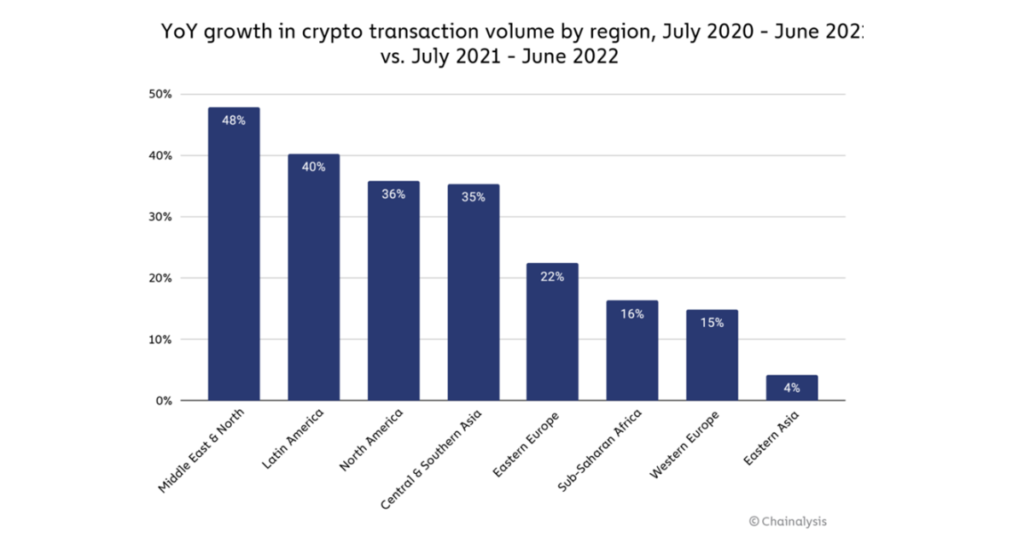

The US-based blockchain analysis firm, Chainalysis recently released its latest report, indicating that the Middle East and North Africa region (MENA) has the fastest growing trend in terms of cryptocurrency adoption, despite being one of the smaller crypto markets in the global adoption index.

According to the report, users in the MENA region received $566 billion in cryptocurrency from July 2021 to June 2022, a 48% increase over the previous year.

Three of the top thirty countries in this year’s index are located in MENA

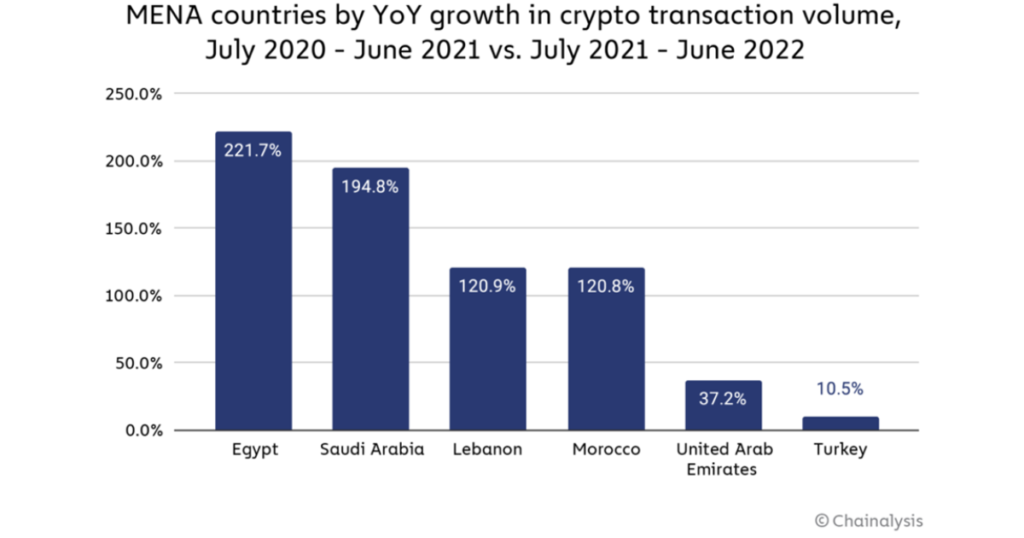

Turkey (12), Egypt (14), and Morocco (24). The research identified savings preservation, remittance payments, and increasingly permissive crypto regulations as key drivers of such adoption in these countries.

Rapid fiat currency depreciation in Turkey and Egypt has increased users’ interest in cryptocurrency for savings preservation. In August, Turkish inflation reached 80.5%, while the Egyptian Pound fell 13.5%.

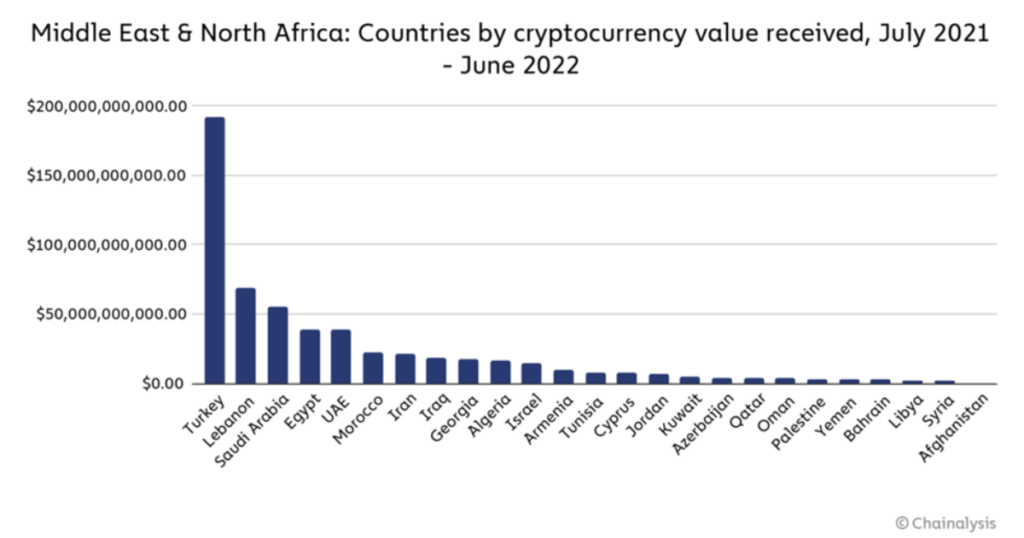

According to the report, the volume of crypto transactions in Egypt tripled between July 2021 and June 2022 compared to the previous year. Turkey remains the region’s largest crypto market, with users receiving $192 billion during the same period.

The report further noted that Morocco’s inflation rate has fallen to a more manageable 5.3%.

The North African country’s significant levels of crypto adoption, on the other hand, appear to be linked to the government’s newly permissive crypto stance.

In 2017, the Moroccan central bank announced penalties and fines for users found transacting in cryptocurrencies within the country.

However, earlier this year, the central bank entered into a collaboration agreement with the IMF and the World Bank to develop crypto regulations that prioritize innovation and consumer protection.

Factors Driving MENA’s Wide Crypto Adoption

Institutional Acceptance

Governments and businesses in the MENA region played a critical role in driving economies toward digital transformation by embracing and expanding the use of blockchain which has resulted in massive gains in terms of acceptance and usage of digital assets across the region.

The government of the United Arab Emirates, for instance, debuted the Emirates Blockchain Strategy 2021 to move half of all government transactions onto the blockchain by this year. Earlier this year, Dubai’s Multi Commodities Center (DMCC) also set up a Crypto Center to support businesses in the blockchain and cryptographic sectors. Similarly, the Saudi Arabian Monetary Authority was one of the world’s first to use blockchain technology for money transfers. From government support to adoption, it is clear that technology plays a critical role in shaping MENA countries’ growth and development.

With the growing institutional acceptance, governments have welcomed blockchain and crypto innovation through regulatory licenses—providing guardrails and testbeds for fintech companies to thrive and innovate. The Central Bank of Bahrain’s Fintech and Innovation Unit is one such that provides Sandbox authorization for companies to test innovative fintech solutions, encouraging further growth and progress for the industry. As countless governments across the world clamp down and tighten regulations on crypto, MENA’s welcoming stance to blockchain and digital assets is vital to the continued global development of the sector.

Going Green

The green revolution is another driving force behind the growth of digital assets in the MENA region. Currently, countries in the region are utilizing blockchain technology to advance their sustainability agendas. Companies in MENA are leading innovative projects centered on this intersection of technology and sustainability, providing a unique opportunity for blockchain and crypto’s growth in green initiatives.

Traditional energy producers such as oil giant, Aramco have made the transition to blockchain to increase efficiency and sustainability as Saudi Arabia continues on its path to make renewable energy half of its energy production by 2030. Similarly, smart city initiatives like Dubai’s Sustainable City — the UAE’s first net-zero energy development — and other upcoming smart cities like Dubai South and Desert Rose City are using blockchain to power their processes.

Furthermore, local businesses have already embraced blockchain and digital assets to advance environmental, social, and governance (ESG) initiatives. Recently, the world’s first token minted from the tokenization of a Tesla charging unit was launched in Bahrain, and it is an example of driving the development of green technologies while encouraging digital asset use cases. This is just one example of how digital assets can help reduce funding barriers in ESG initiatives. Tokenization can increase access to assets that were previously inaccessible to institutional and retail investors by digitizing and fractionalizing large hard assets such as electric vehicle charging units, solar panels, or wind turbines.

As sustainability continues to be an urgent global agenda, the MENA region’s lead in blockchain and digital asset innovation in the green sector will no doubt cement its position as a decisive leader driving digital initiatives within ESG.

The GCC Countries Crypto Adoption

While the Gulf Cooperation Council (GCC) member states – Saudi Arabia, Kuwait, the United Arab Emirates (UAE), Qatar, Bahrain, and Oman – rarely make it to the top of the crypto adoption index, their role in the crypto ecosystem should never be underestimated, according to the report.

The report equally maintained that Saudi Arabia has the third-largest crypto market in MENA, with the UAE ranking fifth. These Arab countries have strong ties to the global cryptocurrency markets. For example, Dubai has become a hub for cryptocurrency firms that serve customers from all over Asia and Africa, not just the Middle East.

Afghanistan, one of the former MENA leaders in grassroots crypto adoption, is currently experiencing a major downturn, according to the report. Afghanistan ranked 20th in Chainalysis’ 2021 crypto adoption index. However, since the Taliban took over the regime in August of last year, the country has dropped to the bottom of this year’s list. Under Taliban rule, cryptocurrency is considered gambling and is therefore prohibited. So far, several cryptocurrency dealers have been apprehended in the country.

Chainalysis published a similar report last month, revealing that, despite global cryptocurrency adoption slowing due to the effects of the crypto winter, emerging nations continued to dominate the adoption index this year, as they did the year before.

Reasons for Crypto Surge in the GCC

Akos Erzse, Senior Manager for Public Policy at the Dubai-based crypto exchange BitOasis, has mentioned some of the reasons for the crypto surge in the GCC countries. According to him the main drivers of crypto adoption in the GCC are different from those in the rest of MENA. “When you look at markets in the GCC, we take the view that this adoption is driven by young, tech-savvy early adopters with relatively high disposable incomes that are, you know, searching for investment options and have a conviction in crypto right now.” Moreover, adoption is “not just on the retail or customer side, but also in the ecosystem, with financial institutions and banks beginning to work with businesses like us.” Erzse also emphasized the role that recent inflation has played in pushing cryptocurrency adoption in other parts of the region.

However, emerging markets appear to be ahead of high-income countries in terms of adoption. According to the report, the top ten countries in the world with the highest crypto adoption are (1) Vietnam, (2) the Philippines, (3) Ukraine, (4) India, (5) the United States, (6) Pakistan, (7) Brazil, (8) Thailand, (9) Russia, and (10) China. As can be seen from the list, the United States is the index’s sole representative of high-income countries. Upper-middle-income countries include China, Russia, and Brazil.