Africa’s Disrupt Story: The Case of Fintech Startups in Nigeria

Disrupt

During the 1940s polyvinyl chloride became common, hence the name “vinyl”. Vinyl records were the bomb. The tech informed the process of video/audio recording and video/audio casting through the 20th century. It was laughable when Lou Ottens decided to shrink large disks into a more efficient pocket sized tape cassette. Ottens disrupt story can be likened to what Fintechs are doing in Africa and particularly Nigeria.

Africa’s disrupt story has been similar story. Banks disrupted old saving patterns. Banks then thought of new ways to engage customers through tech and disrupted traditional banking methods. Fintechs came in soon and started making easy even easier.

Overview of Nigeria’s Fintech Space

Fintech has grown into the powerful sector it is in Nigeria and Africa as a result of growing desire to digitalize processes. The use technology to solve problems grew alongside commerce and population in Nigeria.

Fintechs have taken on banks and have provided financial solutions in areas where banks have been inefficient. People want to save money, but more important, they need easier ways to do this. The goal of Fintechs have been to ensure that they provide avenues to help people save money and save at their convenience.

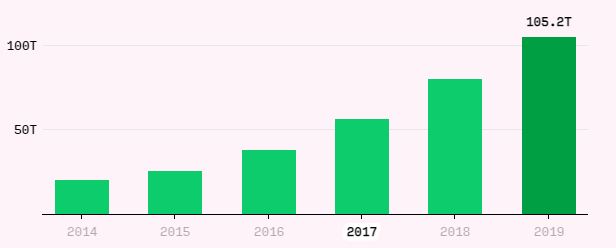

Rising increase in electronic payment has also informed fintech growth in Nigeria. Flutterwave was launched in 2016, and Paystack in 2015. Digital payments in Nigeria have surged since 2014, hitting $256 billion (105 trillion naira) by 2019. It is right to point that Fintechs have been responsible for this by developing easy-to-use payment solutions for individuals and businesses.

Electronic transfer in Nigeria from 2014-2019 (Rest of World)

Nigerian bank started employing technology at the back-end and front-end of their operations. Meaning to outsmart fellow banks in the country after the 1986 Structural Adjustment Programme introduction. The increased competition in the banking sector has led to the application of technology in daily banking activities. In 2007, the Central Bank of Nigeria (CBN) launched the Payment Systems Vision 2020 (PSV 2020) proposing for a cashless society.

Disruption is kicking really good in Nigeria’s fintech sector. Being ranked as one of the top three fintech hubs in Africa is a mean feat considering how Fintech has evolved in Nigeria despite numerous challenges.

Fintechs Challenges in Nigeria

Nigeria’s Fintechs challenges are not so distant from those experienced by the general tech sector. In trying to disrupt traditional banking system, power has been a big issue in the most populous black nation. Every government promises to fix Nigeria’s power issue but does very little or nothing. Data quality remains poor. It is even poorer in rural areas. Majority of Nigerians still can’t afford data services. But even if Fintechs decide to overlook these bottlenecks, in comes the Securities and Exchange Commission, Nigeria (SEC).

In April last year, the Nigerian capital market regulator, SEC released a circular declaring the activities of some fintech trading platforms including Chaka, Trove, Bamboo, and Risevest, illegal. By August, a federal high court in Abuja, Nigeria, has on Tuesday granted the request of the Central Bank of Nigeria (CBN) to freeze the account of six fintech companies.

The Fintech startups affected by the ex parte motion include Rise Vest Technologies, Bamboo Systems Technology Limited, Bamboo System Technologies Limited OPNS, Chaka technologies Limited, CTL/Business Expenses, and Trove Technologies Limited.

Inspite of these policies, fintechs have strived in Nigeria. However, to avoid cases like this, players in the Nigerian tech space can work with regulatory bodies to lobby for policies that will aid their growth and development.

Fintechs’ Disruption

Only 45% of Nigeria’s adult population is banked. This statistic cites a lack of convenience in the system. A high number of Nigerian adults are alienated from formal financial services due to the physical distance between their banks and home and the length of time needed for most bank processes. Fintech startups have fixed this convenience issue.

Ten years ago, it was rare to see a Nigerian startup raising $10 million. Now the country’s fintech unicorns are becoming just as valuable as its banks. Interswitch is valued at over $1 billion, OPay is valued at over $2 billion, Flutterwave just hit the $3 billion. It does not come as a surprise that Fintechs have been doing great things. In managing customers’ finance, they have positioned themselves to address pain points in affordable payments, quick loans, and flexible savings and investments.

By creating e-wallets, Fintechs relieved sign up stress. Using mobile devices, users can easily sign up, and save. Its simplified channels have allowed SMEs in Nigeria and beyond receive online payments locally and internationally.

Borrowing used to be hectic, requiring collaterals and lots of paper works. But Fintechs such as Carbon, New Credit, Cash Cash, Renmoney and other stepped in to simplify the process. Today, banking fintech solutions have been fast followers here with leading banks launching digital lending platforms like Quick Credit by GTBank and Quickbucks by Access Bank.

More recently, the market has seen an influx of asset management fintechs such as RiseVest, Chaka, and Bamboo, offering users an opportunity to invest in international stock markets from their local currency account through their app.

What Next?

Nigeria’s tech savvy youths don’t need to be coerced by Fintechs before diving into the digital finance frenzy. Financial disrupt is what they crave and these Fintechs are offering. This will attract more and more investors and the country’s Fintech sector will continue to boom.

It is satisfying telling an African success story. we are ecstatic about what the next big thing to happen in Africa’s tech space. Here at The Ouut, we look forward to bringing you more information on what is going on in the African technology industry. You can subscribe to receive news the moment it drops by clicking here.