Egypt Gradually Becoming the Preferred Offshoring Hub for BPO and ITO

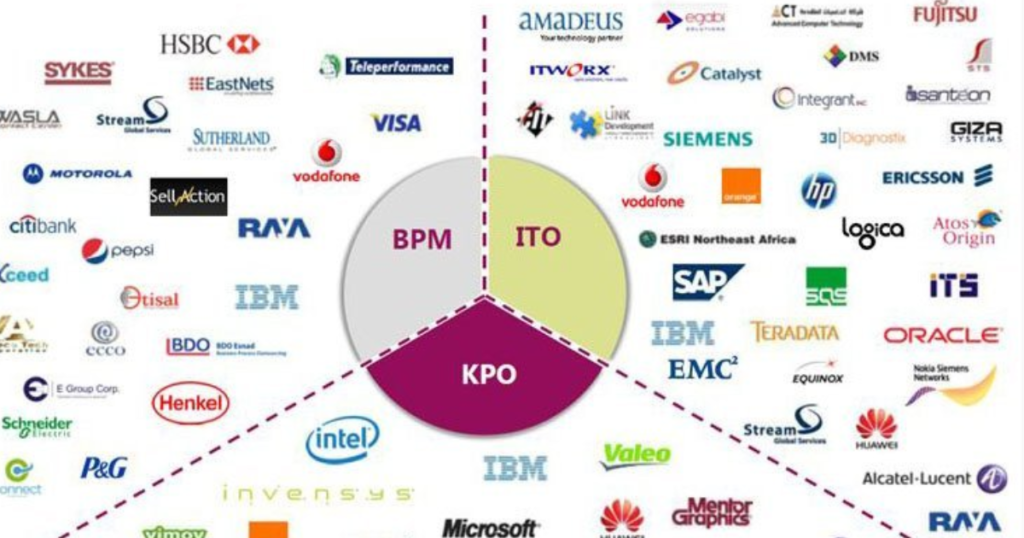

Egypt with a population of about 102 million people has invariably positioned itself to become a major hub of business and technology services to Western companies. Hence, the North African country has become one of the leading business process outsourcing (BPO) and information technology outsourcing (ITO) destinations in the global marketplace.

According to an IDC report, the combined IT, BPO, and KPO export markets in Egypt grew from $3.2 billion in 2017 to $4.7 billion in 2020. However, Egypt has seen surpassed these numbers in recent times with an increase in outsourcing jobs and tech companies expanding global delivery centers to the country.

The Information Technology Industry Development Agency (ITIDA), for example, reported an increase in the number of business services and IT jobs offshored to the country.

According to the agency, at least 19 global service providers and leading technology companies announced plans to expand in Egypt, and four new market entrants established offices and R&D centers during the current year’s second quarter (2Q).

Apart from positioning Egypt as an ideal and safe location for business processes and IT services, the government has successfully crafted a business environment that makes it appealing and easy for foreign investors to establish BPO/ITO operations in the country over the years. This was accomplished through the implementation of critical economic reforms and programs.

Specialized centers and laws have been established to significantly improve the ease of doing business in Egypt and thus attract foreign direct investment (FDI).

Some Value Propositions Necessitating Egypt’s BPO and ITO Growth

Abundant multilingual talent, competitive costs, modern infrastructure, supportive government, ideal geographical location, and a business and entrepreneurial environment conducive to growth are some of the factors supporting Egypt’s BPO and ITO growth.

Egypt has one of the world’s largest IT workforces. “Engineers make up a sizable proportion of Egypt’s human capital pool,” according to Rasha Ezz El-Din Mohamed, Sales and Marketing Director at Egyptian BPO/ITO outsourcer Xceed.

“Of Egypt’s 540,000 annual university graduates, over 50,000 have IT-related qualifications, adding to the talent pool while also expanding Egypt’s IT-enabled service (ITES) capabilities.” Egypt has a rapidly growing market for digital and analytics offshoring, in addition to a thriving entrepreneurial scene,” Mohamed added.

Furthermore, graduates’ diverse skills and knowledge have expanded the Egyptian BPO/ITO talent pool. According to the national statistics office, CAPMAS, Egypt annually produces the following types of graduates who work in BPO/ITO firms: 81,000 graduates in accounting and taxation; 45,000 specialized teachers; 30,000 database and network graduates; and 22,000 graduates in social services counseling.

This allows BPO/ITO service providers to hire new employees from a wide range of specializations and industries, such as data management, customer service, education, training, and financial services.

Also, Graduates in Egypt are finishing their university education with proficiency in a wider variety of languages which allows companies in Egypt to provide tailored BPO/ITO services. Over 90,000 Egyptians graduate annually with English-language qualifications, making Egypt highly favorable in the United States and Australian BPO/ITO markets.

Because Arabic is also the native language of Egypt, it opens the door to providing BPO/ITO services to 300 million Arabic consumers worldwide, including its home market.

Government Support for Tech Talents

Moreover, during the Covid-19 pandemic, ITIDA launched several initiatives to assist the country’s BPO/ITO industry. Egypt FWD initiative to train 100,000 people in data science, web development, and digital marketing and onboard them on freelancing platforms, Hackathon, Expedited ExportIT Program cash rebate, Webinars: Saturday Night Live with TIEC, Marketplace: “Our Opportunity is Digital” providing opportunities for SMEs in national digital transformation projects, IT Academia Collaboration, Fast-Track Funding; Access to Electronic Innovation Complexes; and Taking Advantage of its Services

Vodafone Intelligent Solutions Sites New Office in Egypt

Vodafone Intelligent Solutions (VOIS), a Vodafone Group subsidiary and its preferred partner for talent, technology, and transformation, recently opened a new office in Alexandria, creating 1,000 new contact center jobs to serve Vodafone’s global customers in both German and English.

However, this is not the first expansion announcement this year; several key outsourcing industry players, including Webhelp, Sutherland, PWC, STMicroelectronics, and many more, have already announced expansion plans.

Commenting on the entrant, Amr Mahfouz, CEO of the ITIDA said “We’re excited to see VOIS expand its footprint in Egypt through the new office in Alexandria, a city with many competitive advantages, untapped and abundant tech talents, and multilingual capabilities.”

The geopolitical tensions in other service locations have also boosted Egypt’s global appeal to investors and encouraged more global enterprises to choose Egypt as a reliable offshoring destination and business services hub.

“The current geopolitical environment benefits Egypt and directs investors and global service providers to the country as an ideal unparalleled offshoring destination and global digital services delivery hub for the EMEA region,” Mahfouz added.

He also encouraged multinational corporations to invest in tier 2 cities, where there are abundant opportunities and talent at a low cost.

The opening of the new office adds to ITIDA and _VOIS’s mutual journey of productive cooperation and constructive partnership.

“Our collaboration with VOIS is one of our outstanding successes in attracting and encouraging foreign investment in the IT offshoring business and the IT sector in general,” Mahfouz added.

Egypt’s attractiveness to investors has grown since the government launched a new incentive scheme for foreign investments in support of the 2022-2026 Digital Egypt Strategy for the Offshoring Industry. ITIDA’s ambitious strategy is propelling the sector on a higher growth trajectory.

The Sector’s Contribution to the country

According to Egypt’s Ministry of Communications and Information Technology, the local ICT sector grew at the fastest rate among all state sectors during FY2021/22 (about 16.3%). Egypt’s digital exports totaled $4.9 billion during the same period.

Furthermore, Mahfouz praised the multilingual abilities and skills of Egyptian youths working in the outsourcing industry. He stated that current demand outnumbers supply and that one of ITIDA’s strategic goals is to invest in developing digital and soft skills, as well as creating a talent pool capable of building the knowledge economy.

The VOIS Egypt office serves 14 markets worldwide. The company invests EGP 3 billion per year and exports services worth $145 million. In five years, VOIS plans to invest EGP 18 billion and increase the value of its Egyptian operations to $1 billion.

Furthermore, the company intends to grow its team from 8,600 to 10,000+ employees in its Cairo and Alexandria offices, making it the second largest in terms of headcount among VOIS’ sites in Egypt, India, Hungary, and Romania.

The opening of the new VOIS office strengthens Egypt’s position as an appealing investment destination for multinational corporations such as Vodafone, which is looking to expand its global delivery business in the country.

Egypt, with a population of approximately 120 million people, has consistently positioned itself as a major hub of business and technology services for Western firms. As a result, the North African country has grown to become one of the world’s leading destinations for business process outsourcing (BPO) and information technology outsourcing (ITO).

Egypt’s global BPO market share is expected to increase to 16.9% by 2019, according to International Data Corporation (IDC). The combined IT, BPO, and KPO export market in Egypt is expected to grow from $3.2 billion in 2017 to $4.7 billion in 2020, according to IDC.