How Stitch Became an African Fintech Force in Just 1 Year

Stitch was officially launched in February 2021 after it had been in stealth mode 2 years. The south African Fintech startup has since pulled strides, ensuring that it disrupts the continent’s financial space. Stitch came out of stealth with a $4m seed round. The round has remained the largest seed round raised by any API fintech startup in Africa.

Kiaan Pillay, Priyen Pillay and Natalie Cuthbert founded Stitch in 2021 after raising a seed round. The startup operates as an API infrastructure company that enables simple, easy access to user financial accounts in Africa with a lightweight single Sign-On experience, reducing the technical and operational effort.

Kiaan Pillay, co-founder and CEO of Stitch attained viable knowledge of the startup space prior to the launch. He had worked as the head of operations for South African insurance API platform Root and also joined Smile Identity, a San Francisco-based identity API company. While at Smile Identity, Pillay worked closely with Fintechs across Africa and discovered certain infrastructural issues.

The growth and development of Stitch shows that the Fintech space in Africa has remained competitive. The space has expanded overtime, allowing for the growth of startups and financial inclusion of unbanked Africans. Prior to Stitch’s expansion to Nigeria, the Nigerian Fintech space had major Fintech players including Flutterwave. However, this hasn’t held Stitch in it transforms the continent’s fintech space.

According to Stitch, its goal is to build the infrastructure, developer experience, and core functionality for the financial graph. The startup aims to stitch also these services under its platform with the help of solid partners, and understanding of local markets and regulatory environments.

Stitch’s customers range from wallet-based companies, to financial service providers and e-commerce startups.

A Look at How Stitch Operates

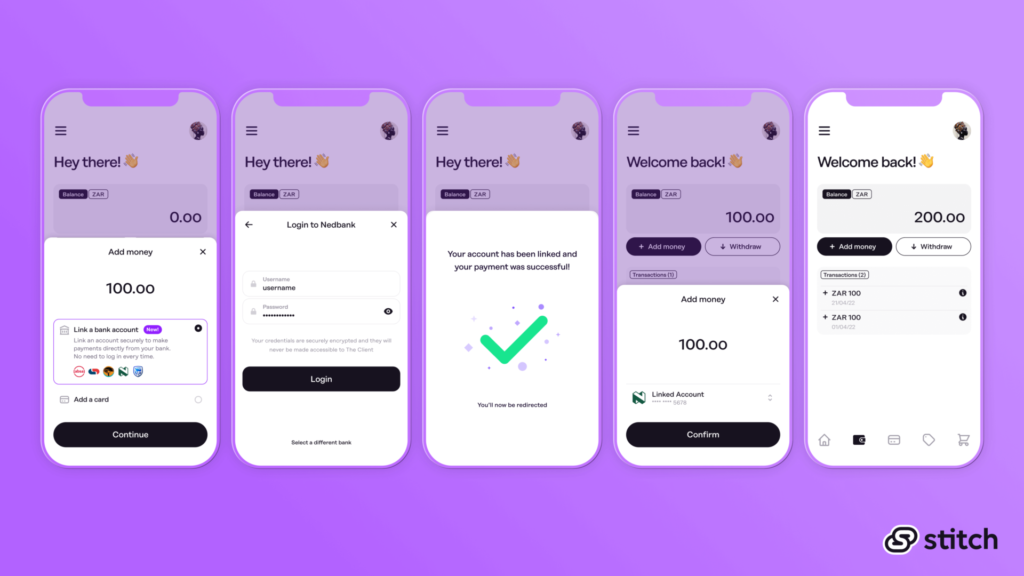

Stitch began with a data and identity API, which allows developers to connect their apps to financial accounts. The startup launched the typical Plaid playbook used by fintech infrastructure players around the world in February. The software enabled developers and Fintechs connect their applications to users’ financial accounts. They can also access users’ transaction histories, balances, confirm identities, and perform fraud checks with their permission. Stitch launched a payment product in April 2021 that allows for bank-to-bank transfers for one-click pay-ins and payouts.

The fintech decided to address these issues and help businesses process payments better by soft launching its pay-by-bank feature.

Stitch offers clients a seamless way to check balance before making a debit, in one single call. The startup also looks to offer a payment experience that either beats the debit card or matches what’s obtainable with the card.

Stitch had also introduced the financial graph with the aim of building the infrastructure, developer experience, and core functionality. The graph increases transaction clarity and trust, lowering costs and creating enormous economic value.

What’s Next for the Startup?

Stitch has increased its data volumes by more than 50% month on month and facilitates about $10 million in monthly payments. The payments solution is now integrated with five Nigerian banks, in addition to those in South Africa.

The fintech has secured $27M after $6M seed rounds last year and a $21M series A round in February. Having expanded to Nigeria last year, the startup will look to expand its payment services in both Nigeria and South Africa.

“We recently had a few customers go live in Nigeria, which has been very exciting for us. The offering for now is just payments there but are eager to deepen the products.” Kiaan Pillay claims the startup will add data and identity this year, as well as deepen the payments set similarly to how it is in South Africa.

The startup is also expected to explore the potentials in African markets, ‘where the wave of digital finance innovation is really beginning to gain momentum’.