How Y Combinator Has Influenced Startups in Africa

Do you know that in Africa it is easier for large (rich, MNCs, or high capital) firms to access financial funds than it is for smaller and infant firms? In fact, it is riskier to access finance in Africa than in any other region of the world even though the development of SMEs has been the political campaign anthems of many leaders in Africa. Only two African countries appear at top 50 in the ranking of countries that enable ease of doing business. This ranking is based on the tenets of countries’ productivity, informal economy, and ease of accessing finance. This unpleasant statistic indicates that there has been great laxity in the attention given to the development of infant companies in the region, one that demanded deliberate intervention.

Paul Graham intervened in 2005, by setting up Y-Combinator (YC), a startup accelerator model. Y-Combinator’s business model is to invest in startup companies, even those considered to be high-risk startups, which may not have proper functioning management. YC has been termed the most prominent startup accelerator in the world by Harvard Business School, as they have taken deliberate steps in helping entrepreneurs get off the ground.

Generally, Y-Combinator has differentiated itself from other startup accelerator firms due to the value-added service they have been able to provide their clients. This service is stretched to the extent of offering a business structure to startup companies that need help devising one. The structure provided by Y-Combinator extends beyond the provision of legal advice on a systematic scale. When YC invests in a startup, it requires its founders to relocate to the client’s work area and participate in a three-month program. During this time, the startup must work on building its product and acquiring users. The founders have access to Y-Combinator expert counselors (partners of YC) who can help with solving legal issues such as incorporation, patent filing, and dispute mediation, but also with building business competencies such as salesmanship and talent hiring.

Y-Combinator strives to relieve founders of inevitable distractions so that they can remain focused on building a viable product, which will enable them to achieve credibility sooner, and consequently, raise more funds, more quickly. This, of course, is an option that just about any startup founder would benefit from.

However, these services come with a price, a price that allows YC get 7% equity of the company. Nothing goes for nothing, so this is as expected. As little as this price may seem, it makes quite a lot of entrepreneurs uncomfortable, as some see it as a slimy means of capitalism. Should we be mad at a startup accelerator firm for trying to make a profit?

The bottom line is that many startup firms will never make it to where they should be without the help of an accelerator firm, so it is up to the startup founders to decide if this is a fair price to pay for success and if the alternative is obscurity, no matter how good your product is.

Influence of Y Combinator on Africa

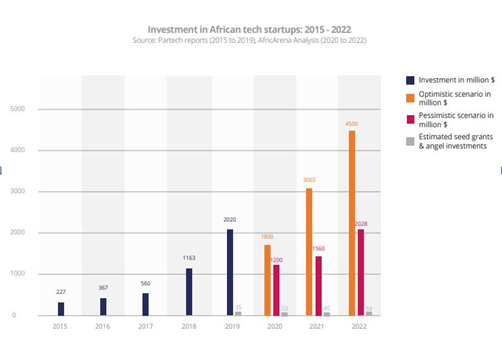

Source: AfricArena

Notice the persistent increase in tech investment from the chart above?

This trend is the factor that has been lacking in the tech industry in Africa prior to the influx of startup accelerator models in the region. One cannot overstate the influence that an accelerator company like Y-Combinator has had on the establishment and development of tech companies in Africa. The knowledge that there is a startup accelerator firm that is ready to handle financial risks and provide opportunities is a great motivation for tech entrepreneurs, and this encourages them to take innovative actions.

A total of twenty-eight (28) tech startups in Africa have taken part in Y Combinator’s accelerator scheme. In 2016, eight startups from Africa joined the accelerator; these include Envyl (formerly Shypmate, Ghana), Flutterwave (Nigeria) Instabug (Egypt), Kuhustle (Kenya), Lynks (Egypt), OMG Digital (Ghana), Paystack (Nigeria) and WorldCover (Ghana).

At 35.7%, which translated into ten startups, 2017 has the highest number of startups from Africa admitted into Y-Combinator in a single year. Seven of the ten startups came from Nigeria; Aella Credit, BuyPower, Helium Health (formerly One Medical), RelianceHMO (formerly Kangpe), Kudi, Releaf and Tizeti. While the other three were; Trade (Ghana), Tress (Ghana) and WaystoCap (Ghana).

Y-Combinator has taken a large step in bridging the gap between infant tech companies and capital generation by carrying out two funding cycles yearly for infant companies. In line with this, they engage clients in a clear and honest interview process that allows them acquire interests in a systematic manner. Y-Combinator also simplifies its discussions and interests so as to maintain a mutually beneficial playing field for both parties.

As part of the non-financial benefits of participating in YC, infant tech companies are required to participate in a program on-site, efficiently connecting them with resources, and putting in place structure, timelines, and incentives around a single goal which increases the likelihood for these infant companies to make progress.

How African Startups can apply to YC

Y-Combinator runs two three-month funding cycles a year, one from January through March and one from June through August. Interested startups can apply online via www.apply.ycombinator.com and any founders can apply. Startups that submit early will have an added advantage over others as YC will have more time to read their applications, just as with any other applications.

The most promising startups will be invited for an online interview, and this batch of Y- Combinator trainings will also be remote due to COVID-19.

During the 3-month cycle, speakers will be available every week to talk about their startups and what they learned from launch to present-day. Y-Combinator doesn’t really end after 3 months; only the talks do, the startup accelerator will continue to give advice and make introductions for as long as it is needed.

Although there have been some misconceptions about Y-Combinator by individuals and organizations, which have not been proven to be true, the startup accelerator has more to do in Africa.

Startups which have partnered with Y-Combinator have higher likelihood of success. The accelerator introduces an operating model which has offered a structure to startups, and this structure has proven to be strong enough to withstand the dynamics of society. In Africa, so far, there are only pros for the existence of Y-Combinator.