Africa and Tech 2021

It’s slow, but it’s moving

An article from theouut.com in March stated thus: In a world that continues to evolve, and fast, Africa is very quickly rising in the ranks of tech innovation and evolution. At the moment, Africa has a finger in every pie in the technology industry; true, the finger is barely there in some sectors, but for many, modern African technology is in deep.

The above paragraph defined Africa’s tech space at the moment- ‘it is slow, but it is moving’. Data from the Africa report has shown that the number of startups to secure funding has continuously increased each year since 2015. In 2015, only 125 startups secured investment. This figure grew to 146 in 2016, 159 in 2017, and 210 in 2018. The number of startups further increased in 2019 to 311, and continued to climb in 2020 as it increased to 397.

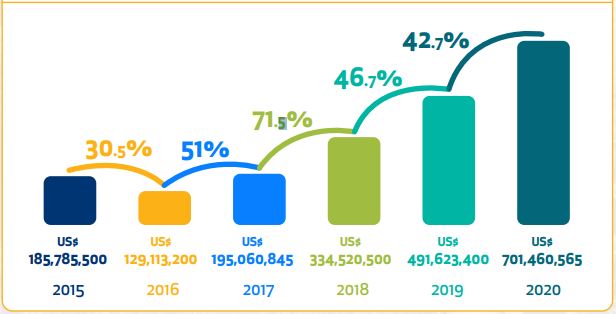

Africa’s tech growth was also felt in its funding statistic as it has experienced year-on-year growth since 2016. After a 30.5% decline ($129,113,200) from its previous record of $185,785,500 in 2015, Africa’s tech space has experienced funding record breaking years from 2016 till present. In 2017, total funds raised were up 51% at $195,060,845; soared a further 71.5% in 2018 to reach $334,520,500; and in 2019 grew 46.7% again to $491,623,400.

Seeing these impressive run from Africa’s tech space may be traced to the notion that Africa has become a fertile ground for entrepreneurs and start-ups to grow and blossom. This notion doesn’t just exist within local investors, but among international investors as well. International accelerators investing in an African startup is now even more common. Flat6Labs, Y Combinator, Founders Factory Africa, 500 Startups and MEST Africa among the usual suspects. Accelerator-linked investments are good signs of growth, a sign that Africa’s tech space continues to evolve.

With the view that tech startups are the preserve of only the richest countries, data has shown that the likes of Silicon Valley, Boston and New York in the US, London and Berlin in Europe and Hong Kong in Asia remain in a league of their own when it comes to catalyzing venture capital (VC) investment. However, the overflow in global tech startups and tech funding rate has allowed for the emergence of tech entrepreneurs way beyond those powerhouses. The African Development Bank reported that 22% of Africa’s working-age population are starting businesses — the highest rate of entrepreneurship in the world. This trend has propelled a wave of tech start-ups across the continent- specifically among the big 4 of Nigeria, South Africa, Kenya and Egypt.

The Pandemic Paradox

Was the pandemic not supposed disrupt commerce, startups and tech globally? Well, disruption is a complex word- it can be positive or negative. Well, the whole event of the pandemic created a shift in Africa’s tech space.

First, let us revisit the funding reports of pre-pandemic, pandemic and post-pandemic years in Africa’s tech space. Having earlier confirmed the year-on-year growth in funding in the year preceding the pandemic, we will quickly delve into the reality of Africa’s tech space between 2020 and 2021.

Funding growth by year (Source: Africa Tech Startups Funding Report, 2020)

As reported by Africa Tech Startups Funding Report, the figure above attests to the resilience of Africa’s tech ecosystem which attained a renewed growth of $701,460,565 representing a 42.68% growth rate from the previous year. Some of the stand-out rounds of 2020 included Egyptian e-health venture Vezeeta ($40,000,000), Nigerian fintech Flutterwave ($35,000,000), South African retail-tech startup Skynamo ($30,000,000), Kenyan agri-tech company Twiga Foods ($29,400,000), and Kenyan conservation tech solution Komaza ($28,000,000).

Africa’s tech funding resilience in 2020 was very impressive and laudable. The reality greatly exceeded the expectations. But as laudable as this result was, it was bettered in the first half of 2021. A report from Disrupt Africa in August revealed that a total of 303 African tech startups have raised a combined $1,184,220,000, up 69% on the $701,460,565 banked over the entirety of 2020.

This certainly appears like a pandemic-pull funding growth. We can certainly not underestimate the level of disrupt the pandemic created in the African tech space. The pandemic paradox is real. Rather than become a watershed for African Tech startups, the pandemic became a force that pulled African entrepreneurs, African VCs as well foreign VCs and accelerator firms. It created a desire to accelerate tech in Africa.

Growth and more growth

Africa needs to unleash innovation that drives job creation, economic opportunities, and expansive access to finance, education, and health care throughout the region. To build technological competitiveness, Africa must stimulate technological learning activities and activate policies that build local technological capabilities.

Africa’s tech space has seen incredible raise this year. Flutterwave became a Unicorn in 2021 with $170M raise; Chipper Cash became a unicorn with a $100m Series C round; US-based Equinix acquired Nigeria’s MainOne for $320m; Opay received $400m from soft bank; 54gene’s $15m raise. The list goes on and so will the progress given the current trend and global attention the region has been receiving.

Records have tumbled in 2021, African tech startup have become undeniably relevant, and have risen to the challenge posed by the pandemic. African technology space has witnessed enormous growth in a short time, and from the looks of things, we are excited as there is so much more coming.

It’s a new month in a new year, we are ecstatic about what the next big thing to happen in Africa’s tech space. Here at The Ouut, we look forward to bringing you more information on what is going on in the African technology industry. You can subscribe to receive news the moment it drops by clicking here.