OZÉ is Transforming SME financing and Access to Credit in Africa

Ghanaian Fintech startup, OZÉ has been providing digital record-keeping tools with embedded finance products to medium and small businesses in Africa since 2018. After OZÉ, several other accounting apps followed, a few of them include Kippa, Bumpa and Sabi Cash.

Since accounting information is needed by business and startup owners to fuel the newfound investor interest in African startups, the importance of an accounting app like OZÉ becomes critical for businesses looking to receive concise accounting information on their businesses. CEO Meghan McCormick and chief operating officer, Dave Emnett founded OZÉ in 2018 following a series of travels McCormick made across Africa. Meghan noticed the challenges small businesses face and their dire need for financial and recordkeeping tools to thrive.

Be reminded of the excruciating processes in assessing accounting information for decision making- IDENTIFYING, RECORDING, MEASURING, CLASSIFYING, VERIFYING, SUMMARIZING, ANALYZING and INTERPRETING and communicating financial information. Come on, the world needs the financial app to shrink the time taken to do all these. Before even talking about the time taken, a business owner will need to have accounting knowledge at a certain level.

The Blessings of the OZÉ App

SMEs succeeding becomes crucial to Africa’s developing economies. In Nigeria, small and medium enterprises (SMEs) account for 96% of businesses and 84% of employment. They also contribute 46% to Nigeria’s gross domestic product (GDP). Yet, one key determinant for success, access to credit, is still a big problem.

The problem of access to finance is one of the primary problem OZÉ is fixing for African SMEs. OZÉ leverages its “proprietary algorithm” to offers its users that opportunity thanks to its partnership with banks. OZÉ observes the user data and then connect them to the financial institution responsible for giving out loans. It says that although its loan portfolio is small, it has recorded no defaults to date.

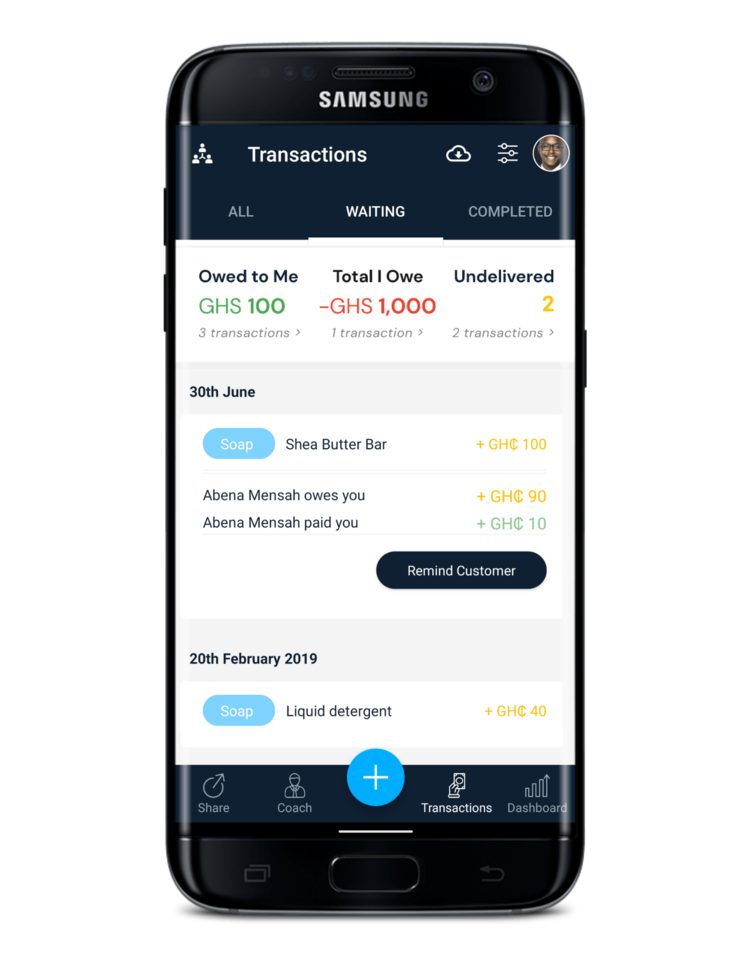

OZÉ app allows users to send invoices and receipts. What OZÉ really is doing is helping small business owners know how they are performing. Performance knowledge is needed by business owners to make decisions based on data.

Meghan McCormick, OZÉ’s co-founder and CEO said: “There’s so much money to be made by getting your operations under control, and tracking your data plays a large part.”

By collecting the invoices, receipts, and transaction history of a business, it is easy to develop a loan size that matches its profile. Also, users have to use the app for 90 days to become eligible for loans. Despite the value that access to credit adds to the app, OZÉ insists that the use case for keeping track of business data is more than loans.

OZÉ generates its revenue via a freemium model with basic features available for free. The tiered versions give users access to analytics and figures, starting from $2 per month and go up to $20. It also makes money from its lending business by collecting a commission when users receive loans from financiers.

Growing from the West

OZÉ took the prototype app to Ghana in 2018. The Ghana pre-launch was a great choice. Ghana has the highest mobile penetration in West Africa. The startup started its continental expansion with Nigeria in 2021. This came after securing $700,000 in seed funding from Anorak Ventures and Matuca Sarl.

OZÉ boasts of a client base of more than 125,000 business owners in Ghana and Nigeria. That number is just a drop in the ocean of more than 100 million small businesses across West Africa. In Ghana, businesses can accept payments via mobile money or card and a bank transfer or card in Nigeria. According to the company, businesses that use OZÉ as a choice of payment instead of using other platforms or cash will have higher credit limits and lower interest rates.

Last year, OZÉ’s active monthly users grew by 1,200%. The company said that the number of loans granted on the platform also increased by 200% from Q3 to Q4 of 2021. OZÉ also claims that 97% of business owners using the platform run businesses that are growing, profitable, or both.

After raising $3 million in pre-series A funding round, OZÉ will begin expansion plans into new African markets. The startup successfully translated the app to French and has plans to launch in other Francophone countries. OZÉ looks ready to conquer every section of Africa’s tough market.