Truzo Launches Digital Escrow Service to Curb Transactionary Risks for UK-SA trade

In order to facilitate secure and dependable transactions between the UK and South Africa, Truzo, the first digital escrow platform with an African emphasis and FCA approval, has been launched in the UK. After winning the UK Tech Hub Going Global 2019 competition and accelerating its growth as part of the UK Government’s Global Entrepreneur Programme, Truzo has now launched in the UK.

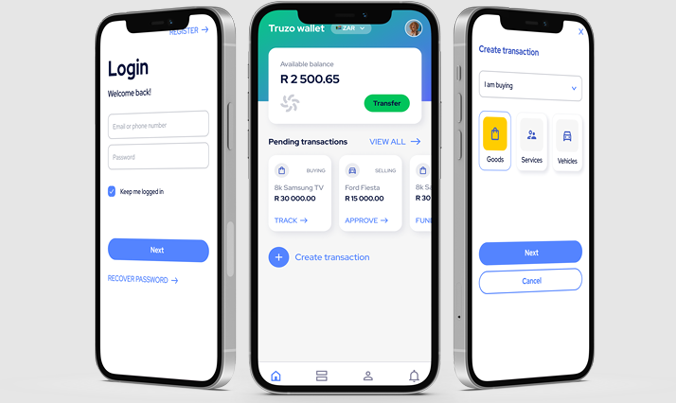

The platform lowers the price of cross-border trade by digitizing and getting rid of the expensive fees connected with letters of credit and currency changes, making it simpler for South African and UK vendors to provide competitive rates for the goods and services they import. Remittance, payment, and receipt functions are also available on the site, along with multi-currency digital wallets.

The technology puts confidence at the center of every transaction, according to Terence Naidu, founder and CEO of Truzo. The platform, which is backed by the Department of Foreign Trade’s Global Entrepreneur Program and collaborates with CurrencyCloud to streamline cross-border and multi-currency transactions, is one of the safest and most secure methods for businesses in Africa and the UK to buy and sell.

According to Derek Goodwin, Head of the Global Entrepreneur Programme, Department for International Trade, the UK is a hotbed for innovators and pioneers who are revolutionizing the financial services industry by simplifying transactions and reducing costs. Goodwin also noted that the UK is one of the top locations for FinTech globally.

The year 2023 will be crucial in Truzo’s next stage of expansion, and the company is committed to expanding its operations and services in the UK. With plans to continue investing in product development, hiring, and the expansion of its services into new markets, Truzo will conclude its next round of investment at the beginning of the second quarter of this year.

Transactionary Risks and Escrow Service

Escrow is a service made to offer guarantees to the counterparties in a transaction. Cash or other assets provided by a party to the transaction are kept in escrow by the escrow provider. When specific criteria are met, an escrow agent delivers these assets to the opposite party. The emergence of disruptive technologies like fintech and others has been extremely advantageous for the escrow sector. The use of escrow services driven by fintech has never been safer when making significant purchases or working with a new vendor.

According to Nick Cheetham, chief revenue officer of Currencycloud, Truzo’s creation of the first African-focused escrow platform to receive FCA approval and its strict compliance capabilities present an exciting opportunity for people and companies looking for innovative fintech solutions.

Because all registered users have their compliance extensively inspected and verified, Truzo’s low-fee, simple-to-use platform offers a safe way to trade and sell between strangers. Once compliance has been confirmed, customers can quickly set up a Truzo wallet to send and receive payments using the platform.

Truzo is dedicated to enhancing digital literacy in the areas where it operates as a forward-thinking and moral fintech company. To that purpose, 2% of Truzo’s earnings go to its bursary foundation, which helps and finances students from less privileged homes who want to attend college.