Why Southern Africa Needs More Startups like FlexID

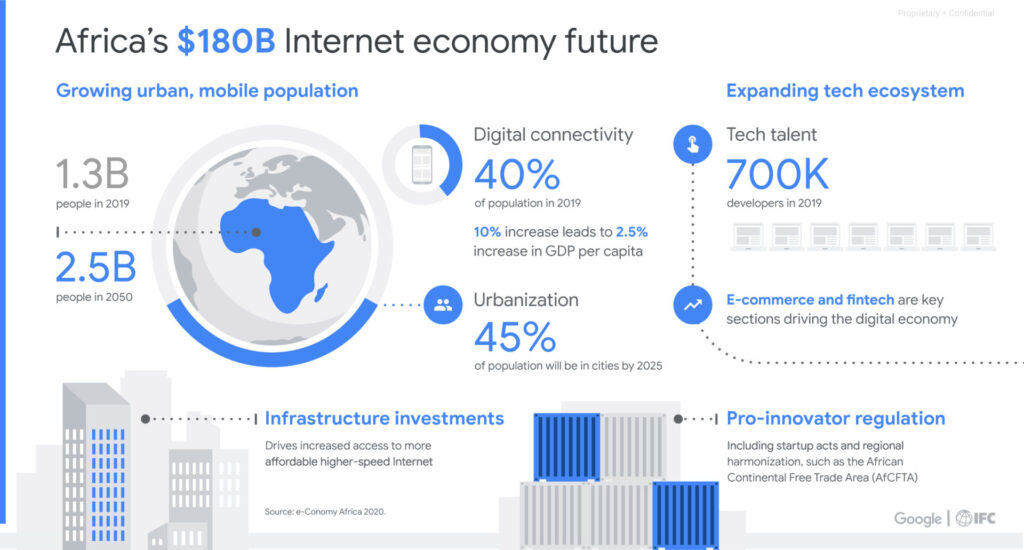

The demand for this identity verification was increased by the rapid rate of digitization. The Know Your Customer (KYC) process of identification and verification became even more necessary for public and private organizations as innovation flourished but cybercrime did not abate. According to research by the IFC and Google, Africa’s internet economy might grow to $180 billion by 2025, or 5.2% of the continent’s GDP. The estimated potential contribution by 2050 could be $712 billion, or 8.5% of the continent’s GDP.

However, there is a dark side to the internet’s growth, one that involves a rising threat that businesses, governments, and regular people may become victims of cybercrime. Cybercrime and new technology have been cited by the South African Reserve Bank (SARB) as major dangers to South Africa’s banking industry. In its report, the reserve bank said threats including internet and mobile banking platforms, may be exploited to facilitate money-laundering and fund terrorism.

Crimes involving cybercrime and/or breaches of cyber security have dramatically increased in recent years in Southern Africa. Therefore, it is not surprising that South Africa, which ranks sixth in the world for cybercrime density, has quickly established a reputation as a global hotspot for the crime. Furthermore, since 2019, the number of cyberattacks in South Africa has increased by more than 200%, making it the country with the biggest year-over-year growth in cybercrime.

Manie van Schalkwyk, CEO of the Southern African Fraud Prevention Service (SAFPS), advises consumers to take every precaution to ensure that their data is secure at all times. Cyberattacks have the ability to cause organizations to suffer catastrophic financial losses. For this reason, it is now imperative that more startups like FlexID with in-depth understanding of the cyber risks, and providing Digital Identity Management are available to mitigate the losses associated with cyber-attacks.

About FlexID

FlexID is a platform for cross-channel identity orchestration that manages access controls, fraud detection, and authentication. FlexID was established to lessen financial exclusion by Victor Mapunga, a Zimbabwean serial entrepreneur in the technology sector. Out of discontent with the banking system’s exclusion of people without identification documents, Mapunga developed the platform.

After personally encountering the crippling challenges associated with opening a bank account, Mapunga came up with his business idea and constructed FlexID on WhatsApp, which he referred to as one of the “most ubiquitous platforms” for internet access in Africa. In the previous three years, FlexID has verified 1.2 million bank credentials in Zimbabwe. Now, it focuses on accelerating customer onboarding into the formal sector without sacrificing privacy.

Using low code journey editing tools, FlexID deploys business policies, authenticators, fraud systems, and authorization tools without modifying application code. The consolidation of existing identity point solutions into a single pane of glass through centralized policy administration and third-party integration makes programming easier, lowers management costs, and increases agility to keep up with emerging technologies. To identify and reduce suspicious activity at every stage, in every system, and across every channel, comprehensive user and device behavioral analytics is integrated with risk information that is currently available.

Acting as a Web3 and Blockchain-like Solution

According to data from the Swiss Crypto Valley Venture Capital, or CV VC, although funding for African Blockchain firms reached $127 million in 2021, it has already reached $91 million in the first three months of 2022, a 1,668% rise over the same period last year. African businesses have already started to address challenges like accessibility and fraud by leveraging Blockchain and automation to cut the costs of historically expensive operations, and more use cases are in the works.

Global financial inclusion has been identified as having been sped up through FlexID. FlexID aims to initially assist 400 million Africans who are unable to access banking services due to a lack of identity documents. Identity is fundamental to contemporary commerce, says Mapunga. Without an ID, one cannot participate in the economy even at the most basic levels such as access to basic telco services, mobile money and banking.”

FlexID is a system that connects the informal economy to the formal one. Using information directly from granted identifiers and AI-powered biometrics to stop fraud in real-time, the startup offers a swift and precise method to validate identities of individuals or businesses across Africa. FlexID verifies that individuals are who they claim to be. Users can comply with local regulations and conduct KYC checks on their clients.