Zywa, a YC-backed Neobank for Gen Z, Gets $3M for Expansion Across MENA

Zywa, a Dubai-based Y Combinator-backed neobank for Gen Z, has received a $3 million pre-seed investment to expand into the Middle East and North Africa.

Goodwater Capital, Dubai Future District Fund, Rebel Fund, Trampoline Venture Partners, Zemu VC, as well as some prominent European family offices, and strategic angel investors participated in the round.

The neobank will utilize the funds to accelerate its growth in the United Arab Emirates and to kick-start its expansion into Saudi Arabia and Egypt. The new funding follows a $1 million pre-seed investment in February of this year.

Zywa also makes it easier for parents to send money to their children and track their spending and saving habits.

Alok Kumar, the CEO and co-founder of Zywa in a statement explained “Gen Zs in the UAE spend about AED 5B+ every year, and still rely on cash or their parents’ cards despite having options like supplementary cards issued by their parents’ banks. We have added value to these options which give access to digital payment, although not fundamentally designed for gen Z.”

“We are Gen Z building for Gen Z, and we aim to grow our product as they grow, to be the only financial services platform they will ever need…The seed fund will help us focus on product, growth, and strategic partnerships to accelerate our efforts in the UAE and Egypt markets while prepping us to launch in Saudi Arabia by early 2023,” he added.

A Brief Note on Zywa

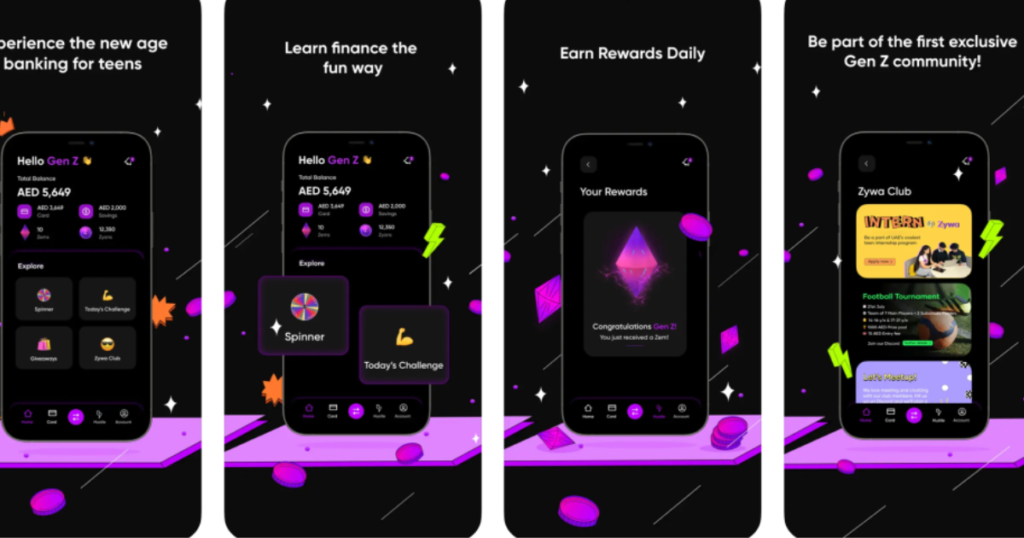

Alok Kumar and Nuha Hashem founded Zywa in 2021, inspired by their personal experiences in the Gulf region, where they primarily used cash or their parent’s credit cards to make payments. They created Zywa as a social banking app and prepaid card to allow Gen Z (people aged 11 to 25) to receive money, manage it, and make payments.

Working with schools to host workshops and hackathons is one of the strategic partnerships Zywa is considering to further expose it to its target clientele. It also plans to partner with teen-led businesses to allow them to sell on the app, as well as discount partnerships with brands popular with Generation Z.

It will also add a social component to its app by allowing users to share photos or videos of their purchases as well as react to their friends’ purchases on various feeds.

Zywa, which currently earns revenue from card interchange and merchant or brand partnerships, is also adding community-based value-add services, such as a platform it is developing within the app to allow users to apply for internships at Zywa and partner startups, as a strategy to encourage users to start earning early. In addition, it has gamified finance to reward those who save, budget, and invest their money.