Africa’s Disrupt Story: The Case of E-Commerce Startups in Egypt

North African Disrupt

The Egyptian government has shown increased support to further boost the country’s startup ecosystem and disrupt tech. Egypt’s technology and innovation-driven ecosystem has seen nothing but growth in the past years. As such, the number of startups in Egypt has grown fast, while also attracting attention from both regional and international VCs, global accelerators, as well as tech incubators. Egypt’s ability to attract growth as seen the country establish itself as the central tech hub of North Africa. Egypt’s silicon Cape, Cairo has been able to rival better-known startup ecosystems including Lagos, Nairobi and Cape Town.

Egyptian Startup Ecosystem Report 2021, showed that over the last five years, Egypt has not only quickly grown the number of start-ups but is also attracting investments big enough to deliver unicorns. Between 2015 and 2021, over $791 million has been raised by some 318 tech startups across 447 individual rounds. At these figures, Egypt’s tech ecosystem rivals more established startup ecosystems like South Africa, Nigeria and Kenya. Egypt accounts for 19.8 per cent of the active tech startups across Africa. Egypt’s tech ecosystem now stands in terms of levels of entrepreneurial innovation and investment in North Africa.

The support shown by the Egyptian government towards has been able to foster innovative entrepreneurship among Egyptian youths. Importantly, this has built a link to other North Africa countries, spreading innovative development. Technology Innovation and Entrepreneurship Center (TIEC) and Egypt Ventures have promoted innovation in the region. There has been a recent influx of companies with a focus on recycling, clean energy, transportation, Healthtech, education and fintech.

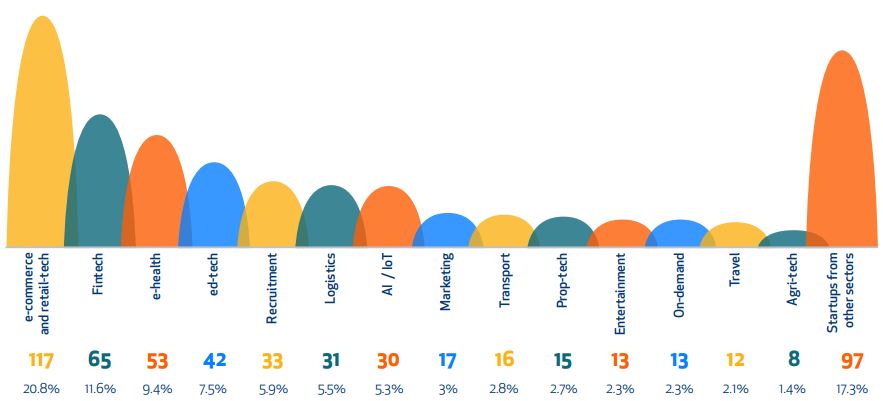

Egyptian tech startups by sector

However, while Fintech dominates in Nigeria, South Africa and Kenya, Egypt’s tech space growth has largely driven by e-commerce and retail tech – accounting for 20.8 percent of 562 active startups in the market.

The Arabian Trend in Egypt

As the bridge between Africa and the Middle East, Egypt remains an attractive market for both investors and entrepreneurs. In 2021, Egyptian startups were the most accelerated on the continent. 38.6% of them took part in some kind of acceleration or incubation programme. The likes of TIEC, Flat6Labs, Athar, the AUC VLab, Falak and individual funders were the usual suspects.

However, a majority of Egyptian startups’ funding have come from Arabians or Arabian firms. The past years has seen Arabian VCs exert their desire to implement the provisions of Article II of the Arab League Charter. Signatories of the Agreement are Egypt, Iraq, Jordan, Kuwait, Sudan, Syrian Arab Republic and the Arab Republic of Yemen. In exporting capital, Arabians have exerted efforts to promote preferential investments in the other Arab states.

The Arabian trend in Egypt’s funding space has shown the desire to provide the funding facility needed to improve upon the growth of Egypt’s tech space. Over the past six years, Egyptian startups have dominated the North African region, capturing 80% of the total investments made.

Cairo was designated the capital of the United Arab Republic in 1958. Today, the Arab worlds have turned the state into a startup hub in Africa. According to Disrupt Africa, almost 40 per cent of Egyptian tech startups have undergone some form of acceleration or incubation, an impressive statistic and one that speaks favourably to a local support ecosystem that also incorporates government, corporates and universities.

Why e-Commerce?

With 117 active ventures, Egypt’s e-Commerce space is almost twice the amount of companies active in the fintech space. This is an unusual trend when compared to other tech heavy weights in the continent. Fintech has remained the leading sector in most African countries, so developing a niche for e-Commerce startups is somewhat strange.

Of those 117 commerce-focused startups, 15 (12.8%) are Amazon or Jumia-style multi-product e-commerce stores. Nineteen (16.2%) are focused on clothes and accessories, and 16 (13.7%) on food, drinks and groceries. Forty-six (39.3%) operate in assorted other niches.

More so, within Egypt’s tech startup ecosystem, e-Commerce is the largest employer. The e-Commerce sector created 2,718 jobs in the country. The largest e-Commerce employers are MaxAB (320), Elmenus (194), ExpandCart (187), Breadfast (176), and Capiter (173).

The Arab world provides a thriving hub for technology. This trend is supported by strong investor appetite, internet-savvy consumers, open innovative ecosystem of leaders and most especially, spendthrift tourists. These factors come together to push for the development of a well-organized e-Commerce space in the region. With a local population exceeding 100 million and a high mobile penetration rate, Egyptian e-Commerce startups can exploit the human factors available to create more profit and provide enhanced shopping experiences in the country and region.