Africa’s Funding Gap: The case of Anglophone and Francophone Africa

Unwanted Attention

Was Wave’s $200 million Series A financing in September last year unwanted attention to Francophone Africa? With African startups being particularly hyped for global funding and investment over the past years, much of this funding has been skewed particularly towards Anglophone Africa and this is a huge indication of Africa’s funding gap.

In an exclusive podcast interview with African Business, Digital Africa executive director Stéphan Eloïse Gras highlights a “huge inequality” in access to funding and capacity between Francophone and Anglophone Africa. This gap was what President Emmanuel Macron of France tried to bridge when he pledged $148m to Digital Africa, the country’s initiative to support 500 startups which has a specific mandate to target underinvested Francophone markets.

Until September 2021, all of Africa’s unicorns had emerged from Anglophone or Arabic-speaking parts of the continent, so it was a thing of joy when Wave, a mobile money provider based in Francophone Senegal, raised the biggest ever Series A round in Africa and got everyone believing that things were starting to change.

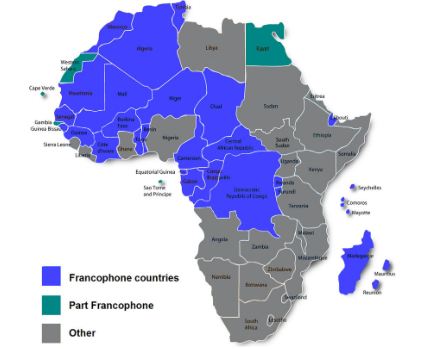

These all seem like unwanted attention for the region. Africans wanted more and got nothing afterward. It should be noted that French is the official language of 21 countries in Africa, (8 other countries also speak the language). But across Africa from 2015 to 2021, startups raised $8.8 billion, only $417.9 million went to Francophone countries.

Francophone countries in Africa

Although the number of early-stage deals among African startups is increasing, the average size of the deals remains low in francophone Africa compared to that of other regions, and funding gaps persist at the early stages, according to a new report on the industry in emerging markets.

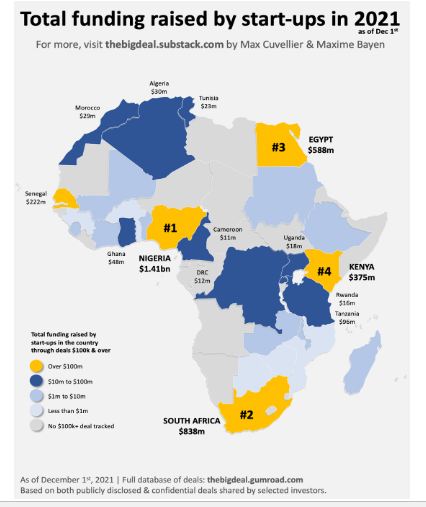

In 2021, tech startups operating across Africa jointly raised over $4.27 billion in 800+ deals, breaking the initial $1.1 billion record funding that was pumped into the continent amidst the pandemic last year. While most of the funding went to fintech startups, Nigeria, South Africa, Egypt, and Kenya continued to top the list as the big four — with 80% of the total raised on the continent so far this year (35% for Nigeria alone). But this is not just about the big four versus francophone Africa (although the big four are mostly Anglophone nations). Nonetheless, the bullishness of Anglophone African stakeholders and investors could be boldly seen in Africa’s tech funding scene.

Source: The Big Deal

In 2021, Wave’s overstated $200m funding was all that was stated on Senegal’s tech funding space as there was just an extra $22m funding added to the big figure. Take away Wave’s deal, and you have just $22m from Senegal.

There was $30m from Algeria (coming from just one investment from logistics and last-mile delivery startup, Yassir in November). This scene was even better than Morocco’s $29m raise; Tunisia’s $23m (with about 87% of the total funding coming from Expensya’s $20m investment from MAIF Avenir and Silicon Badia); Rwanda’s $16m (mostly from mobility startup, Ampersand); the DRC’s $12m and Cameroon’s $11m raise.

This poor run of funding form among francophone nations should not be ignored, it has been reoccurring over the years. According to a report by Partech Ventures on Financing Startups in Africa, amid a record result for the continent, only 1% of the $1.16 billion of equity raised by African Tech Startup in 2018 was allocated to French-speaking Africa. In 2021, the percentage records show Francophone Senegal making 13% from the over $4b raised. Also, Cameroon 0.7% and Ivory Coast 0.3%.

Responsible Factors

Francophone startups are not able to raise comparable funding to their English-speaking counterparts, due to several factors. English being the de facto language in technology and the digital era, it’s more natural for investors to focus on Anglophone markets such as Nigeria, South Africa, and Kenya. Maybe an economic parameter like population best captures the reason for the funding gap among African nations. Africa’s tech startups’ funding reality mirrors a correlation between national population and investor interest and given a majority of Francophone nations largely home to smaller populations and markets, investor interests have been low. The 120 million population across 15 Francophone West and Central African countries as of 2019 was well dwarfed by Nigeria’s alone.

The gap might as well be as a result of the significantly strict regulatory landscape in francophone Africa is often cited as a major factor that’s contributed to a venture funding apathy held by foreign investors, who prefer to invest in Anglophone markets. From reports, Francophone startups tend to be more formal and verbose and few journalists or investors have the patience to read through tons of pages of detailed documents.

Coura Sene, Wave’s General Manager for the eight French-speaking countries in the West African Economic and Monetary Union (WAEMU), speaking in an interview said: “Francophone Africa inherited the French system’s bureaucracy, heavy administration, and governance style; as such, processes and regulations can be stricter than in other regions,”.

According to Dario Giuliani, founder, and CEO of Briter Bridges, key government regulations may have been the bottlenecks to funding in Francophone Africa. The founder speaking at the Sesamers on Tour Stop #4: Africa pointed at several challenges holding back investors in Francophone Africa.

“Unsurprisingly, investment trends highlight significant asymmetries in volumes and distribution of capital between francophone Africa and other regions across the continent,” the report says. “Our interviews showed that lack of clarity around regulations, scarce capital pools, language barriers, and limited networking opportunities remain some of the greatest challenges to consider when entering the francophone African market.”

Indeed, the report notes that the 2020 World Bank Ease of Doing Business report found that “most French-speaking African countries feature in the lower end of the list.”

Disrupt Africa recently summarized the cause of the funding gap between Francophone and Anglophone African nations. As reported, Francophone startups are not able to raise comparable funding to their English-speaking counterparts, due to several factors among which the French-speaking African market is perceived as small by investors, and the level of investment readiness for French-speaking African startups is weaker than that of their English-speaking counterparts, and third, the venture capital culture is less well established in these regions.

Recovery

World Bank launched the l’Afrique Excelle Programme, to help address these critical gaps for French-speaking African entrepreneurs and create a set of angel networks in West Africa to expand and accelerate their investment capabilities and potential.

Despite the low funding performance in 2021 (apart from Wave’s raise), Cynthia Mandjek, investment manager at France-based, Africa-focused VC firm Saviu Ventures, thinks investors are waking up to opportunities in Francophone Africa, which is “long overdue” for disruption.

The Dakar Network Angels can offer more. Angel networks fill an important gap in the startup investment cycle as they can offer founders seed-stage funding to prove their growth potential and then possibly attract bigger investors.

In 2019, the African Development Bank (AfDB) approved a $14 million equity investment in Adiwale Fund 1, a private equity fund that targets high-growth SMEs in Francophone West Africa. The AfDB can concentrate more investment in Francophone nations to ensure tech startups development in the region.