How YC-backed Nigerian Startup, Identitypass, is Bridging the Identity Verification Gap in Africa

Verification of users has become more necessary with the development of digital businesses globally. The most basic use of this tool is to offer or engage users based on verified personal information. This approach to customer acquisition forms the core of YC-backed Nigerian startup, Identitypass.

Identitypass was founded in January 2021 by Lanre Ogungbe, Niyi Adegboye, and David Obi to enable digital businesses to verify their customers within seconds. The startup participated Y-Combinator’s W22 accelerator program which ran from January through March, 2022.

A Holiday Update From Us:

??We're excited to announce that we're part of the @ycombinator W22 batch. pic.twitter.com/Q4ixq14QzC

— Identitypass (@myidentitypass) December 27, 2021

Customer verification is an essential KYC (Know Your Customer) campaign since it safeguards the credibility of a business offer. Consumers that meet required criteria must believe the deal is tailored just for them, otherwise it will lose its attractiveness. Identity verification also safeguards a company’s image, and prevent discount abuse.

Businesses have used a variety of methods to authenticate a customer’s eligibility for a customised offer in the past. The most common way this was achieved was users needing to show IDs in stores and other business areas. However, now that the world has gone digital, digital verification is the simplest and most effective approach.

KYC practices forms and important aspect of business as it establishes a client relationship with a business. Because of its significance in regard to client onboarding, identity fraud and AML (anti-money laundering) controls, as well as IRS regulatory criteria, Know Your Customer, or KYC, is one of the most significant difficulties that organizations and institutions in any industry confront.

The widespread use of new technologies and the internet necessitates the development of standards to aid business operations. Identitypass is leveraging AI to make it easier for African businesses to enhance all operations and is making user screening easier to perform in real-time.

How the Startup Works

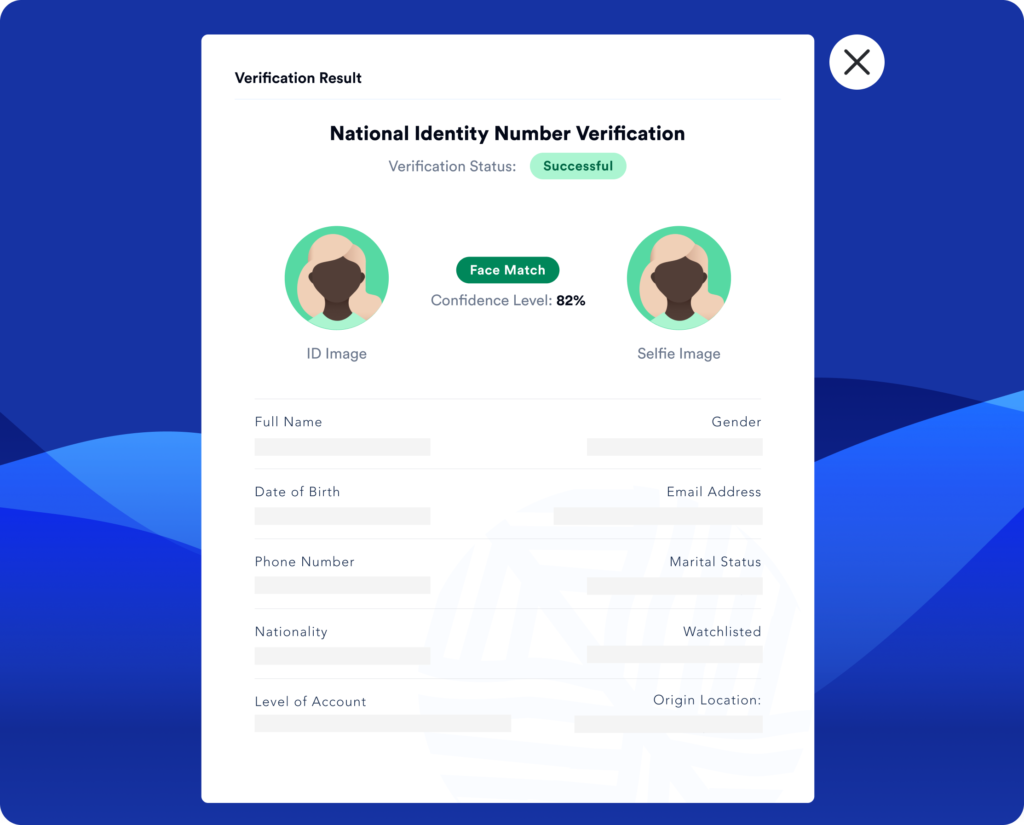

Identitypass has liberalized customer onboarding and remittance for business via real-time KYC screening. It has enabled businesses practice KYC/AML screening without affecting customer experience. Identity verification has become a huge part of the KYC process especially for banks, financial institutions, and other businesses to verify the identity of their customers via liveness checks using computers or mobile phones.

Identitypass has helped improved business efficiency by enabling these institutions carry out verification in record time. This involves 3 easy steps:

One: Sign up on our portal to get access to our verification endpoints.

Two: Get your Api keys and integrate our solutions with your website or Application

Three: Get access full access start using our Solutions.

Businesses can implement Identitypass data search on your website/application to personalize web pages with contact or visitor information.

The platform also carries out Onboarding Screening of customer’s daily transactions to track real-time fraudulent activities. Businesses can also access rules and machine learning data insight to combat cyber security challenges. Identitypass’ radar can also automatically flag down fraudulent activities at the point of discovery.

What Next for Identitypass?

The startup already operates in Nigeria, Ghana, Kenya, Sierra Leone, and South Africa. Identitypass currently serves a portfolio of organizations across fintech, crypto, mobility, and online market exchanges.

Identitypass recently closed a $2.8 million seed round and will be looking to position itself as a Pan-African company. Sierra Leone became its latest verification market this month. Identitypass promises to use the latest funding to expand its existing infrastructure, roll out new verticals around compliance, security and data collection, enter into new African countries and make new hires.