Now Stitching with Stitch Payouts; South African Fintech Rolls Out New Product

The South African API Fintech startup, Stitch, has introduced Stitch Payouts. The startup claims the solution will simplify and make it faster for businesses to pay clients, suppliers, partners, and staff.

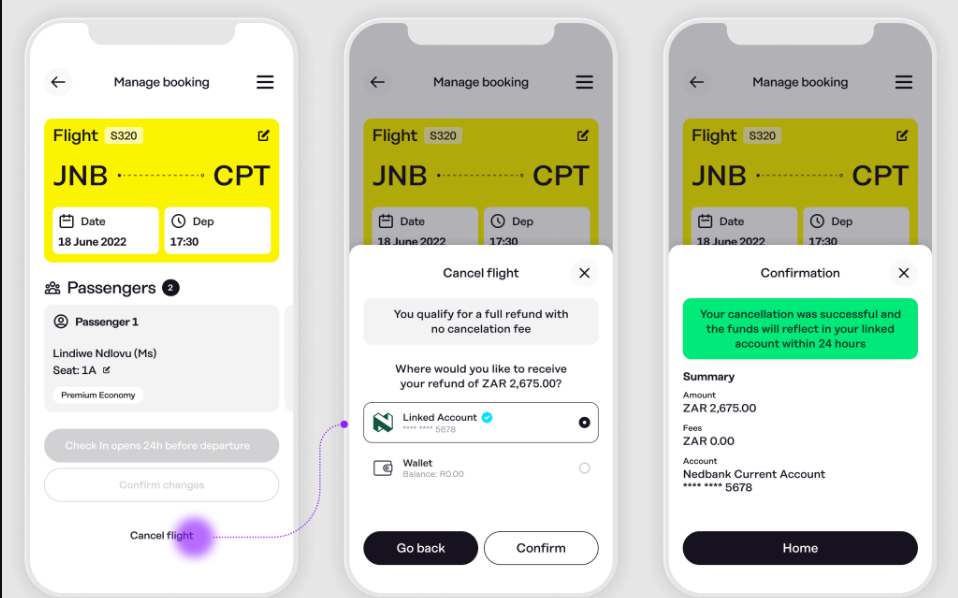

Refunds, withdrawals, and disbursements are the three components of Stitch Payouts. Refunds will allow Stitch customers to reverse funds sent to the same account used for a pay-in, allowing businesses like e-commerce store operators to refund customers conveniently.

On the other side, withdrawals enable authenticated Stitch accounts to take money out of cryptocurrency and fintech wallets. Finally, disbursements will allow stitch clients to quickly and easily pay suppliers, merchants, employees, and other parties. These payments can be transferred to any domestic account following verification.

How Stitch Became an African Fintech Force in Just 1 Year

This announcement reflects Stitch’s goal to become a leading name in Africa’s Fintech space. Before Stitch Payout, the startup had rolled out Stitch LinkPay (an API that enables businesses to link and verify user financial accounts for easy access to financial data and seamless and secure payments and payouts). The startup had also raised $21m series A funding in February.

Who can use Payouts?

Stitch Payouts can be helpful in almost any organization that frequently needs to deliver payments to clients, suppliers, partners, workers, and others. Stitch Payout will be handy for the operations of the following:

- Fintech businesses and wallet-based apps can enable users to link their primary financial account (such as a bank account) to withdraw funds whenever they need.

- Marketplaces and platforms (such as ride-hailing services) can enable suppliers to cash out quickly.

- E-commerce businesses can enable instant refunds and same-day settlements for merchants.

- Lenders and insurers can efficiently disburse funds to verified accounts.

Only South African consumers can use the service; this country is one of Stitch’s two markets. Stitch Payout is currently unavailable for Nigerian customers.

What Stitch Payouts Offers Businesses

Managing manual bank payments and navigating various bank and payment service provider (PSP) dashboards will no longer be necessary, thanks to Stitch Payouts, according to co-founder and CPO of Stitch Junaid Dadan.

With Stitch Payouts, businesses can choose between same-day (T+1) or instant settlement. This enables them to initiate payments in real-time over API, thereby eliminating slow integrations and manual reconciliation. The Stitch creates payouts to any domestic account in South Africa over API, on a per-transaction basis or in bulk. Users can also track their payments with status checks via webhook or query anytime.

Businesses can also choose to transfer funds to Stitch as a float. The app monitors and tracks balance against payout requests. Stitch Payouts also notifies users and queues pending payments when their float balance is low, so they don’t need to initiate payout requests again.