Torch-lighting the Post-Pandemic Drop in Healthtech Funding in Africa

Despite accounting for 25% of the world’s disease burden in 2017, data from the World Health Organization (WHO) reveals that Africa only accounts for less than 1% of global health expenditures. It gets worse: other continents have produced over 98% of the medicine that the continent promotes and distributes to hospitals, pharmacies, and healthcare facilities used in Africa.

In order to raise life expectancy in Africa—which is currently 64.5 years—beyond the global average of 73 years (for both sexes) and attain self-sustainability in the case of another global health catastrophe, the continent will need to use innovation.

The regulation of digital and online pharmacies has historically been hazy or nonexistent, but African countries are now taking action to control internet pharmacies. For instance, a fresh set of rules by Nigeria looking to regulate online pharmacies and Ghana’s central portal for online pharmacy operators’ activities set the stage for government’s intervention in both countries.

African health operators ingeniously worked around limitations by developing Frontline SMS as early as the middle of the 2000s, when internet connectivity was extremely limited on the continent. This innovation enabled patients send short text messages of images of blood samples taken with a basic camera phone to medical practitioners.

However, with patients constantly seeking access to an effective healthcare system, and investors looking for the continent’s next growth engine and Africa’s Frontline SMS innovation would be a forerunner to a Healthtech boom. It would take a devastating pandemic in 2020 for Africans and investors to realize this.

The Covid Boom

It is predicted that by 2030, the African healthcare market will be valued $259 billion. The commercial sector has a lucrative opportunity to take a piece of the action.

Health funding is an extreme necessity for Africa because the region is one of the least urbanized places in the world—with half of the people living in rural settlements, and the other half living in urban areas. Most importantly, applying tech to a booming health sector enables efficiency at an increasing rate that propels the ability to reach patients who are unable to access healthcare services in rural areas.

Africa and Tech 2021

The Covid-19 pandemic boosted opportunities and this led to a surge in the Africa Healthtech startups, claims a Quartz Africa study from March. In 2020, investments in health technology totaled $102.9 million over 62 fundraising deals, which was 14.7% of all announced investment rounds in 2020. This is up 257.5% on the $28.8 million (5.9% of total) raised in 2019, which in turn was 51.8% higher than 2018’s $18.9 million (5.6% of funds). Thus the amount of cash secured by the e-health space in 2020 rocketed ahead of previous years, and was the third fastest growing sector in this regard.

Africa was not an exception when it came to the COVID-19 pandemic’s global impact on the telemedicine sector. As medical professionals and people looked for remote consultation alternatives during the epidemic, telemedicine startups have massively saturated the African health tech market. Due to the low doctor-to-patient ratio on the continent (approximately 1 doctor for every 5000 people), virtual healthcare services help to lessen the strain on Africa’s shrinking doctor and nurse population and increase patient access to healthcare services.

Post-Pandemic Drop in Healthtech Funding

In the previous five years, the African tech industry experienced exponential development, with companies raising close to $5 billion in 2021. The overall amount of venture capital funding in Africa reached $1.8 billion in the first quarter of 2022, continuing the trend. When compared to Q1 2021, when this amount stood at $730M, it has increased by 150%. Fintech business Flutterwave raised $250 million in the highest round, followed by Wasoko with $125 million, Moove with $105 million, and InstaDeep with $100 million.

Global activity slowed down in the second quarter of 2022 as a result of the oil, food, and commodity crises brought on by Russia’s invasion of Ukraine. This led to problems with the world’s supply chains and greater inflation, which sparked a worldwide economic slowdown, a decline in the capital and cryptocurrency markets, and worries about a possible recession.

There were over 56 fundraising rounds as Healthtech deals totaled little over $77 million USD in July 2021. However, a large portion of this could be traced to a single funding round closed by LifeQ, a biometrics business originally established in South Africa but now based in the United States.

South Africa’s Biometrics Company LifeQ secures $47 Million Investment Funding

Africa’s Healthtech funding reality shows that the COVID-19 epidemic exposed a number of flaws and prompted a significant amount of interest from domestic and global investors in the African healthcare sector. With a population of more than 1.4 billion, the African market presented enormous opportunity for investment in healthcare services. However, as the Fintech, E-commerce and Logistics sectors rapidly increased their user bases and levels of public visibility through acquisition of funds, the Healthtech space increased at a slower or decreasing rate.

Notable Stats on Healthtech Funding

According to data compiled by the Health Finance Coalition, barely 1% of global health finance is invested in Africa. This leaves the continent with an annual funding gap of more than $200 billion.

Data from Disrupt Africa’s funding report 2021 shows that: “A total of 55 startups – 9.8% of the African total – secured investment, a figure that was a 34.1% increase on the 41 that raised in 2020.

“There was also growth when it came to total funding secured by those 55 startups, but here the rate was much slower than the previous year. Indeed, African e-health startups raised more funding in 2020 than they did in all of the previous five years combined, with $102,994,000 raised. We did see an increase in funding in 2021, with a total of $122,542,000 raised, but a growth rate of 19% compares unfavourably with other major sectors. It also meant Healthtech’s share of total funding fell to 5.7%, back to pre-2020 levels.”

It concludes that the average raise per startup fell back to $2,228,036 from $2,512,049 in 2020. This indicates that majority of the Healthtech funding have concentrated on a few startups in the period LifeQ’s ($47 million); Nigeria’s 54gene ($25 million); South Africa’s hearX Group ($8.3 million); Egyptian Yodawy ($7.5 million) and Nigeria’s DrugStoc ($4.4 million).

How did Africa’s Healthtech space not continue in the fast lane it was in 2020? Although seen to be increasing, Africa’s Healthtech space has seen reduced funding rate compared to previous records and expectations. As the world drifts away from the negative impacts of the pandemic, investors seem to be drifting away also from Healthtech startups. Fintechs and E-commerce have still dominated and increased at increasing rates.

Xup 2022?

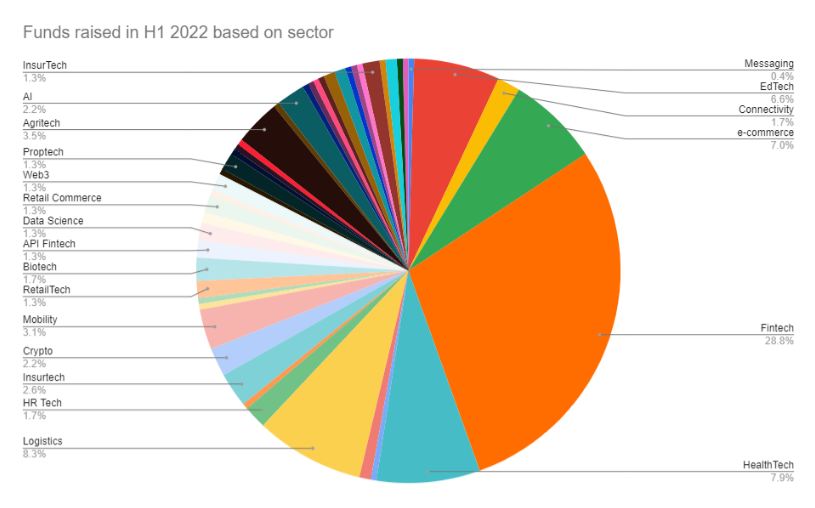

Fintech startups in Africa are still taking the largest chunk of the funding, having raised 28.8% ($845 million) of the $2.5 billion raised by African startups in H1 of 2022. The logistics and Mobility sector raised 11.4% of the funds, making it the second-highest sector. Followed by Healthtech (7.9% or $197 million), e-Commerce (7.0%) and Edtech (6.6%) startups.

The $197 million raised by Healthtech startups this year comes as an increase compared to $61.982 million raised in H1 2021 across a total of 15 deals and $91.2 million across 42 funding rounds recorded in H1 2020. But at 7.9% of total funding, it indicates a low investment within the sector.

Children in Africa are 14 times more likely to die before their fifth birthday than children in Europe or North America. There are 2.3 doctors per 10,000 people in Africa, compared to 39.4 in Europe. Africa accounts for 96% of global deaths from malaria and 61% of deaths from AIDS. These statistics, and countless others, clearly illustrate the urgent need for investment in Africa’s health systems.