China-Backed African Fintech Startup OPay looks to raise $400Million

Africa’s Fintech startups have not looked backed since they put their hands in the plow. From Paga’s acquisition of Ethiopian software firm in January 2020, Dayra securing $3m pre-seed funds in March 2020 to KUDA raising $25m in March 2021, and Flutterwave’s unicorn achievement in March 2021. We are used to the Fintech startups doing great things, it’s even better they are not slowing down as another Fintech startup OPay has announced it is looking to raise $400m to fuel its expansion.

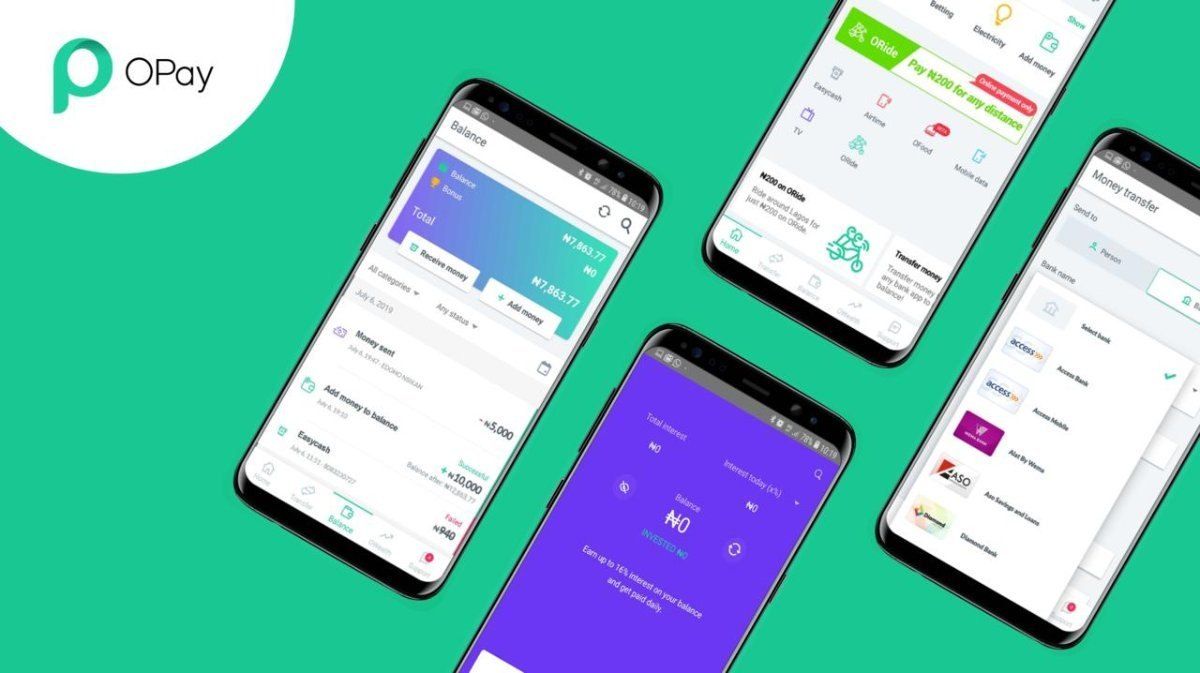

OPay operates a consumer platform that allows users to send and receive money, pay bills, and order food and groceries. It empowers and enables users to accomplish more with their money by providing smart financial services. It is a one-stop mobile-based platform for payment, transportation, food and grocery delivery, and other important services in everyday life. Millions of users rely on OPay every day to send and receive money, pay bills, and order food and groceries.

OPay was created in 2018 by its Chinese founder and CEO Zhou Yahui. The startups began their operations in Nigeria targeting the most populous black nation on earth. The startup was able to expand its service to Egypt in 2021.

Although OPay’s business is in Africa, most of its existing investors are in China, including Chinese on-demand services app Meituan, prominent Chinese VC firms such as Source Code Capital, Sequoia Capital China, IDG Capital, Gaorong Capital, GSR Ventures, Redpoint China, and Bertelsmann Asia Investments, SoftBank Ventures Asia.

OPay’s most recent funding round was in November 2019, when it raised $120 million from Meituan and Chinese VC firms. That round valued OPay at $500 million. At the time, it seemed the pace was good. But with Fintech startups springing up in Africa and already existing ones running riot with their fundings, the competition in the mobile payment space becomes stiff.

The $400m funds will be a major addition to Fintech’s war chest if they are to cause a major upset in the Fintech sector in Africa accelerate the app’s expansion into new markets and services.