How Kenyan Tech Startup Ecosystem Consolidated its Place among the African Big 4 in 2022

Kenya has a flourishing tech startup ecosystem, with a plethora of successful startups that have received substantial funding and grown significantly. M-Pesa, a mobile payments startup that has revolutionized financial services in the country; BRCK, a hardware, and software firm that delivers internet connectivity and other technological solutions in areas with limited infrastructure; and Ushahidi, a platform for crowd-sourced crisis mapping, are among the most well-known Kenyan tech startups.

A variety of factors have contributed to the success of Kenya’s tech startup ecosystem. One example is the country’s high level of mobile phone penetration, which has enabled the expansion of firms such as M-Pesa and made it easier for startups to reach customers. Another example is the government’s efforts to support the tech sector, such as the iHub, a startup incubator and co-working space in Nairobi.

Kenyan tech startups have attracted some of the most venture capitalist interest in Africa, with the local startup ecosystem moving from fourth to third place in 2022, after South Africa.

According to StartupBlink data, Kenya received 2.1 points in the startup ecosystem index in 2022. Kenya was ranked 62nd out of 100 countries in the world. Furthermore, it was the third-largest African startup market after South Africa and Nigeria. Since 2019, the nation’s startups have consistently broken their records for the amount of funding raised each year. Kenyan startups received $291 million in total investments in 2021, while the amount received in 2022 is over $506 million, nearly doubling the amount received in 2021. In the same year, Nairobi-based M-Kopa Solar received the largest funding of $75 million, compared to Gro Intelligence’s $85 million in 2021.

Bold Moves by the Kenyan Tech Startup Ecosystem in 2022

Kenya Became the First African Country to Introduced Coding in Schools

After former Kenyan president Uhuru Kenyatta announced the addition of computer programming as a subject in its primary and secondary school curricula in August 2022, Kenya became the first African country to officially teach coding as a subject across the country. This announcement was well received because computer programming teaches children to experiment and instills confidence in their ability to be creative. It is also seen as a move to ensure that Kenya maintains its position as one of the continent’s hotbeds of digital innovation.

Global Tech Giants Found Home in Nairobi

Some well-known technology companies opened their offices in Nairobi, Kenya’s capital, in 2022. Some of these businesses include Google, which announced the establishment of its first African development center in Nairobi, Kenya, in April 2022. The center is expected to contribute to the development of transformative products and services for Africans. In the same month, Visa established its first African innovation studio in Kenya. This facility will serve Sub-Saharan Africa and be part of Visa’s network of innovation centers, operating since 2016 in cities such as London, Dubai, and Singapore. The Nairobi studio is the first in Africa and the sixth in the world.

In addition, Bolt opened its first African headquarters in Nairobi in July, serving as a regional hub for the seven African countries in which it operates: Kenya, Uganda, Tanzania, Nigeria, Ghana, South Africa, and Tunisia.

Safaricom Officially Launched 5G Network in Kenya

After months of testing in Nairobi and a few other Kenyan cities, Safaricom officially launched its 5G network in October 2022. The first 35 active 5G sites were launched in Nairobi, Kisumu, Kisii, Kakamega, and Mombasa, with plans to expand to 200 5G sites across the country by March 2023.

Kenya Regulates Digital Lending Service Providers

On March 18, 2022, the Central Bank of Kenya (Digital Credit Providers) Regulations 2022 was gazette. The law requires CBK to license and oversee previously unregulated Digital Credit Providers (DCPs). Digital Lenders were required to apply to the CBK for a license within six months of the publication of these Regulations, on September 17, 2022, or face being forced to cease operations in Kenya. Regulation of digital lenders became necessary to protect borrowers from predatory lending practices such as denying borrowers full access to pricing information, punishing defaulters, and recovering unpaid loans.

Safaricom’s M-Pesa Powered GlobalPay Virtual Card Launched In Partnership With Visa

In collaboration with Visa, Safaricom launched their GlobalPay virtual card in June 2022, which uses M-Pesa to make payments via the Safaricom M-Pesa mobile app. The virtual card enabled Kenyan consumers who use Safaricom’s M-Pesa mobile money service to make cashless payments at merchant locations in over 200 countries via Visa’s global network. The virtual card is intended to protect customers from incurring forex conversion costs on local online payments billed in Kenya Shillings. It is only available for international online payments made outside of Kenya. Given that Safaricom’s M-Pesa has over 30 million users in Kenya, the Visa card has enormous growth potential in the future.

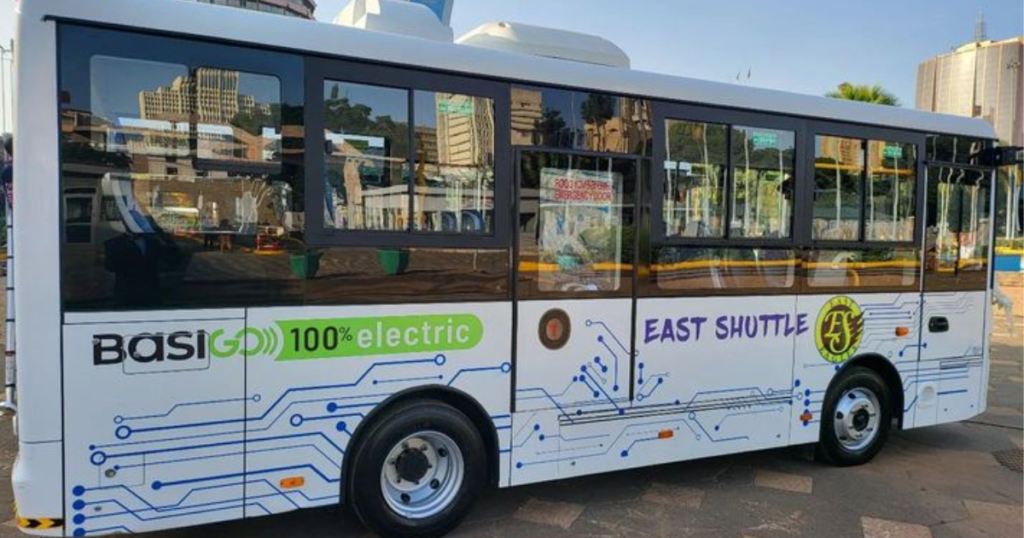

Electric Mobility Became Gain Acceptability in Kenya

In 2022, EV startups such as ROAM and BasiGo began testing their electric buses in Kenya for the public transportation sector with funding from KCB and Family Bank. Hyundai also requests that their Kona Electric Vehicle (EV) be sold to corporate fleets such as the International Red Cross and KenGen. KenGen has pledged to install 30 EV charging stations across the country by 2023.

Kenya Regulates Digital Taxi Services, Capped Revenue Share Commissions

The Kenyan government published new rules for digital taxi platforms in 2022, lowering the commission they require from drivers to 18%. James Macharia, Cabinet Secretary for Transport and Infrastructure, has published these rules.

According to the law “The commission which shall be paid by a transport network driver or a transport network owner to the transport network company shall not exceed eighteen percent of the total earnings of the trip.”

The term “transport network platform” refers to “a digital platform or any other similar system offered, used, or operated by a transport network company and used by persons for the transportation of passengers for compensation by a transport network driver,” according to the new law.

This became necessary because many Uber and Bolt drivers have frequently complained and gone on strike over what they perceive to be a lopsided commission structure in favor of taxi-hailing apps. The National Transport and Safety Authority required Uber and Bolt on to reduce their commissions to 18%. (NTSA). Uber used to charge a 25% commission, Bolt charged a 20% commission, and Little Cab charged a 15% commission. In October 2022, the NTSA also granted all digital taxi-hailing services, such as Uber, 14 days to apply for licenses as transportation network companies.

In conclusion, the Kenyan tech startup ecosystem has been very consistent in terms of innovation, the volume of funding received, and the provision of unique tech solutions in the last couple of years, and it has earned the right not only to reckon with the continent’s big boys but also to be a big force to reckon with in Africa when it comes to tech startups.